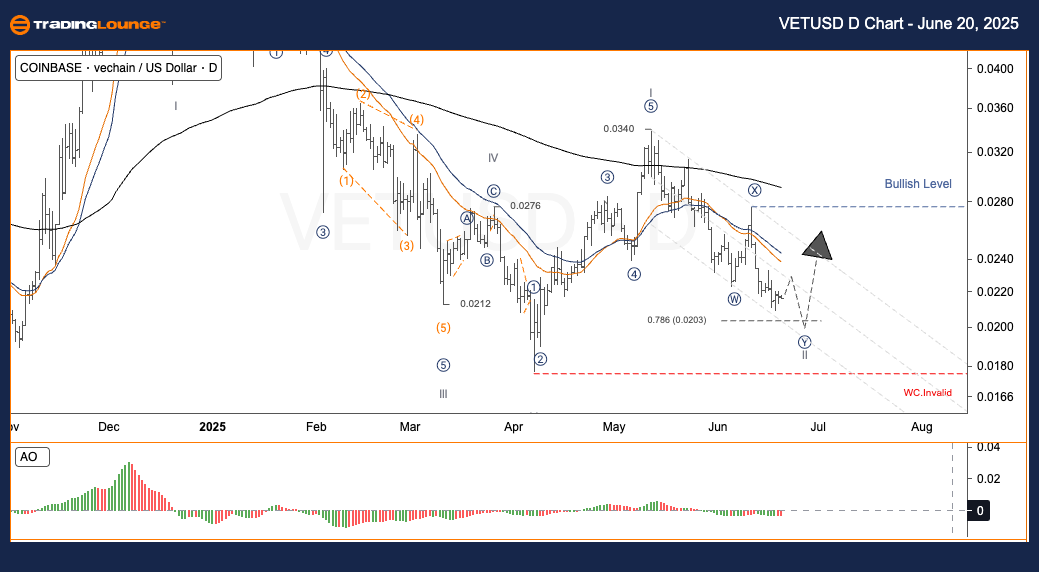

VeChain (VET) to US Dollar (USD) – VETUSD Elliott Wave Analysis – TradingLounge Daily Chart

VETUSD Elliott Wave Technical Forecast

Function: Counter-Trend Movement

Mode: Corrective Phase

Structure: Double Correction Pattern

Current Position: Wave Y

Next Major Direction: To Be Confirmed

Invalidation Level for Wave Count: Under Review

VeChain (VETUSD) – Daily Trading Strategy

The VET/USD pair is approaching the final leg of Wave II within its corrective formation. Should the price move into the 0.020–0.018 zone and then produce a swift upside reaction, it may mark the beginning of a bullish impulsive Wave III.

Trading Strategies:

Short-Term Traders (Swing Strategy):

✅ Track momentum indicators like RSI and MACD for divergence signals. Ensure no new confirmed lows form.

✅ Look for bullish reversal candlestick patterns, such as Bullish Engulfing, accompanied by increasing volume before entering long trades.

🟥 If VETUSD falls beneath the 0.01700 level, it invalidates the current Wave II structure and requires reassessment.

VeChain (VET) to US Dollar (USD) – VETUSD Elliott Wave Analysis – TradingLounge 4-Hour Chart

VETUSD Elliott Wave Technical Forecast

Function: Counter-Trend Structure

Mode: Ongoing Correction

Structure: Double Corrective Pattern

Current Position: Wave Y

Next Directional Move: Awaiting Confirmation

Wave Invalidation Level: Under Review

VeChain (VETUSD) – H4 Trading Strategy

The VET/USD price continues to unfold within the final stages of corrective Wave II. A pullback toward the 0.020–0.018 support area, followed by a strong rebound, could confirm the launch of bullish Wave III.

Trading Strategies:

Swing Traders:

✅ Watch RSI and MACD indicators for signs of divergence while confirming that no new major lows appear.

✅ Entry signals may come from clear bullish reversal candles supported by high trading volume.

🟥 A drop below 0.01700 invalidates this wave count, necessitating a fresh analysis.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: XRPUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support