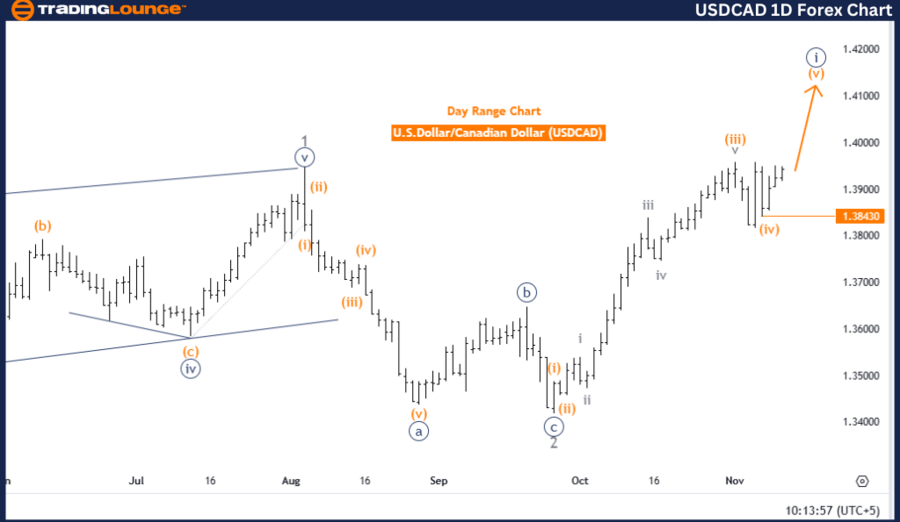

U.S. Dollar / Canadian Dollar (USDCAD) Daily Chart

Function: Trend

Mode: Impulsive

Structure: Navy blue wave 1

Position: Gray wave 3

Direction Next Lower Degrees: Navy blue wave 2

Details: Orange wave 4 of navy blue wave 1 appears completed; orange wave 5 of navy blue wave 1 is in progress.

Wave Cancel Invalidation Level: 1.38430

The USDCAD Elliott Wave analysis on the daily chart from Trading Lounge highlights an ongoing impulsive wave trend in an upward trajectory, structured as navy blue wave 1.

Key observations include:

- Gray wave 3 remains active.

- Orange wave 4, a sub-wave within navy blue wave 1, seems completed.

- This completion sets the stage for orange wave 5, which is anticipated to extend the upward movement of navy blue wave 1.

The bullish trend suggests continued upward momentum as orange wave 5 progresses within this wave structure. Traders should remain attentive to wave developments and confirm the completion of orange wave 5 to validate the broader upward trajectory of navy blue wave 1.

Key Marker – Invalidation Level

The invalidation level is identified at 1.38430. A decline to or below this level would invalidate the current wave structure, signaling potential trend shifts or structural changes. This serves as a critical checkpoint for traders, offering a benchmark to validate or reassess the current analysis.

Summary

The USDCAD daily chart maintains a bullish perspective, supported by the continuation of orange wave 5 within navy blue wave 1. However, traders should stay cautious near the invalidation level of 1.38430, as a breach would necessitate a reevaluation of the wave framework.

U.S. Dollar / Canadian Dollar (USDCAD) 4-Hour Chart

USDCAD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 5

Position: Navy blue wave 1

Direction Next Lower Degrees: Navy blue wave 2

Details: Orange wave 4 appears completed; orange wave 5 of navy blue wave 1 is in progress.

Wave Cancel Invalidation Level: 1.38430

The 4-hour USDCAD Elliott Wave analysis focuses on the ongoing impulsive wave structure, particularly orange wave 5, which is unfolding within the broader navy blue wave 1 framework.

Key highlights include:

- The apparent completion of orange wave 4 has paved the way for the development of orange wave 5, which continues the upward trajectory.

- Orange wave 5 reinforces the prevailing bullish trend within the navy blue wave 1 structure, with further upward momentum expected as this wave progresses.

Key Marker – Invalidation Level

The invalidation level is set at 1.38430. If prices fall to or below this threshold, it would disrupt the current wave structure, potentially signaling a reversal or the need for reassessment. This level acts as a pivotal reference for maintaining the integrity of the bullish trend.

Summary

The analysis on the 4-hour chart points to continued bullish momentum, with orange wave 5 leading the upward push within navy blue wave 1. Traders should monitor wave progress closely, as the completion of orange wave 5 would affirm the upward trend. However, vigilance is essential near the invalidation level of 1.38430, as any breach could indicate a breakdown of the wave framework and necessitate strategy adjustments.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EURGBP Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support