GX Uranium ETF Commodity Elliott Wave Technical Analysis

The GX URA ETF, also known as the Global X Uranium ETF, tracks the performance of companies in the uranium industry. This ETF offers investors a diversified portfolio that includes firms involved in uranium mining, exploration, and production worldwide. As nuclear power gains recognition as a cleaner energy alternative, the demand for uranium is expected to rise, making the GX URA ETF an attractive option for investors looking to benefit from the sector's growth.

GX URA ETF Elliott Wave Technical Analysis

The GX URA ETF has resumed its downward trajectory, continuing the sell-off that started from its peak in May 2024. The recent decline suggests a bearish impulse wave structure is forming, indicating further downside movement is likely in the coming weeks.

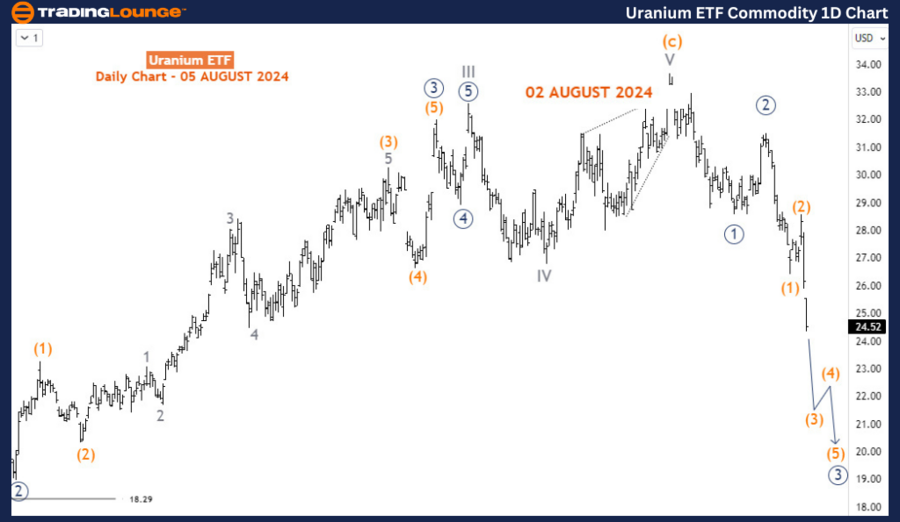

Daily Chart Analysis

On the daily chart, the bullish corrective cycle that began in March 2020 concluded on May 21, 2024. During this cycle, the supercycle waves (a)-(b)-(c) unfolded, with wave (a) completing as an impulse wave in November 2021. This was followed by a wave (b) pullback, which ended as a double zigzag in July 2022 at 17.70. From the July 2022 low, a bullish impulse wave commenced, culminating at the May 2024 peak.

From this peak, we are likely to witness either a full bearish impulse wave sequence (1-2-3-4-5) or an A-B-C corrective decline of the cycle degree. The price is currently in wave (3) of 3 (circled) of either a or I, suggesting that wave (3) could extend lower toward the 21.58-20.39 range in the coming weeks.

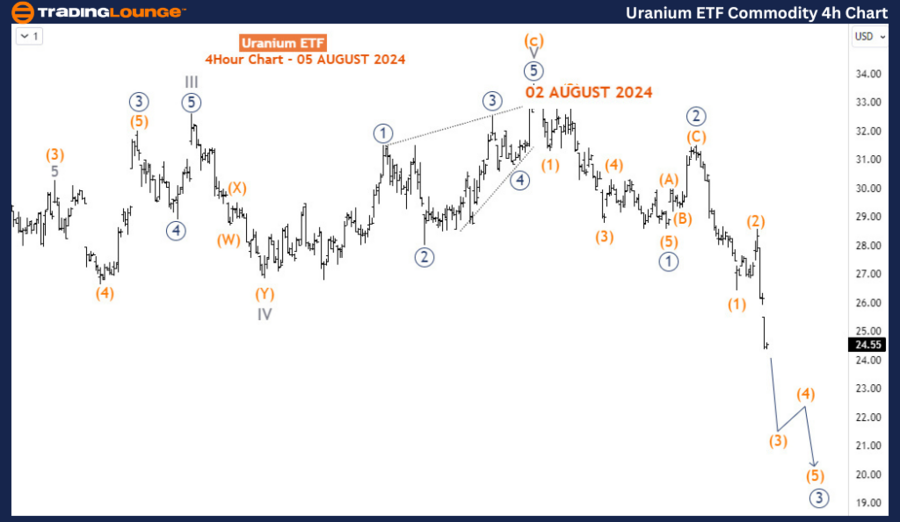

H4 Chart Analysis

The H4 chart aligns with the daily chart's outlook, reinforcing the expectation that wave (3) will continue to push lower. Sellers are in control of this ETF, and the bearish momentum is likely to persist, driving prices further down.

Conclusion

In summary, the GX URA ETF is amid a significant sell-off, driven by a developing bearish impulse wave structure. With the potential for wave (3) to extend lower, traders should expect continued downward pressure on this ETF. The outlook remains bearish, and selling opportunities may arise as the market progresses toward key support levels.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support