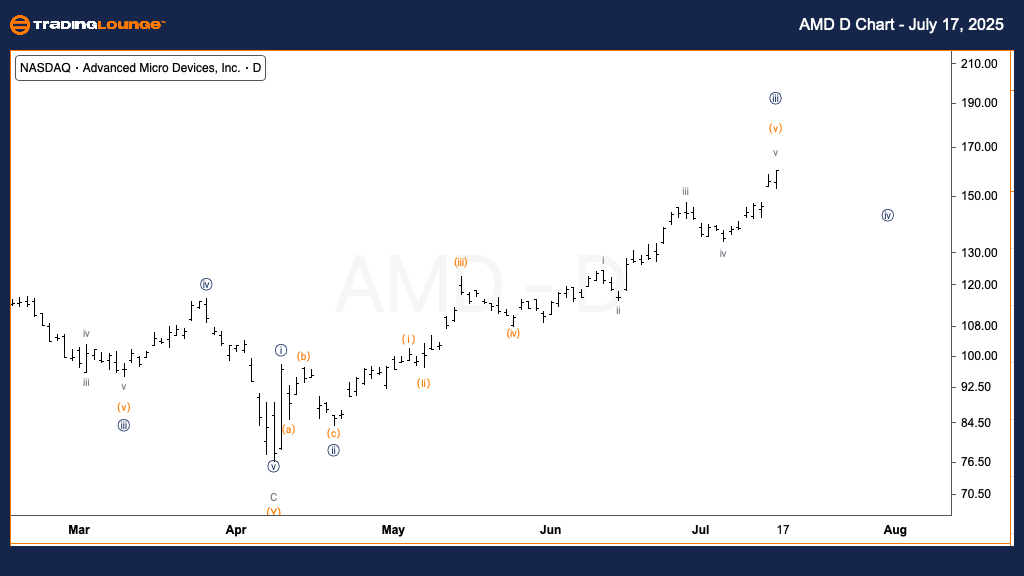

AMD Elliott Wave Analysis – Trading Lounge Daily Chart

Advanced Micro Devices Inc. (AMD) Daily Chart Overview

AMD Elliott Wave Technical Overview

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (v) of {iii}

Direction: Possible Top in Wave (v)

Details: Price nearing Minor Group 2 zone around $180, signaling potential completion of wave {iii}.

On the daily timeframe, AMD stock is approaching the final phase of an impulsive Elliott Wave cycle. Currently, wave (v) of {iii} is developing, and price action is moving close to the key resistance level at $180, aligning with the end of Minor Group 2 in wave terms.

Though AMD maintains an upward trend, the proximity to this resistance level may indicate a short-term peak. A break or reversal around this zone would suggest wave {iii} has completed, initiating a corrective wave {iv} pullback. Traders are advised to watch for reversal signals near $180 to anticipate a shift in momentum.

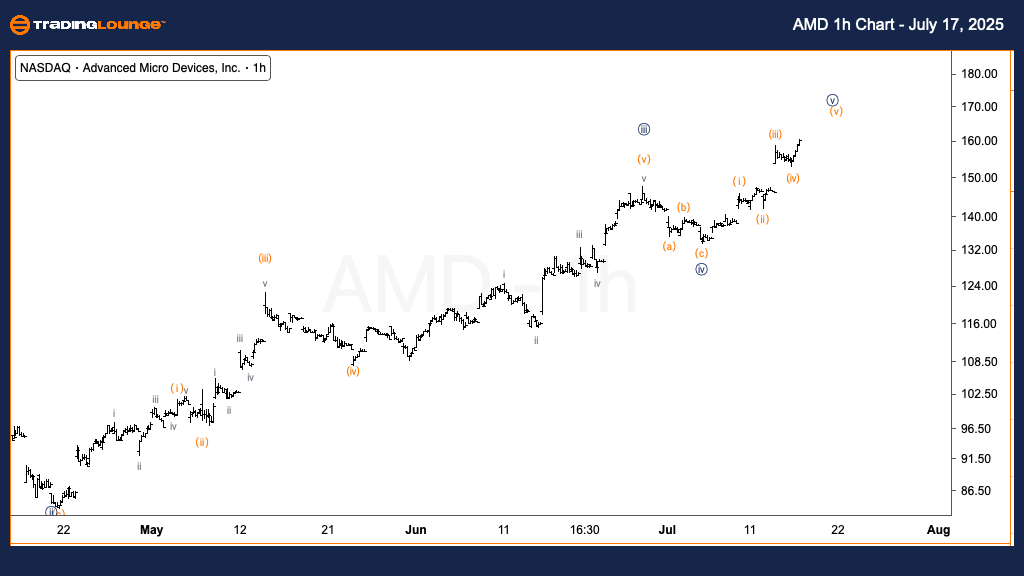

Advanced Micro Devices Inc. (AMD) US Stock 1H Chart Analysis

AMD Elliott Wave Technical Overview

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (V) of {v}

Direction: Potential Top in Wave (v)

Details: Conservative wave count indicates wave {v} of 1 is reaching final stages.

The hourly chart offers a detailed view of AMD’s shorter-term Elliott Wave formation. The stock is in the last leg of wave (V) within {v} of 1, suggesting that a near-term top could be forming soon.

This conservative count implies that once this last move concludes, wave 2 correction might begin. As the price closes in on the $180 resistance zone, traders should remain alert to any reversal signals, which could offer early insight into the start of a broader corrective phase.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: MicroStrategy (MSTR) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support