NEWMONT CORPORATION (NEM) – Elliott Wave Technical Analysis

TradingLounge Elliott Wave Forecast for ASX:NEM

Overview

This Elliott Wave analysis focuses on NEWMONT CORPORATION (ASX:NEM), highlighting potential bullish price movements and key levels to watch. Our wave count suggests an upside opportunity, making it essential for traders to monitor critical resistance and support areas for trend validation.

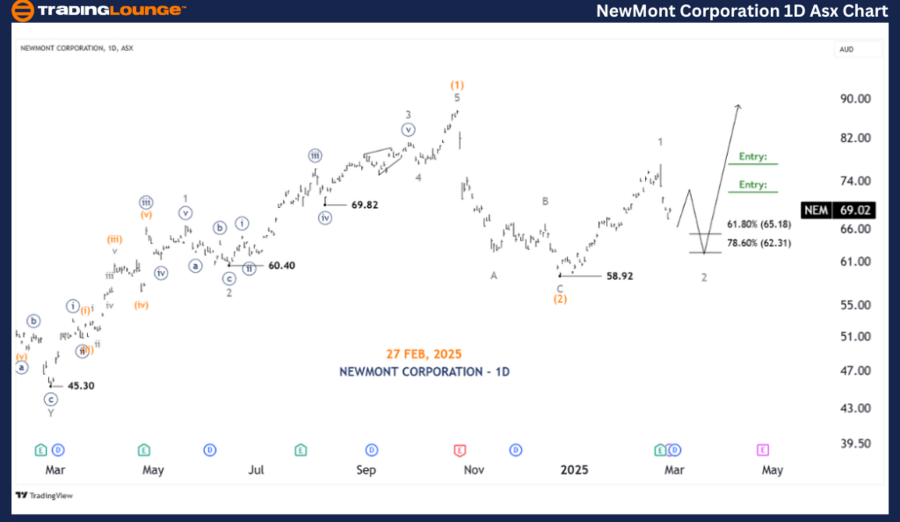

NEWMONT CORPORATION (NEM) – Elliott Wave Technical Analysis (1D Chart - Semilog Scale)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 2 - grey of Wave (3) - orange

Analysis Details

- Wave (2) - orange appears to have completed a Zigzag correction around 58.92, signaling a potential bullish move into Wave (3) - orange.

- If confirmed, Wave (3) - orange is likely extending into wave 1,2 - grey.

- Upon the completion of Wave 2 - grey, confirmation of renewed bullish momentum into Wave 3 - grey will be expected.

Key Levels

- Invalidation Point: 58.92 (If price drops below this level, the wave count is invalidated.)

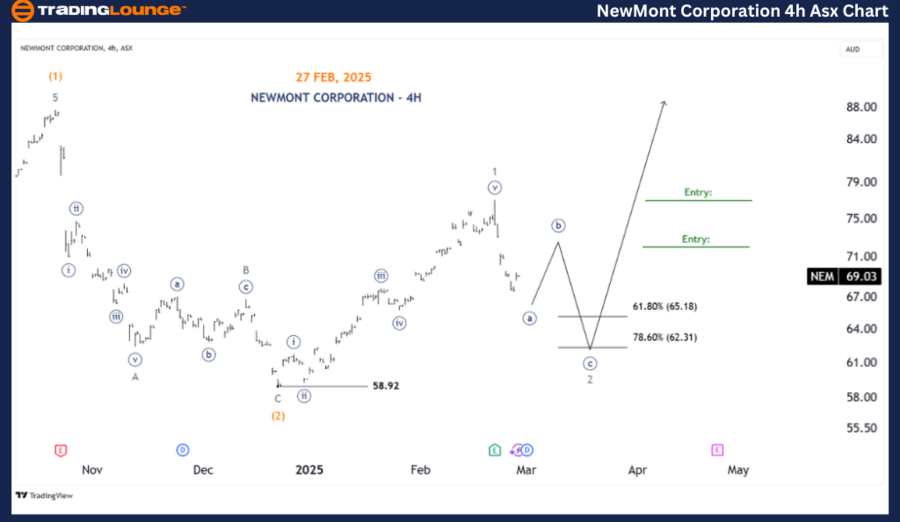

NEWMONT CORPORATION (NEM) – Elliott Wave Technical Analysis (4-Hour Chart)

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((a)) - navy of Wave 2 - grey

Analysis Details

- Wave 1 - grey has completed at 59.92, and the price is currently forming Wave 2 - grey.

- This corrective move is developing into a Zigzag pattern labeled ((a))((b))((c)) - navy, with a projected decline toward 65.18 - 62.31.

- Once Wave 2 - grey is complete, potential long entry points could emerge, particularly at the completion of Wave ((b)) - navy, leading into Wave 3 - grey.

- However, if the price drops below 62.31, traders should exercise caution, as this would weaken the forecast and require a reassessment of the market structure.

Key Levels

- Invalidation Point: 58.92 (A break below this level signals a need for a new wave count.)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WESTPAC BANKING CORPORATION – WBC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis of NEWMONT CORPORATION (NEM) on ASX highlights potential bullish price movements while identifying key support and resistance zones. The provided wave count and price projections help traders refine their strategies with a data-driven approach. By tracking these critical levels, traders can make informed decisions, leveraging Elliott Wave principles to maximize trading opportunities.