ASX: CAR GROUP LIMITED (CAR) Elliott Wave Technical Analysis – TradingLounge

Greetings,

This updated Elliott Wave analysis for CAR GROUP LIMITED (ASX:CAR), listed on the Australian Securities Exchange, identifies a key technical development. Our recent evaluation suggests that CAR has likely completed a corrective phase, specifically Wave (4) - orange, forming a classic Zigzag pattern. This signals potential bullish momentum, indicating that a new upward trend may be developing. This technical summary includes a market forecast and a critical invalidation level to monitor for trend confirmation.

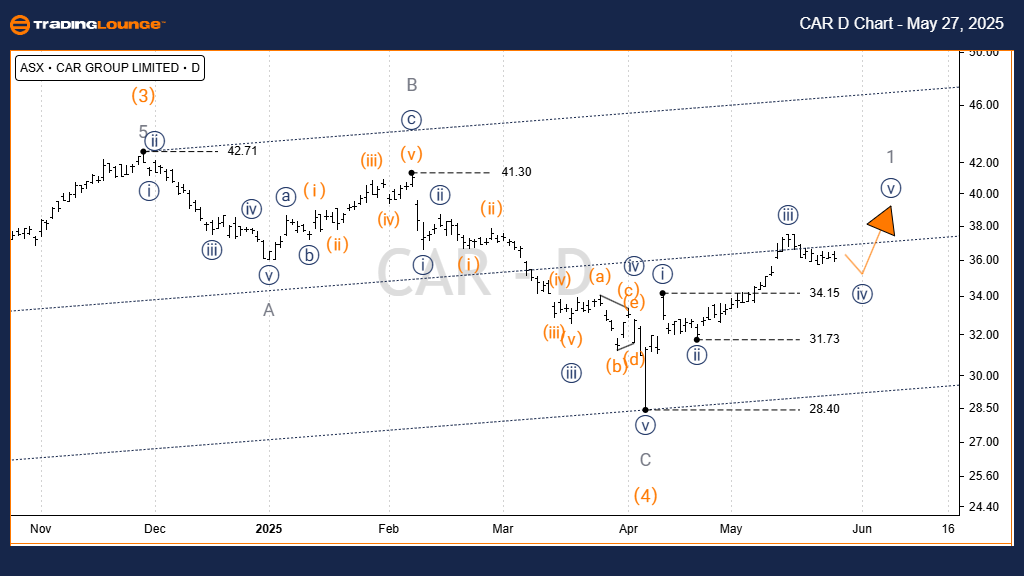

ASX: CAR GROUP LIMITED (CAR) Elliott Wave Analysis – Daily Chart

ASX: CAR GROUP LIMITED (CAR) Daily Chart (Semilog Scale) Analysis

Trend Type: Intermediate

Wave Mode: Motive

Structure: Impulse

Current Wave: Wave iv)) - navy within Wave 1 - grey of Wave (5) - orange

Key Technical Insights:

- Wave (4) - orange began near the 42.71 level and likely concluded at 28.40, forming an A-B-C Zigzag (grey).

- The C wave (grey) consists of five well-defined subwaves, indicating potential wave completion.

- Current action suggests Wave (5) - orange is now underway.

The market appears to be in a minor retracement via Wave iv)) - navy, which has not broken below Wave i)) - navy — a sign of sustained upward potential through Wave v)) - navy.

Critical Support / Invalidation Level: 34.15 (A break below this level would challenge the current wave interpretation.)

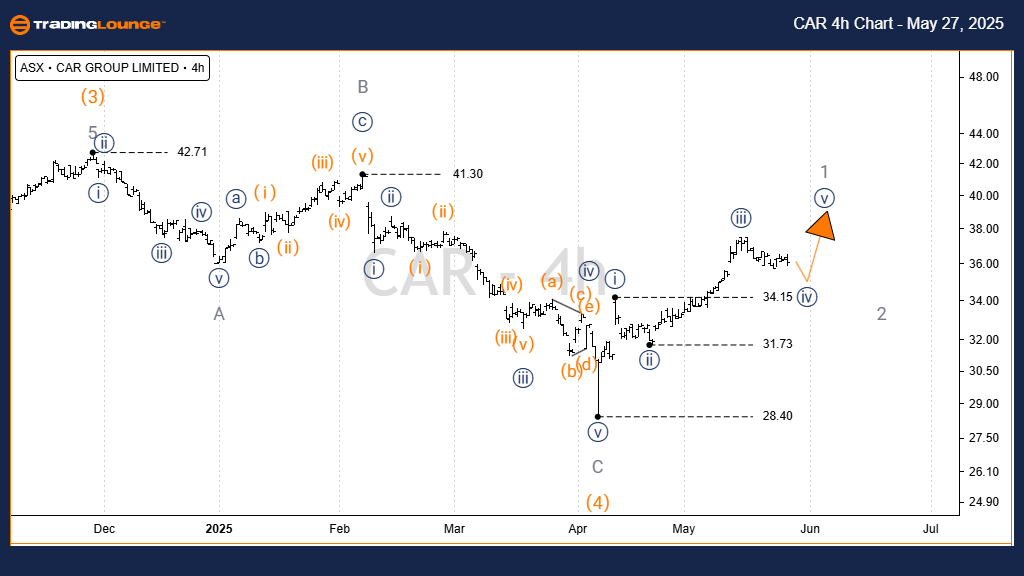

ASX: CAR GROUP LIMITED (CAR) Elliott Wave Technical Analysis – 4-Hour Chart

Trend Type: Minor

Wave Mode: Motive

Structure: Impulse

Current Wave: Wave ((iv)) - navy within Wave 1 - grey of Wave (5) - orange

Technical Breakdown:

- The intraday pattern confirms alignment with the daily chart’s wave structure.

- Wave iv)) - navy continues to unfold with typical corrective behavior.

- No invalid overlap has occurred, supporting the ongoing bullish scenario.

Reinforced Invalidation Level: 34.15 (Consistent with the daily chart’s key support level.)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: IAG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave forecast for ASX: CAR GROUP LIMITED (ASX:CAR) highlights a potentially bullish development based on a completed Wave (4) Zigzag correction. By identifying precise wave counts and key price thresholds, this analysis aids traders in making more informed strategic decisions. As long as prices remain above 34.15, the bullish wave scenario remains intact. Stay tuned for future updates to confirm progress through Wave v)) - navy.