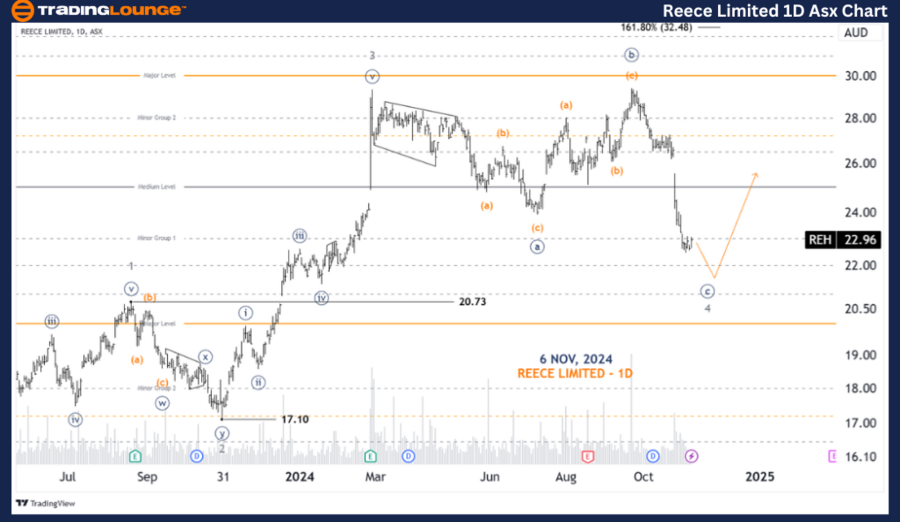

ASX: REECE LIMITED - REH Elliott Wave Analysis and Forecast

Greetings! In today's Elliott Wave update for the Australian Stock Exchange (ASX), we focus on REECE LIMITED - REH (ASX: REH). Our analysis indicates a continuation in REH.ASX's downward momentum, with a potential upward movement anticipated soon, signaling a probable return of the 5-wave (grey).

ASX: REECE LIMITED - REH Daily Chart Analysis (1D, Semilog Scale)

REH Elliott Wave Technical Analysis

Trend Function: Major trend (Intermediate degree, orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave 4-grey

Detailed Analysis: Wave 4-grey has been extending further than initially anticipated, with a slight downward push. Once complete, we anticipate wave 5-grey may initiate an upward movement.

Invalidation Level: 20.73

ASX: REECE LIMITED - REH 4-Hour Chart Analysis

Trend Function: Major trend (Minute degree, navy)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave (v)-orange of Wave ((c))-navy within Wave 4-grey

Detailed Analysis: Wave 4-grey is shaping into an Expanded Flat pattern, with wave ((c))-navy pushing lower. This wave continues to subdivide, and wave (iv)-orange may reach slightly higher levels around 23.50 to 24.17. Upon completion, wave (v)-orange is expected to continue downward. Ultimately, when wave 4-grey finishes, we anticipate wave 5-grey to push higher.

Invalidation Level: 26.52

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NEWS CORPORATION – NWS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: REECE LIMITED - REH highlights key trends and price points for effective trading decisions. We outline specific validation and invalidation levels to add reliability to our wave count and provide a well-rounded perspective on market direction. Our objective is to deliver accurate insights into market behavior to aid investors in their strategies with a professional and precise approach.