PayPal Holdings Inc. (PYPL) Elliott Wave Analysis: Comprehensive Breakdown

This analysis delves into PayPal Holdings Inc. (PYPL), utilizing the Elliott Wave Theory to assess the current market structure and forecast potential future movements. We focus on both the daily and 1-hour charts for a complete view.

PYPL Elliott Wave Analysis: Trading Lounge Daily Chart

PayPal Holdings Inc. (PYPL) Daily Chart Analysis

PYPL Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3 or C

Direction: Upside in wave 3/C

Details:

The analysis identifies an upside potential within wave 3 or C, which is expected to unfold in a five-wave structure. Currently, the market seems to be within wave {iii}. The equality between wave 3 and wave 1 stands at Trading Level 8, around $80, often a minimum target for wave 3 or C.

PYPL Elliott Wave Analysis – Daily Chart

PYPL is in wave 3 or C, a phase characterized by strong upward momentum. The equality level of wave 3 compared to wave 1 suggests a potential target around Trading Level 8 at $80. As wave {iii} develops further, reaching the $80 target appears likely in the near future.

PYPL Elliott Wave Analysis: Trading Lounge 1H Chart

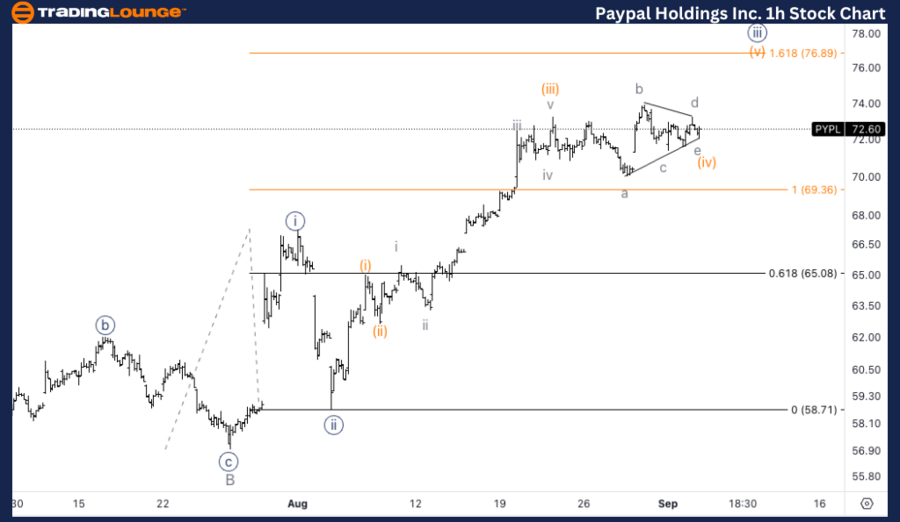

PayPal Holdings Inc. (PYPL) 1H Chart Analysis

PYPL Stock Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iv) of {iii}

Direction: Upside in wave {iii}

Details:

In the 1-hour chart, PYPL is forming a triangle correction in wave (iv) of {iii}. Once this correction is completed, the price is expected to continue upward toward the 1.618 Fibonacci extension of wave {iii} versus wave {i}. This next leg up, wave (v) of {iii}, could push the stock price toward the anticipated $80 target.

PYPL Elliott Wave Technical Analysis – 1H Chart

Currently, PYPL is in wave (iv) of {iii}, where a triangle pattern appears to be nearing completion. Once the triangle correction concludes, the price is likely to resume its upward trajectory, targeting the 1.618 Fibonacci extension of wave {iii} compared to wave {i}. The anticipated upward move in wave (v) of {iii} could lead the price toward the $80 target.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Palo Alto Networks Inc. (PANW) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support