Gold (XAUUSD) Elliott Wave Analysis: Understanding the Current Pullback

Function: Trend

Mode: Impulse

Structure: Impulse Wave

Position: Wave A of (4)

Direction: Wave A of (4) is ongoing

Detailed Analysis:

Gold Elliott Wave Technical Analysis

1st Scenario: The current dip in Gold is likely to continue as part of wave (4) in a zigzag structure.

2nd Scenario: Wave 4 might evolve into an expanding flat, dipping below the current wave 4 low. Should a bullish impulse follow this bearish move below the wave 4 low, this scenario gains favor. The 1st scenario will be preferred if the next rally is corrective. The 1st scenario predicts a lower price than the 2nd.

Gold is in a pullback phase from a fresh all-time high. However, the long-term bullish cycle remains intact. This suggests that buyers will look for opportunities to buy the dip, anticipating the uptrend will resume. Identifying when this dip concludes is crucial. This blog post will analyze that.

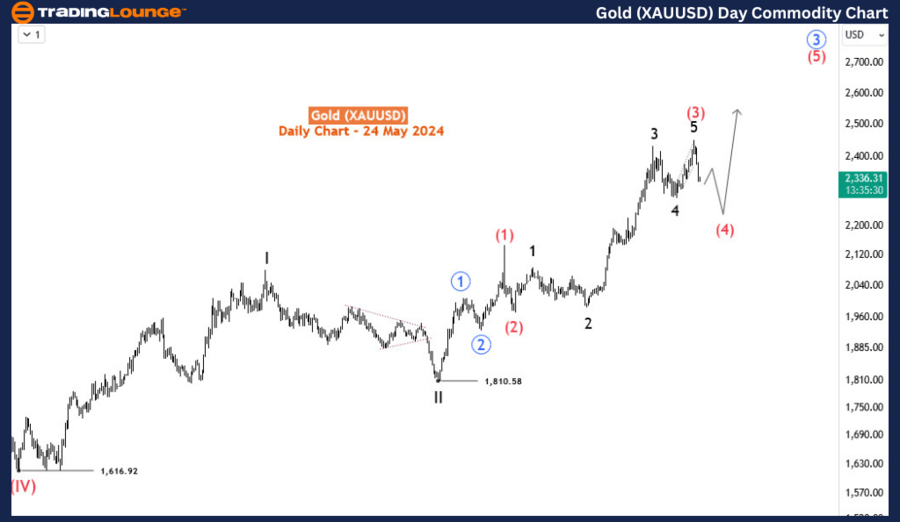

Daily Timeframe Analysis:

The bullish impulse trend on the daily timeframe started from the 1616 low of September 2022. This marked the beginning of the supercycle degree 4th wave of a multi-decade impulse wave. The supercycle 5th wave is still far from completion as it has not yet finished the 3rd sub-wave of its 3rd sub-wave, specifically intermediate wave (3) of primary wave 3 (circled in blue). The current pullback is expected to be wave (4) of the primary degree.

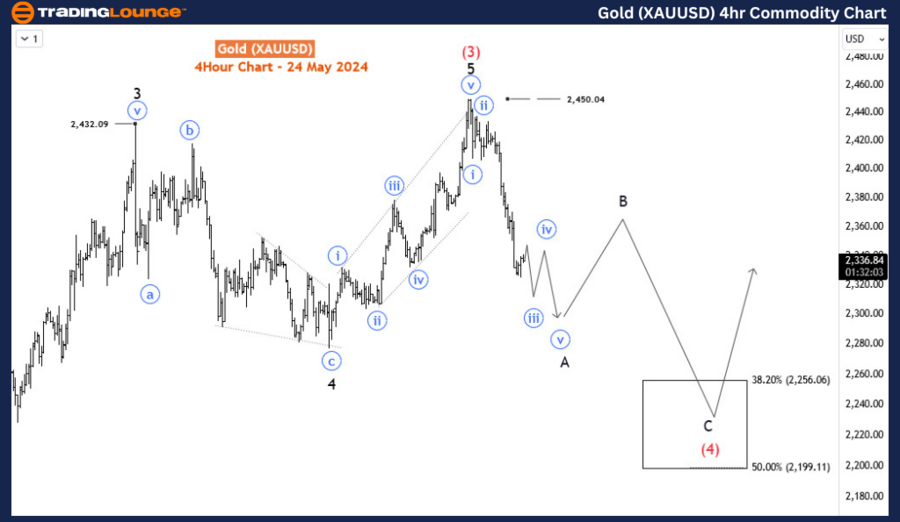

H4 Chart Analysis:

On the H4 chart, wave (4) is finalizing its first wave—wave A—as an impulse. It is anticipated to correct upwards in wave B before dropping further to form a zigzag pattern, reaching at least the 38.2-50% retracement zone between 2256-2199. Following wave (4), the price could rise again in wave (5). However, alternative scenarios exist. The best alternative is a running flat structure for wave 4 of (3). If the current impulse completes a 3-3-5 structure for wave 4 below its current low and then responds with a bullish impulse, this scenario will be favored.

Conclusion:

In conclusion, Gold's current market position within the Elliott Wave framework indicates a significant pullback phase. Investors should watch for key signals to identify the end of this dip and the resumption of the bullish trend. Understanding these scenarios can provide strategic insights into market entry points for buyers.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Iron Ore Commodity Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support