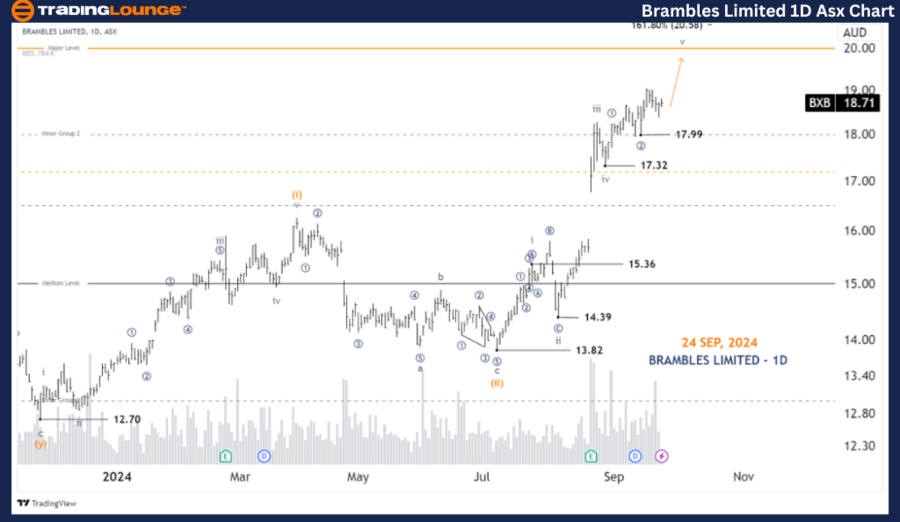

ASX: Brambles Limited – BXB Elliott Wave Analysis (1D Chart)

Welcome to today’s Elliott Wave analysis update for the Australian Stock Exchange (ASX) featuring Brambles Limited (BXB). Our analysis indicates that BXB may continue its upward momentum, driven by a developing v-grey wave.

ASX: Brambles Limited - BXB 1D Chart (Semilog Scale) Overview

BXB Elliott Wave Technical Analysis

Function: Major trend (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ((3))-navy of Wave v-grey of Wave (iii)-orange

Analysis Details: The v-grey wave is currently advancing and may target the Major Level of 20.00. The structure suggests that the v-grey wave is expanding and subdividing into wave ((3))-navy, signaling further potential upside.

Invalidation Point: 17.99

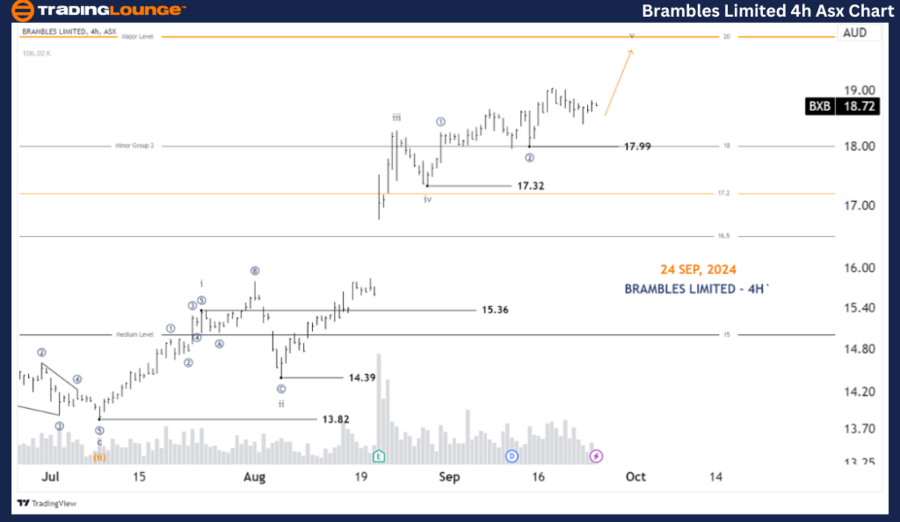

ASX: Brambles Limited - BXB 4-Hour Chart Overview

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((3))-navy of Wave v-grey

Analysis Details: From the recent low of 17.32, the v-grey wave has shown signs of advancing. Both wave ((1))-navy and wave ((2))-navy have completed, and wave ((3))-navy is currently progressing, with a potential move toward the Major Level of 20.00.

Invalidation Point: 17.99

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WISETECH GLOBAL LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our updated Elliott Wave analysis for ASX: Brambles Limited (BXB) highlights the ongoing trends and potential price movements. We provide specific price levels that serve as validation or invalidation points to strengthen our wave count's accuracy. This approach helps traders to make informed decisions based on objective market insights and trend forecasts.