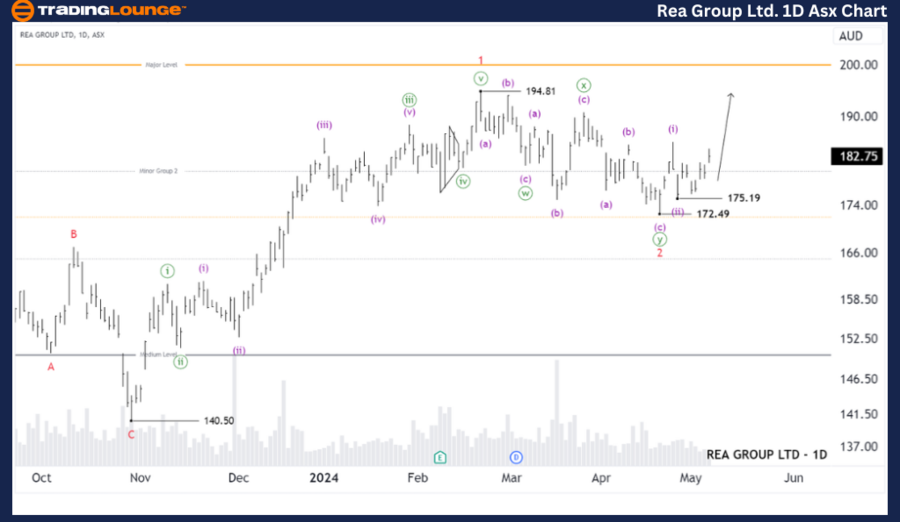

ASX: REA GROUP LTD – REA Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)

Elliott Wave Analysis on the Daily Chart REA Group Ltd, a major player on the Australian Stock Exchange, is currently exhibiting interesting patterns in its stock movement, according to Elliott Wave principles. Our analysis indicates that the stock may have completed its second wave (red) and is now entering a bullish third wave (red). This phase could significantly propel the stock higher, providing a promising outlook for investors..

ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis

ASX: REA GROUP LTD – REA 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, red)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-purple of Wave 3-red

Details: The outlook suggests that wave 2-red has recently concluded, and wave 3-red is now unfolding to push higher. It is subdividing into waves (i) and (ii)-purple, which have ended, and wave (iii)-purple is opening up to push higher. Maintaining a price above 172.49 would be a significant advantage for this outlook.

Invalidation point: 140.50

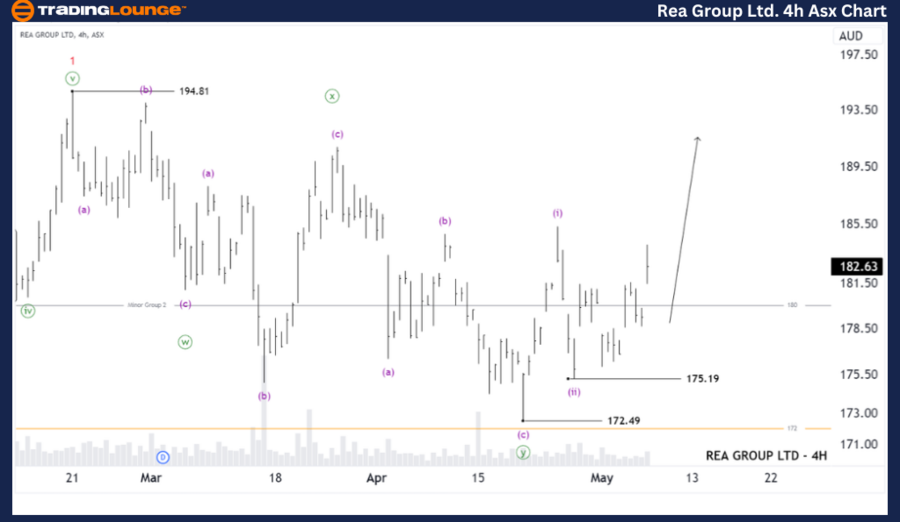

ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis

ASX: REA GROUP LTD – REA 4-Hour Chart Analysis

Function: Major trend (Minuette degree, purple)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-purple

Details: The shorter-term outlook suggests that wave (ii)-purple has just ended, and wave (iii)-purple may be unfolding to push higher. However, there's some uncertainty regarding whether wave (ii) has truly concluded. Therefore, it would be preferable to see the price continue to push slightly higher to clarify this perspective. Following that, I would need to observe an ABC correction to prepare for finding a trade setup with better entry and stop levels than the current ones.

Invalidation point: 172.49

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Elliott Wave Technical Analysis for WTC on the ASX

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 6 Analysts covering over 150 Markets. Chat Room With Support

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: REA GROUP LTD – REA aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.