Cocoa Market Outlook: Elliott Wave Analysis and Future Price Movements

Cocoa Elliott Wave Analysis

Function - Counter-trend

Mode - Corrective

Structure - Not yet defined

Position - Blue wave ‘a’

Direction - Blue wave ‘b’

Details - Bearish impulse from the top appears to have completed the last leg. The current bounce for blue wave ‘b’ can extend toward the 10,000 key resistance.

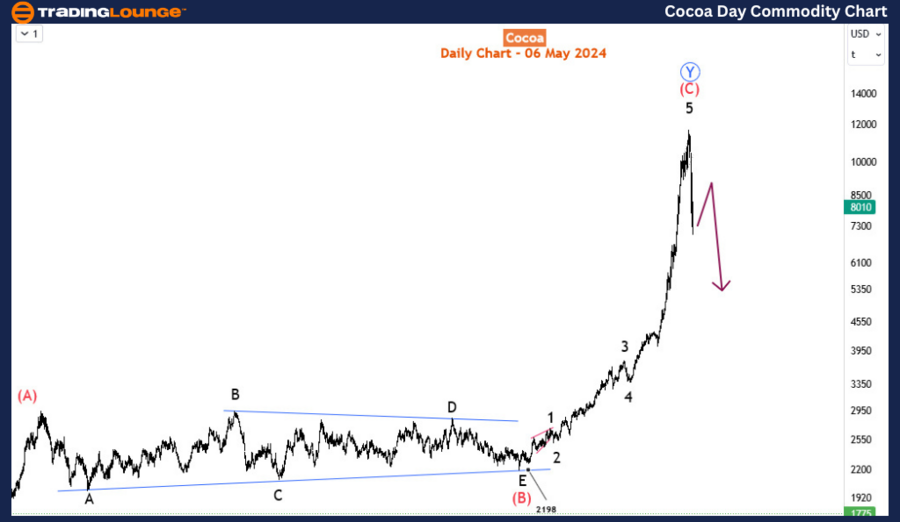

Cocoa, after reaching an all-time high, has undergone a substantial decline, marking its most significant price drop since September 2022. This descent signals a pivotal shift in market sentiment, hinting at further downward movement in the ensuing weeks. However, amidst this bearish momentum, there exists the possibility of a temporary rebound, potentially leading to a retest of the crucial 10,000 major level. In this comprehensive analysis, we aim to delve into both the long-term and medium-term trajectory of this commodity.

Daily Chart Analysis: Tracking Cocoa's Impressive Rally and Subsequent Decline

Examining the daily chart reveals a remarkable rally of over 420% from its September 2022 low of 2198 to achieve a fresh all-time high through an evident impulse wave. Before this surge, the price exhibited sideways movement for approximately six months. Presently, the ongoing decline from the peak appears to be forming the culmination of an impulse wave on the H4 charts. Consequently, we anticipate the emergence of either a continuation of this downward impulse or, at the very least, a corrective 3-wave pullback, potentially manifesting as a flat or zigzag pattern, with the latter being the more probable scenario.

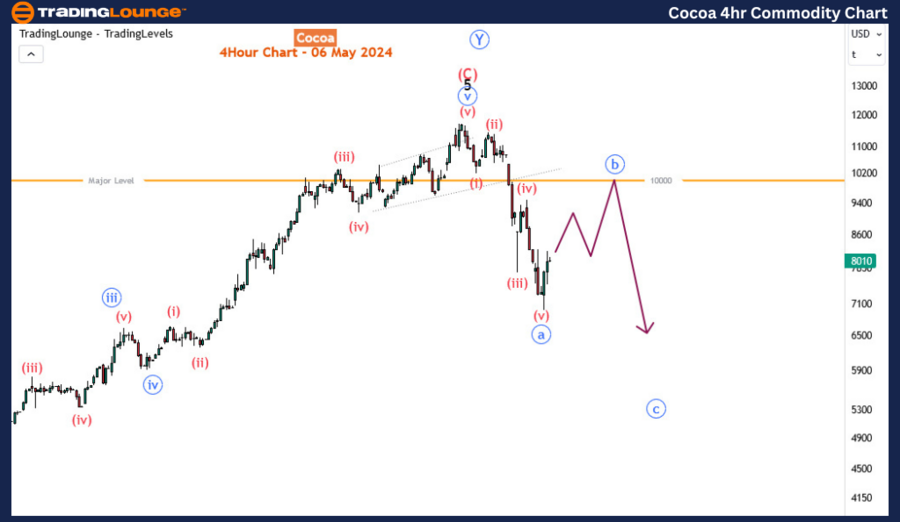

H4 Chart Insights: Detailed Examination of Cocoa's Recent Price Movements

On the H4 chart, the impulse from the all-time high seems to be nearing completion with wave (v). Alternatively, it's plausible that the current upward movement could be part of wave (v), suggesting that the impulse for blue wave ‘a’ may extend further downwards. Regardless, it is anticipated that following this impulse, a corrective bounce for blue wave ‘b’ will likely occur, possibly reaching the 10,000 mark or its vicinity, before the subsequent downward impulse unfolds.

The intensity of the third leg of this pattern will play a decisive role in determining whether a zigzag (blue wave ‘c’) or an impulse (blue wave ’3’) materializes from the peak. Should the third leg terminate at or before the 161.8% Fibonacci extension level, particularly around the 100% mark, the likelihood of a zigzag pattern increases. Conversely, if the extension surpasses the 161.8% threshold, the probability of an impulse wave strengthens. The latter scenario portends a deeper sell-off compared to the former, indicating the potential for a more pronounced downward movement in the market.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 6 Analysts covering over 150 Markets. Chat Room With Support