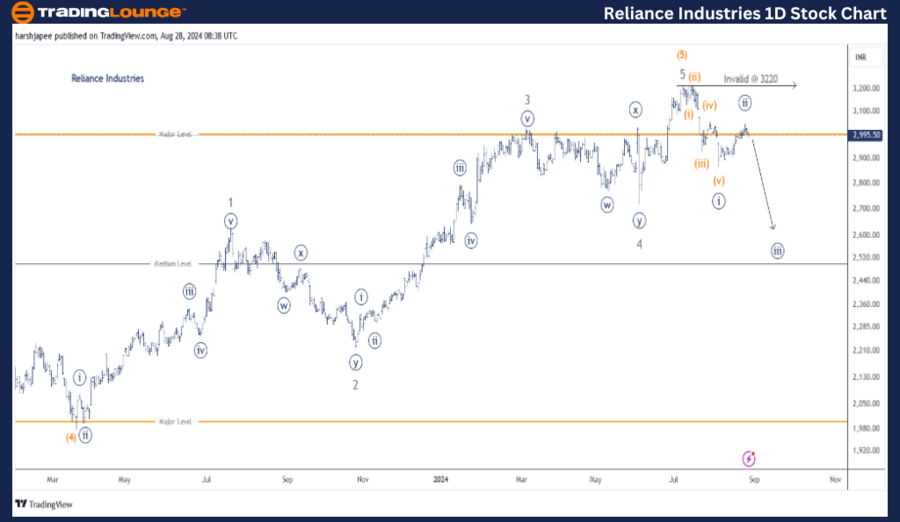

RELIANCE INDUSTRIES – RELIANCE (1D Chart) Elliott Wave Analysis

RELIANCE INDUSTRIES – RELIANCE 1Day Chart Analysis

RELIANCE Elliott Wave Technical Analysis

-

Function: Corrective Lower (Intermediate degree, orange)

-

Mode: Corrective

-

Structure: Zigzag

-

Position: Minute Wave ((ii)) Grey

-

Details: Minute Wave ((ii)) Grey may be complete near 3050, with Minute Wave ((iii)) expected to move lower against 3220

-

Invalidation Point: 3220

Reliance Industries Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart of Reliance Industries indicates a significant top at 3220, established in July 2024. Minute Wave ((v)) of Minor Wave 5 Grey within Intermediate Wave (5) Orange appears complete, signaling the potential for a deeper correction ahead.

The stock has trended upward since the March 2023 lows around the 1980-90 levels, identified as Intermediate Wave (4). The five-wave subdivision looks complete at 3220, marking the end of the fifth wave across multiple degrees.

Furthermore, the stock has started moving lower from the 3220 high, forming Minute Waves ((i)) and ((ii)) Navy. If this bearish structure holds, the stock may experience a sharp decline, provided prices remain below the 3220 mark.

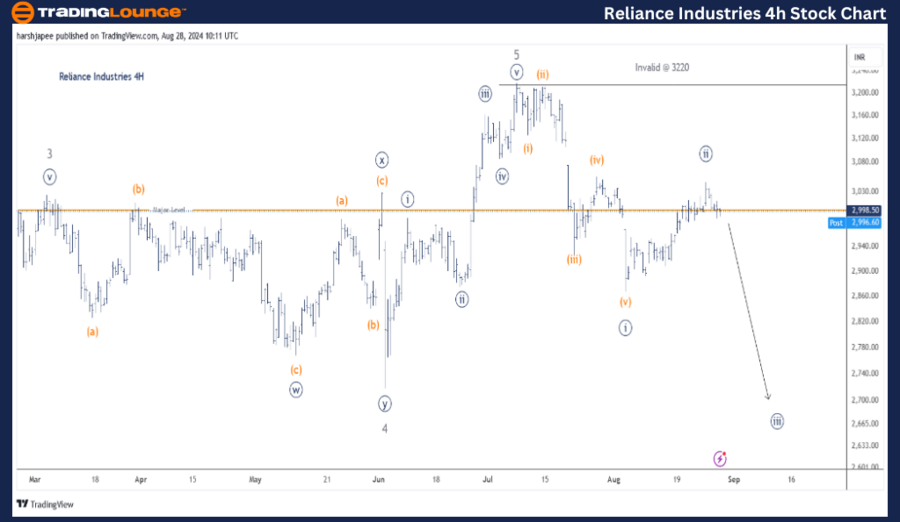

RELIANCE INDUSTRIES – RELIANCE (4H Chart) Elliott Wave Analysis

RELIANCE INDUSTRIES – RELIANCE Stock Technical Analysis

-

Function: Corrective Lower (Intermediate degree, orange)

-

Mode: Corrective

-

Structure: Impulse within a larger degree Zigzag

-

Position: Minute Wave ((ii)) Grey

-

Details: Minute Wave ((ii)) Grey could be complete around 3050, with Minute Wave ((iii)) moving lower against 3220

-

Invalidation Point: 3220

Reliance Industries 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4H chart of Reliance Industries reveals the sub-waves following the completion of Minor Wave 4 Grey around 2720 on June 04, 2024. The stock is subdivided into five waves at the minute degree, culminating at 3220. It closed the day at 2998, showing continued downward pressure.

Lower degree Waves ((i)) and ((ii)) seem complete around 2870 and 3050 levels, respectively. Additionally, the 2850 level is near the previous wave (iv) of one lesser degree. If this analysis is correct, the decline should accelerate moving forward.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: GRASIM Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Reliance Industries is currently trending lower within Minute Wave ((iii)) Navy, targeting a decline against the 3220 level. It’s notable that the stock closed in negative territory, despite the Nifty 50 Index reaching an all-time high earlier in the day.