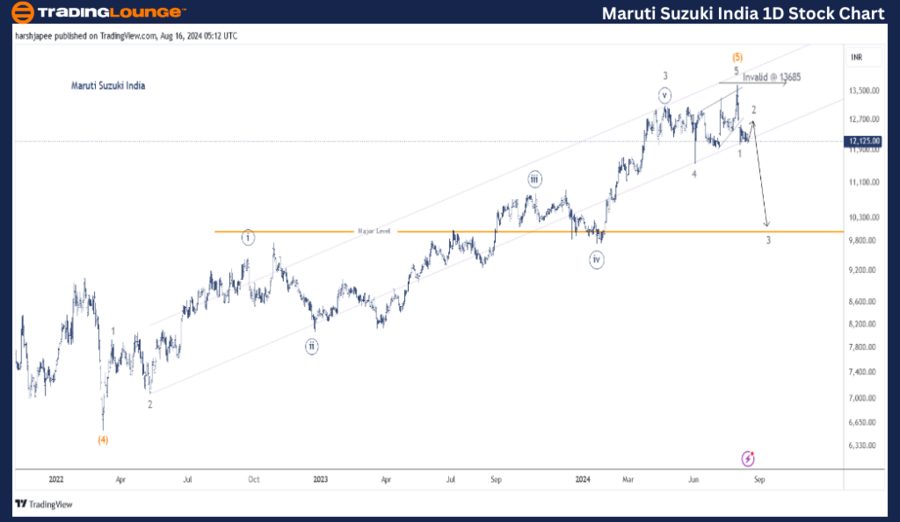

MARUTI SUZUKI INDIA – MARUTI (1D Chart) Elliott Wave Analysis

Function: Counter Trend Lower (Intermediate Degree, Orange)

Mode: Corrective

Structure: Impulse, Within Larger Degree Wave A

Position: Minor Wave 1 Grey Complete

Details: Minor Wave 2 Underway Towards 12700-800 Zone

Invalidation Point: 13685

Maruti Suzuki Stock Daily Chart Analysis and Potential Technical Scenarios

Maruti Suzuki’s daily chart analysis suggests that the stock might have completed its fifth wave at Minor, Intermediate, and Primary (not shown) degrees around the 13685 mark. This high was recorded on July 31, 2024, followed by a decline below Minute Wave ((4)) at 12367.

The broader wave structure indicates that Intermediate Wave (4) bottomed around 6546 in March 2022. Since then, the rally has likely subdivided into five waves (impulse), culminating in Intermediate Wave (5) around the 13685 level.

If this structure holds, Maruti Suzuki may be entering a larger degree corrective wave that has just started, moving against the 13685 high. However, a push through this high would invalidate the bearish scenario.

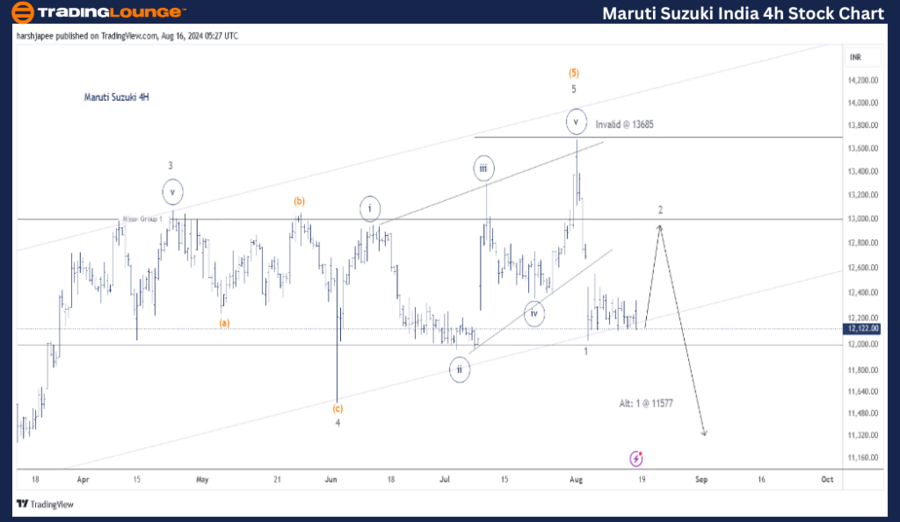

Maruti Suzuki 4-Hour Chart: MARUTI Elliott Wave Analysis

Maruti Suzuki 4-Hour Chart: Elliott Wave Analysis and Potential Technical Scenarios

The 4-hour chart for Maruti Suzuki also indicates a potential top at the 13685 level. Minor Wave 5 of Intermediate Wave (4) unfolded as an ending diagonal, typically signaling the exhaustion of a larger uptrend.

Ending diagonals usually lead to swift price reversals, breaking the fourth wave termination, which is evident in the price action between 13685 and 12120. This drop could be labeled as Minor Wave 1, likely to be followed by a corrective Wave 2.

Alternatively, if Minor Wave 1 is still progressing, another drop could occur, potentially breaching the 11576 lows—the termination point of Minor Wave 4 and the minimum expected drop after a diagonal. In this case, the corrective rally of Minor Wave 2 would be delayed.

Conclusion

Maruti Suzuki stock appears to be setting up for a larger degree corrective drop, at least at the Intermediate degree, moving against the 13685 high.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support