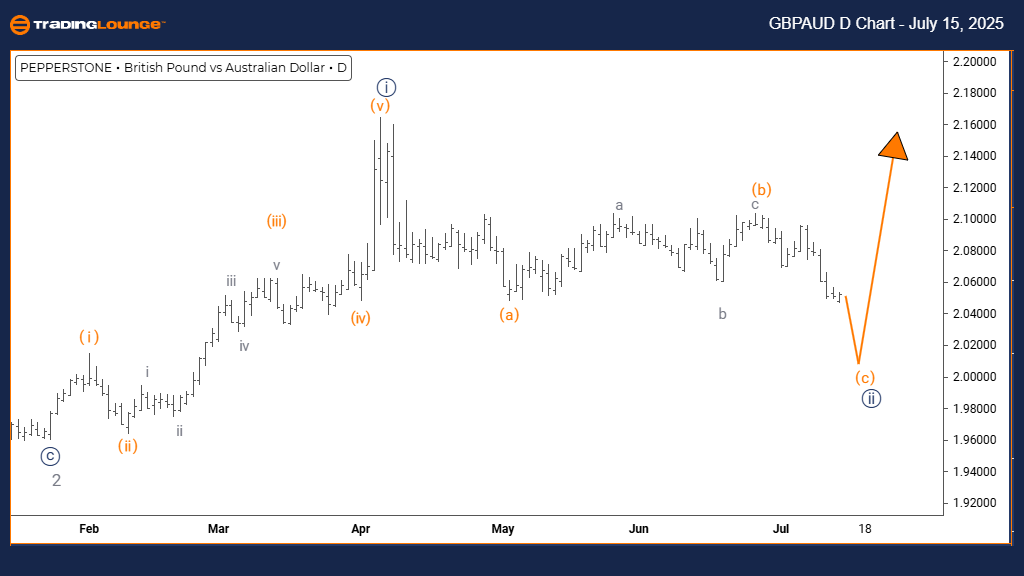

British Pound / Australian Dollar (GBPAUD) Elliott Wave Analysis - TradingLounge Daily Chart

GBPAUD Elliott Wave Forecast

Function: Counter-Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 3

Direction Next Higher Degrees: Navy Blue Wave 3

Details: Completion of Navy Blue Wave 1 confirmed; development of Navy Blue Wave 2 underway.

The daily GBPAUD Elliott Wave analysis indicates a corrective counter-trend phase within a broader bullish structure. Currently, Navy Blue Wave 2 is unfolding inside Gray Wave 3, suggesting a temporary pullback before the larger uptrend continues.

Following the completion of Navy Blue Wave 1, market behavior transitioned into Navy Blue Wave 2, typically representing retracement or sideways consolidation. As a corrective wave, it generally shows less momentum and weaker directionality compared to impulsive moves.

Traders are advised to watch for completion signals in Navy Blue Wave 2. Once it finalizes, the chart structure suggests the emergence of Navy Blue Wave 3, which often carries strong upward momentum. With the price still operating within Gray Wave 3, the overall bullish outlook remains intact.

This daily timeframe analysis offers traders strategic insight into the current phase of the GBPAUD market cycle and helps prepare for the next impulsive wave sequence.

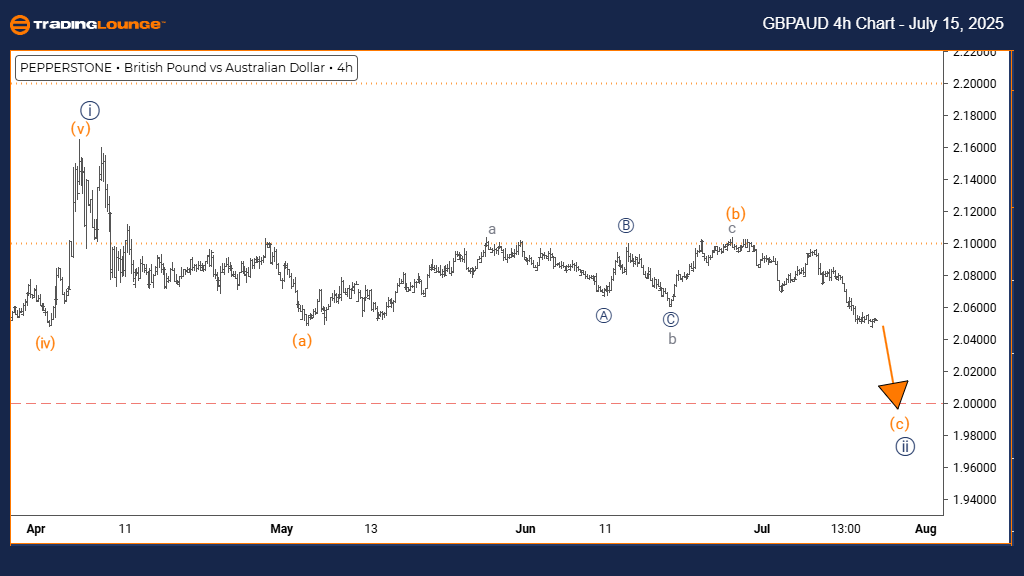

British Pound / Australian Dollar (GBPAUD) Elliott Wave Analysis – TradingLounge 4H Chart

GBPAUD Elliott Wave Forecast

Function: Counter-Trend

Mode: Impulsive

Structure: Orange Wave C

Position: Navy Blue Wave 2

Direction Next Lower Degrees: Orange Wave C (In Progress)

Details: Orange Wave B completed; Orange Wave C currently developing.

The 4-hour GBPAUD Elliott Wave outlook shows a short-term impulsive phase forming Orange Wave C inside the broader Navy Blue Wave 2 correction. This reflects downward movement in the context of a larger upward trend.

After the end of Orange Wave B, the chart now indicates the progression of Orange Wave C, the final leg in the corrective sequence. This wave typically brings deeper retracement with increased volatility and strong short-term bearish momentum.

As part of the corrective structure, Orange Wave C plays a crucial role in shaping the end of Navy Blue Wave 2. Traders should monitor key support zones and look for reversal signals. Once completed, upward continuation is expected with the start of a new impulsive wave.

This analysis equips traders with clear insights to anticipate potential trend reversals and manage trades around the completion of the current correction.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support