This Elliott Wave forecast for NextEra Energy Inc. (NEE) provides a detailed technical outlook based on both daily and intraday timeframes. The charts indicate that NEE is progressing through a corrective phase, which is approaching completion. A bullish reversal may follow as the current wave sequence finalises.

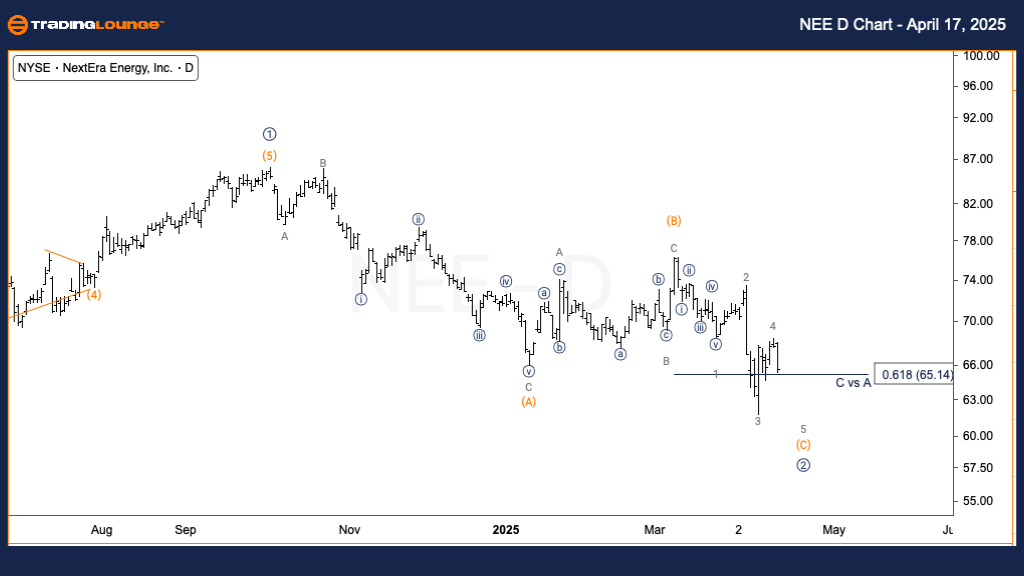

NextEra Energy Inc. (NEE) Elliott Wave Analysis – Tradinglounge Daily Chart

NextEra Energy Inc. (NEE) – Daily Chart Analysis

NEE Elliott Wave Technical Analysis

FUNCTION: Counter trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave (C) of 2

DIRECTION: Bottoming in Wave (C)

DETAILS: Intermediate wave (C) is nearing completion within the broader Primary wave 2 correction. The structure displays a clear three-wave flat correction, suggesting a bullish trend resumption once this phase concludes.

Daily Chart Insight

The daily Elliott Wave chart for NEE shows a nearly complete flat correction within Primary wave 2. As Intermediate wave (C) unfolds, price action is entering a probable reversal zone. Once this corrective wave finalizes, a continuation of the broader uptrend is likely, making this a critical setup for bullish traders.

NextEra Energy Inc. (NEE) – TradingLounge 1-Hour Chart

NEE Elliott Wave Technical Analysis

FUNCTION: Counter trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave 4 of (C)

DIRECTION: Downward continuation into Wave 5

DETAILS: Wave 4 of (C) appears close to completion. A final leg lower in wave 5 of (C) is anticipated. The three-wave bounce from the April 9 low supports the wave 4 label, aligning with the expected structure.

1-Hour Chart Insight

The 1-hour chart supports the daily view, indicating wave 4 of (C) is wrapping up. A downward push in wave 5 of (C) is expected to complete the correction. The internal wave structure confirms the corrective profile, making this timeframe crucial for identifying a potential bullish pivot.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: PANW Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support