Soybean Elliott Wave Technical Analysis

The soybean market is currently in a retracement phase within a long-term corrective pattern that has been unfolding since the peak in June 2022. Although short-term upward momentum is anticipated, the overall trend suggests that a significant sell-off could resume, potentially pushing prices toward the lows observed in 2020.

Long-Term Perspective

Before the downturn in June 2022, the soybean market experienced a strong bullish impulse wave starting in May 2019, lifting prices from around $806 to notable highs. However, over the past 26 months, the market has retraced more than two-thirds of those gains. From an Elliott Wave analysis perspective, the ongoing corrective phase is displaying a three-wave structure, which is common in complex corrective patterns and indicates a deep retracement.

Soybean Daily Chart Analysis

On the daily chart, this corrective wave is developing at the primary wave level. Wave A concluded at $1,249 in October 2023, followed by a peak in Wave B at $1,398 in November 2023. Currently, Wave C is unfolding to the downside. Within this Wave C, sub-waves (1), (2), and (3) of 5 have already been completed. The market is now experiencing a retracement in Wave (4), which is trading above the key $1,000 level. The critical question now is: how high can this Wave (4) rally extend?

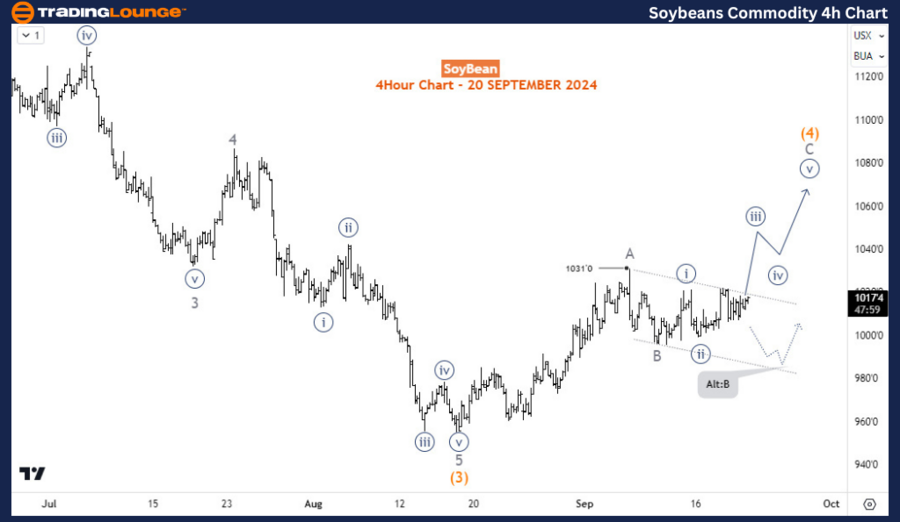

Soybean 4-Hour Chart Analysis

Looking closer at the H4 chart, Wave (4) has completed its first sub-wave, known as Wave A. The bullish move observed since September 11, 2024, suggests that Wave B may be complete. To confirm that Wave B has ended and the market is entering Wave C, the price must break above the high of Wave A. If this scenario plays out, Wave C could extend toward the $1,070 level. On the other hand, if the price fails to break above Wave A’s high, it may indicate that Wave B will extend further down, potentially dipping below $1,000 before forming a solid support level and initiating Wave C.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Corn Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support