GBPUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Lower Degree Direction: Orange Wave 4

Details: Orange Wave 2 is complete, and Orange Wave 3 is currently forming.

Wave Cancellation Invalid Level: 1.25237

GBPUSD Elliott Wave Analysis – Market Overview

The GBPUSD Elliott Wave analysis for the daily chart highlights a strong bullish trend, with price action currently in an impulsive phase. The market is advancing within Orange Wave 3, which is part of the broader uptrend in Navy Blue Wave 1. This wave structure confirms sustained bullish momentum, a characteristic of an impulsive wave formation.

Once Orange Wave 3 concludes, the market is expected to enter Orange Wave 4, which may trigger a temporary correction before the uptrend resumes.

Wave Structure & Market Implications

- Orange Wave 2 has been completed, and the market is advancing in Orange Wave 3, which exhibits strong bullish momentum.

- Traders should closely monitor the development of Orange Wave 3, as its completion will likely lead to Orange Wave 4, a corrective phase that could result in short-term pullbacks or market consolidation.

Key Level to Watch

- Wave Count Invalidation Level: If the price falls below 1.25237, the current wave count becomes invalid.

- A breach of this level may indicate a potential shift in trend or a restructuring of the Elliott Wave pattern.

Conclusion

The GBPUSD market remains in a bullish trend, with Orange Wave 3 currently playing out following the completion of Orange Wave 2. This movement is a component of Navy Blue Wave 1, and the next expected shift is Orange Wave 4, marking a corrective phase.

Traders should track the completion of Orange Wave 3, as it will provide crucial insights into the upcoming price action. Understanding Elliott Wave structures is essential for strategic trading decisions, helping traders align their positions with the market’s momentum.

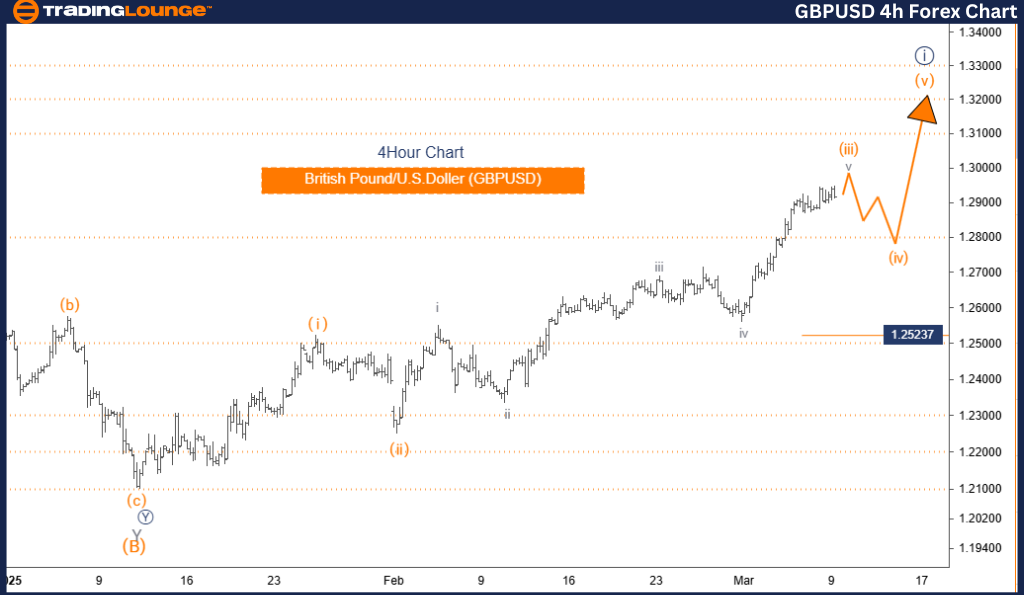

British Pound/U.S. Dollar (GBPUSD) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

GBPUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Lower Degree Direction: Orange Wave 4

Details: Orange Wave 2 has completed, and Orange Wave 3 is currently developing.

Wave Cancellation Invalid Level: 1.25237

GBPUSD Elliott Wave Analysis – Market Overview

The 4-hour Elliott Wave analysis for GBPUSD confirms a strong bullish trend, with the market progressing in an impulsive phase. The price structure follows Orange Wave 3, which is a segment of a broader uptrend within Navy Blue Wave 3. This signals continued upward momentum, aligning with a classic Elliott Wave impulsive structure.

Upon the completion of Orange Wave 3, the next expected move is Orange Wave 4, a corrective phase that might introduce temporary pullbacks before the broader trend resumes.

Wave Structure & Market Implications

- Orange Wave 2 has been completed, and Orange Wave 3 is actively forming, showcasing a strong bullish outlook.

- Traders should watch Orange Wave 3's progression, as its completion will mark the beginning of Orange Wave 4, which might lead to short-term corrections or market consolidation.

Key Level to Watch

- Wave Count Invalidation Level: If GBPUSD drops below 1.25237, the current Elliott Wave structure becomes invalid.

- A break below this level could indicate a trend shift or a reassessment of the wave count.

Conclusion

The GBPUSD market remains bullish, with Orange Wave 3 unfolding after the completion of Orange Wave 2. This price movement is a crucial component of Navy Blue Wave 3, and the next anticipated development is Orange Wave 4, signaling a potential corrective phase.

Traders should focus on Orange Wave 3’s conclusion, as it will dictate the timing and direction of the next market movement. Mastering Elliott Wave principles allows traders to optimize their strategies and align their positions with market dynamics effectively.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: GBPAUD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support