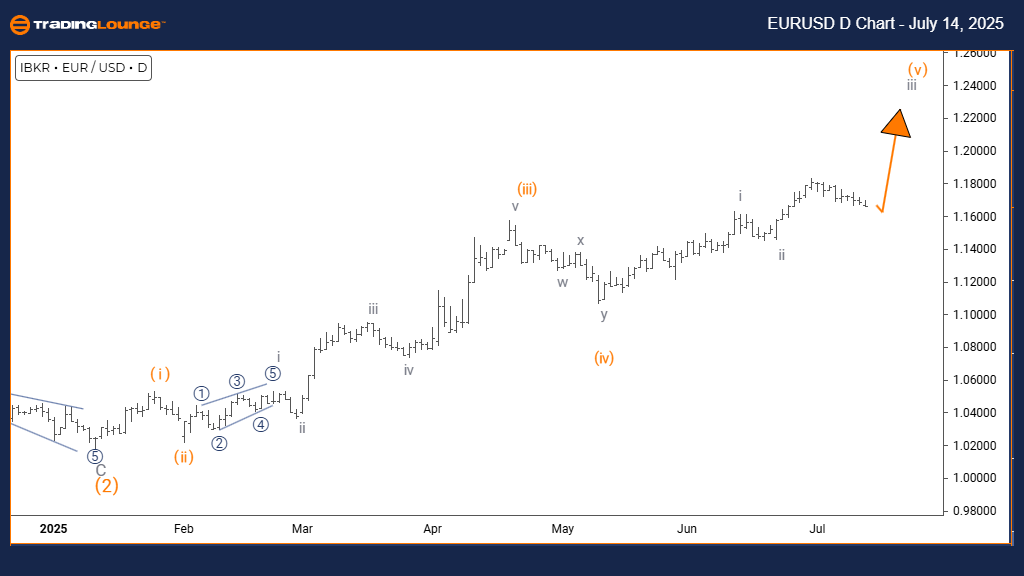

Euro/U.S. Dollar (EURUSD) Elliott Wave Analysis - TradingLounge Daily Chart

EURUSD Daily Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 5

Direction (Next Higher Degrees): Gray Wave 3 Initiated

Details: Gray wave 2 looks complete; gray wave 3 is actively progressing.

The daily EURUSD chart confirms a bullish Elliott Wave structure, highlighting an impulsive trend in motion. The pair currently advances through gray wave 3, positioned inside orange wave 5—an indication of the latter stages of the present impulsive leg.

Completion of gray wave 2 has triggered the beginning of gray wave 3, a phase known for strong upward momentum and clear bullish pressure. The market shows a sequence of higher highs and higher lows, validating the impulsive wave setup.

The presence of orange wave 5 inside gray wave 3 suggests this could be the final push in the intermediate rally. However, as gray wave 3 unfolds at a higher degree, EURUSD likely has more room to rise. Traders should closely track wave extensions and Fibonacci targets—both common markers during wave 3 surges.

EURUSD Elliott Wave Analysis – TradingLounge 4H Chart

Function: Counter Trend

Mode: Corrective

Structure: Micro Navy Blue Wave 2

Position: Within Gray Wave 3

Direction (Next Higher Degrees): Micro Navy Blue Wave 3 Approaching

Details: Micro navy blue wave 1 is confirmed; micro navy blue wave 2 is developing.

The 4-hour EURUSD chart indicates a short-term corrective phase, unfolding as micro navy blue wave 2 inside the broader bullish gray wave 3 trend. This movement reflects a temporary counter-trend pullback.

Micro wave 1 has finished, and the current activity in wave 2 lacks strong directional momentum. This typically leads to sideways or limited retracements, often observed during corrective phases. Once this correction concludes, micro wave 3 should initiate, aligning with the main bullish structure.

Traders should monitor for stabilization signs, reversal candles, or wave completion setups. Since EURUSD remains inside the powerful gray wave 3, any pullback is expected to be short-lived and may offer entry opportunities aligned with the primary trend.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support