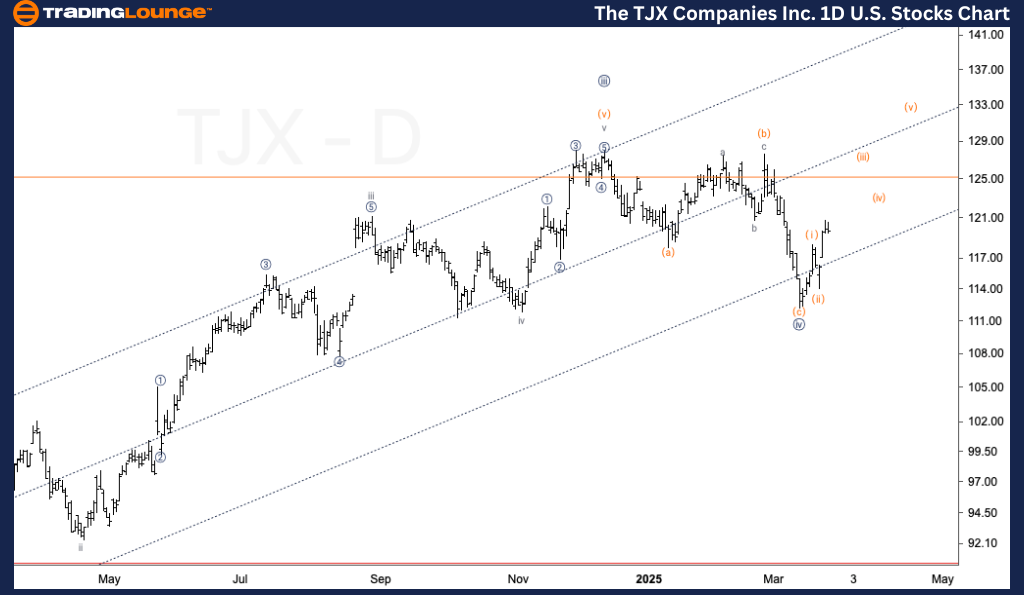

TJX Elliott Wave Analysis – TradingLounge Daily Chart

The TJX Companies Inc. (NYSE: TJX)

TJX Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {v} of 3

Direction: Upward movement into wave {v}

Details: A probable low in Minute wave {iv} appears to have formed slightly above the $110 level. The price action has resumed its upward trajectory, pointing to the likely initiation of wave {v} of 3. A sustained rally would further confirm the bullish Elliott Wave count and continuation of the uptrend.

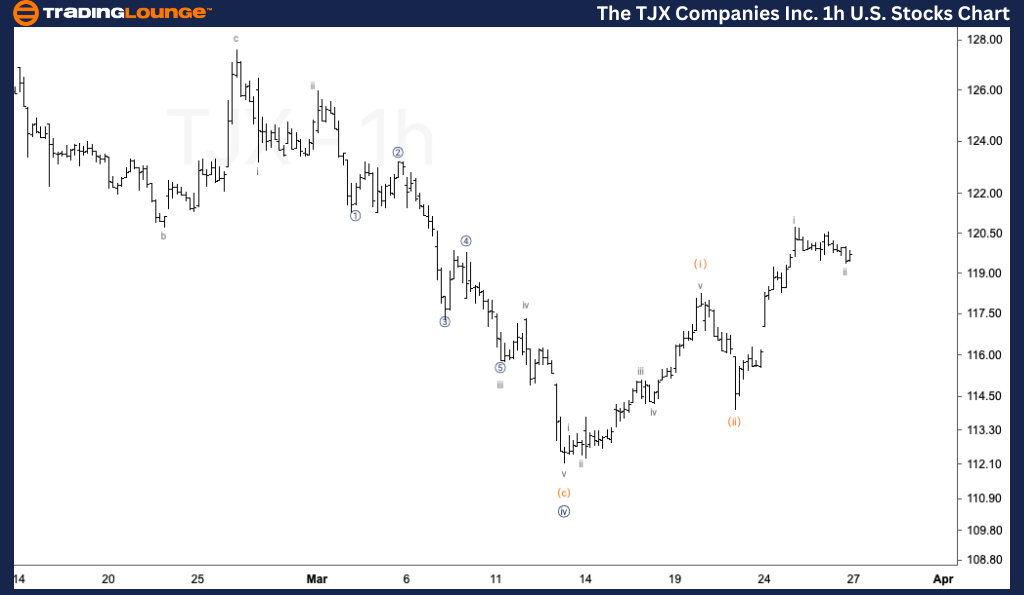

TJX Elliott Wave Analysis – TradingLounge 1-Hour Chart

The TJX Companies Inc. (NYSE: TJX)

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iii) of {v}

Direction: Upside continuation into wave (iii)

Details: Current price action suggests a wave ii pullback within wave (iii) of {v}, setting the stage for a potential strong upward push in wave (iii). The target zone for this next move is around $130, marking the anticipated completion of Minor degree wave MG1.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Caterpillar Inc. (CAT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

The TJX Companies Inc. (TJX) – Elliott Wave Market Outlook

Elliott Wave analysis of TJX (The TJX Companies Inc.) indicates a bullish structure developing on both the daily and 1-hour charts. On the daily timeframe, Minute wave {iv} seems to have bottomed just above $110, with recent price behavior supporting the start of wave {v} of 3. This aligns with expectations of continued upward momentum.

The 1-hour chart shows a wave ii retracement inside wave (iii) of {v}, implying a likely surge toward the $130 price level. Both charts highlight an impulsive wave formation, supporting a bullish trend in the near to mid-term.

Outlook: The bullish scenario remains intact if the current Elliott Wave count holds. Key price zones include support near $110 and resistance near $130, which will be crucial for validating the next move higher.