Elliott Wave Analysis of The TJX Companies Inc. (TJX): A Detailed Overview of Current Trends and Forecasts

This Elliott Wave analysis of The TJX Companies Inc. (TJX) provides insights into both the daily and 1-hour chart structures, offering a comprehensive outlook on the prevailing trends and potential price trajectories.

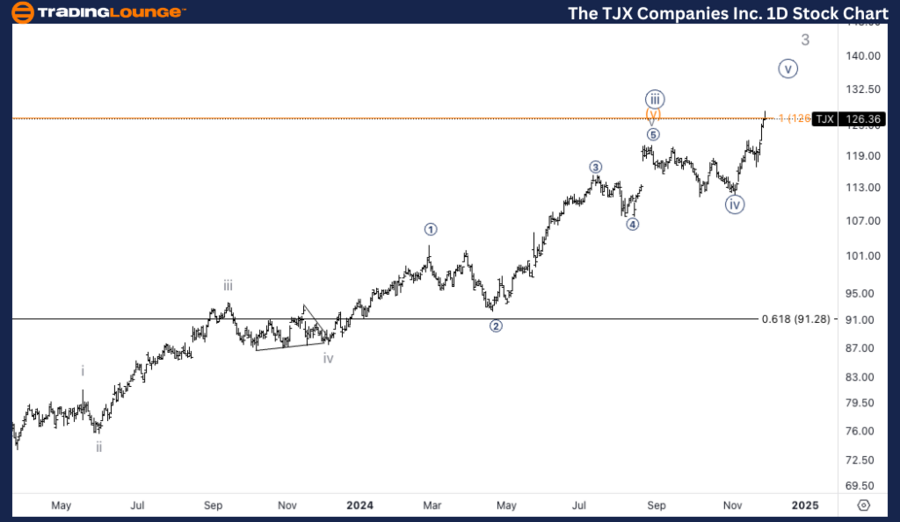

TJX Elliott Wave Analysis - TradingLounge Daily Chart

TJX Companies Inc. (TJX) Daily Chart Overview

TJX Elliott Wave Technical Analysis: Key Details

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {v} of 3 of (5)

Direction: Upside into wave 3

TJX Stock Technical Details:

TJX Daily Chart Insights

TJX is advancing within wave {v} of wave 3, part of the larger (5) wave structure. The stock is moving toward the completion of wave 3, with the equality of wave 3 vs. wave 1 suggesting a near-term target of $126, marking the end of MinorGroup1. If the upward momentum holds, the subsequent target at 1.618 times wave 1 would elevate the price potential to $213.

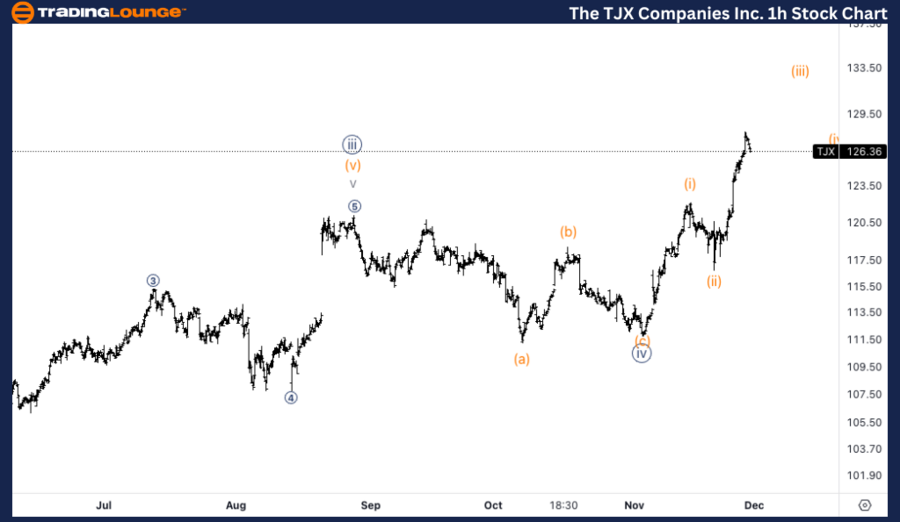

TJX Elliott Wave Analysis - TradingLounge 1-Hour Chart

TJX Companies Inc. (TJX) 1-Hour Chart Overview

TJX Stock Technical Analysis: Key Details

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iii) of {v}

Direction: Upside in wave (iii)

TJX Technical Details:

TJX 1-Hour Chart Insights

On the 1-hour chart, TJX is progressing through wave (iii) of {v}, with further upside likely as the impulsive advance continues to unfold. The five subwaves within wave (iii) are incomplete, signaling potential movement above $130, which marks the endpoint of MinorGroup1.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Chevron Inc. (CVX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Key Takeaways:

- Daily Chart: Upside momentum targets $126, with extended potential to $213 based on wave projections.

- 1-Hour Chart: Continuation above $130 expected as the impulsive pattern within wave (iii) develops further.