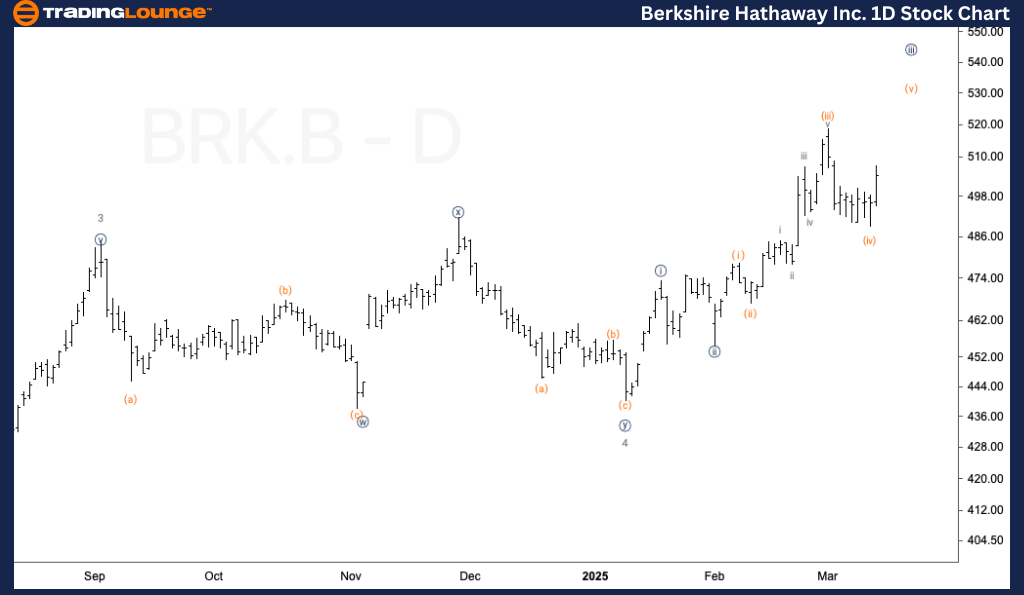

Berkshire Hathaway Inc. (BRK.B) – Elliott Wave Analysis – Trading Lounge Daily Chart

BRK.B Elliott Wave Technical Analysis – Daily Chart

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 5

Direction: Upside within wave {iii}

Details:

Berkshire Hathaway (BRK.B) remains in a strong uptrend, currently advancing within wave {iii} of the larger wave 5 structure. The recent three-wave corrective pattern (wave iv) has likely completed, paving the way for further bullish movement.

Key support at $500 must hold to confirm continued upside momentum and validate the ongoing impulsive trend. A sustained break above this level strengthens the bullish outlook for wave {iii}.

Market Outlook for BRK.B Daily Chart Analysis:

BRK.B remains in an impulsive uptrend, currently advancing within wave {iii} of 5.

The completion of wave iv suggests further upside potential, reinforcing the bullish case for wave {iii}.

Holding above $500 is key for sustained bullish momentum, with a successful support test confirming continued upside movement toward the next resistance zones.

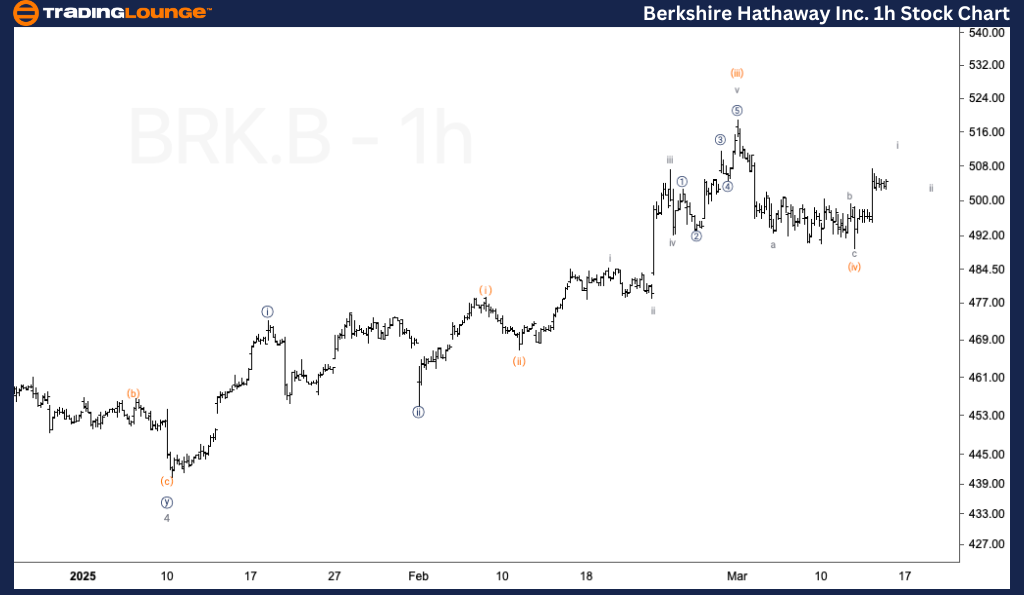

Berkshire Hathaway Inc. (BRK.B) – Elliott Wave Analysis – Trading Lounge 1-Hour Chart

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave i of (v)

Direction: Upside in wave (v)

Details:

The 1-hour chart indicates that BRK.B is progressing within wave (v), with an expected final leg higher in micro wave 5 of subminuette wave i.

A minor pullback in wave ii is anticipated around the $500 support level before the next bullish phase resumes in wave (v). This dip could provide a buying opportunity for traders looking to align with the broader uptrend.

Market Outlook for BRK.B 1-Hour Chart Analysis:

A final leg higher in micro wave 5 of subminuette wave i is expected.

A minor pullback in wave ii near $500 could act as a setup for the next rally in wave (v).

As long as price action remains above $500, the bullish trend remains intact.

Traders should watch price reactions near the $500 level, as it serves as a key pivot for the next phase of the Elliott Wave structure.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Dell Technologies Inc. (DELL) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support