ASX: UNIBAIL-RODAMCO-WESTFIELD (URW) Elliott Wave Technical Analysis – TradingLounge

Greetings,

Today's Elliott Wave analysis provides an updated forecast for UNIBAIL-RODAMCO-WESTFIELD (URW) on the Australian Stock Exchange (ASX).

We anticipate bullish momentum for ASX: URW in the near term. Our short-term outlook suggests that an upcoming wave two pullback will present a high-probability long trade setup. This analysis provides structured insights into when to remain on the sidelines and when to strategically enter trades.

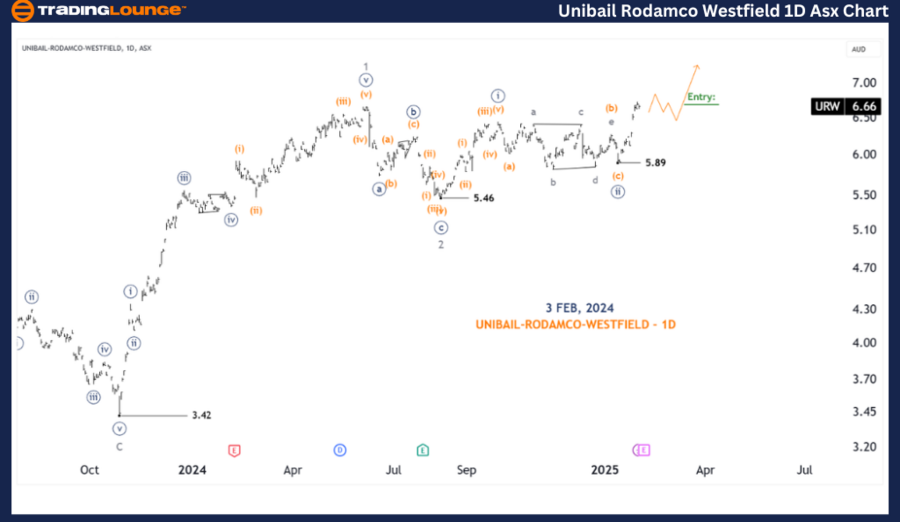

ASX: UNIBAIL-RODAMCO-WESTFIELD (URW) Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy of Wave 3 - grey

Details:

- Wave ((iii)) - navy is moving higher, and a corrective pullback around 6.50 may provide a potential long trade setup.

- On a smaller scale, wave (i) - orange is approaching completion.

- The expected wave (ii) - orange decline will offer an optimal buying opportunity for long trades.

- Invalidation Point: 5.89

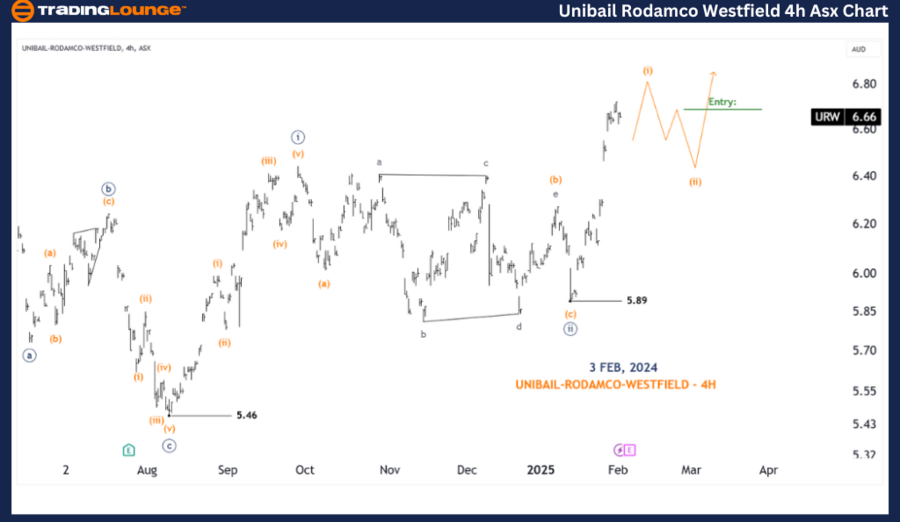

ASX: UNIBAIL-RODAMCO-WESTFIELD (URW) 4-Hour Chart Analysis

Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (i) - orange of Wave ((iii)) - navy

Details:

- The 4-hour chart indicates wave (i) - orange is nearly complete.

- Given the significant wave extension, a stop-loss around 5.89 is necessary for long trades, but may not be optimal.

- Waiting for a pullback will provide a better long-entry point with a tighter and more efficient stop-loss level.

- Invalidation Point: 5.89

- Key Point: Wave b of Wave (ii) - orange

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave forecast offers valuable insights into ASX: URW market trends and trade strategies. By defining key price levels for validation and invalidation, traders can confidently align their positions with the wave count projections.

These factors enable an objective, structured, and professional market perspective, helping traders make informed trading decisions based on Elliott Wave principles.