Welcome to our latest Elliott Wave analysis for Spotify Technology S.A. (SPOT) as of July 12, 2024. This analysis provides an in-depth look at SPOT's price movements using the Elliott Wave Theory, helping traders identify potential opportunities based on current trends and market structure. We will cover insights from both the daily and 4-hour charts to offer a comprehensive perspective on SPOT's market behavior.

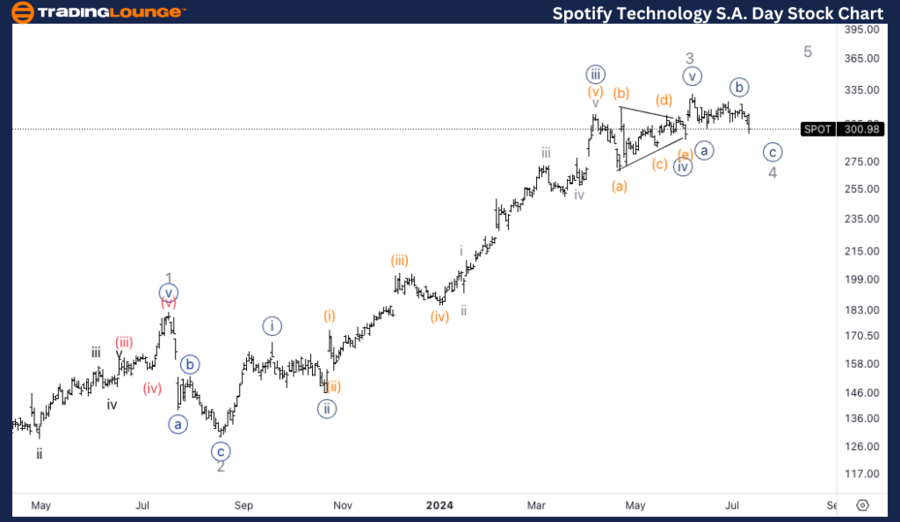

SPOT Elliott Wave Analysis Trading Lounge Daily Chart

Spotify Technology S.A. (SPOT) Daily Chart

SPOT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave 4

Direction: Bottom in wave 4

Details: Looking for developments in Minor wave 4 as we seem to have found a top in wave 3 right at MG1 around $320. Looking for support to be found on MG2 at $200.

SPOT Stock Analysis – Daily Chart

The daily chart indicates that SPOT seems to have found a top in wave 3 around MG1 at $320. We are now looking for support to be found around MG2 at $200 as Minor wave 4 continues to develop. Traders should monitor these levels closely for signs of bottoming out and potential reversal.

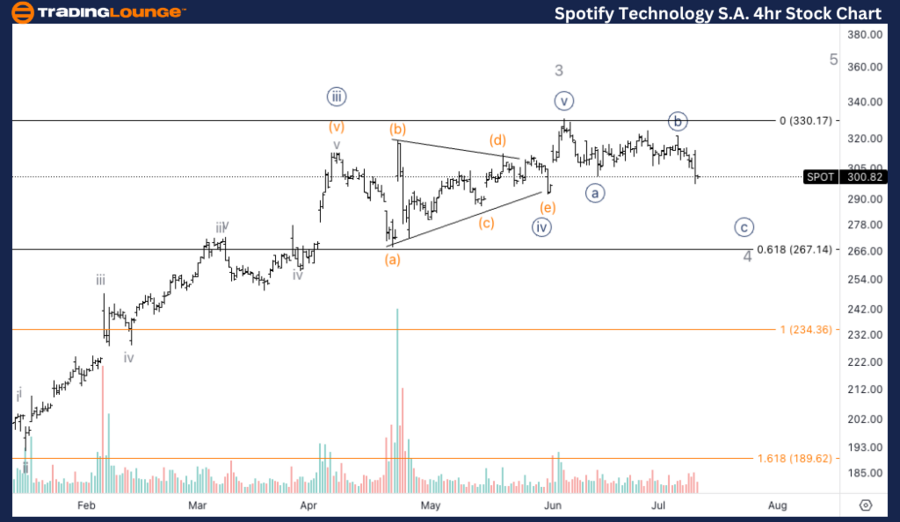

SPOT Elliott Wave Analysis Trading Lounge 4Hr Chart

Spotify Technology S.A. (SPOT) 4Hr Chart

SPOT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave {c} of 4

Direction: Downside in wave {c}

Details: Looking for downside into wave {c}, we have increased volume which suggests more downside should be coming, as well as 0.618 retracement of wave 4 vs. 2 stands at $265.

SPOT Technical Analysis – 4Hr Chart

The 4-hour chart shows that SPOT is targeting further downside in wave {c}. An increase in volume suggests more downside pressure, with the 0.618 retracement of wave 4 vs. wave 2 standing at $265. This level is critical for potential support and should be monitored for a reversal indication.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Deere & Co. (DE)t Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support