ASX: ASX LIMITED – ASX Elliott Wave Analysis (1D Chart)

Welcome to our latest Elliott Wave analysis update on the Australian Stock Exchange (ASX) for ASX LIMITED – ASX. Our analysis reveals that ASX Limited has recently completed wave ((ii))-navy, with wave ((iii))-navy now anticipated to drive the price higher.

ASX LIMITED – TradingLounge ASX Elliott Wave Analysis (1D Chart)

ASX: ASX LIMITED – ASX Day Chart (Semilog Scale) Analysis

ASX LIMITED – ASX Elliott Wave Technical Analysis

Function: Major (Minor degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy of Wave 3-grey

Details: The recent wave ((ii))-navy appears to have reached its low, setting the stage for wave (iii) within wave ((iii))-navy to extend upwards. For this bullish outlook to hold, the price must stay above the 63.15 level. We are nearing a potential Trading Setup with ASX Limited, supported by the 65.00 price level.

Invalidation point: 63.15

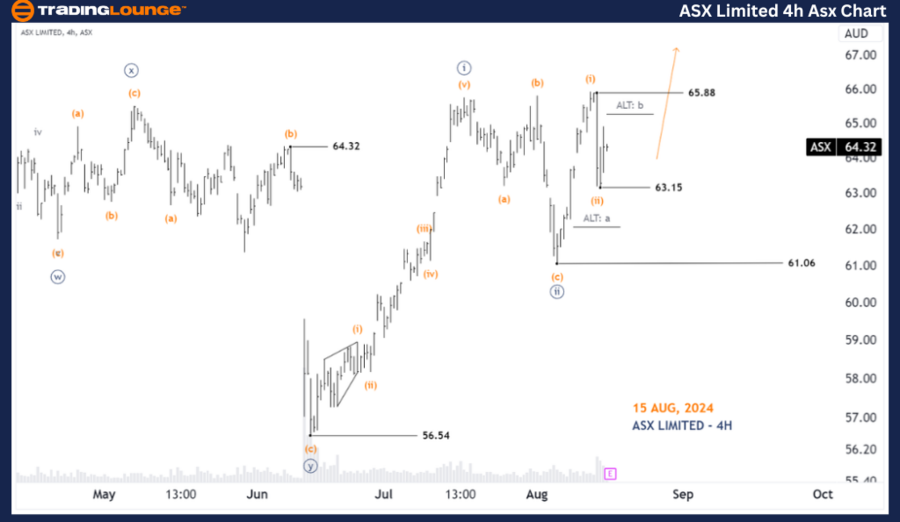

ASX: ASX LIMITED – Tradinglounge ASX Elliott Wave Analysis (4-Hour Chart)

ASX: ASX LIMITED – ASX 4-Hour Chart Analysis

Function: Major Trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((ii))-navy

Details: The wave (ii)-orange has likely bottomed at 63.15, with wave (iii)-orange beginning to unfold, aiming to push prices higher. A move above 65.88 would further confirm that wave (iii)-orange of wave ((iii))-navy is active, signaling a continuation of the upward trend. Maintaining prices above 63.15 is critical to preserving this analysis.

Invalidation point: 63.15

Confirmation point: 65.88

Conclusion

Our Elliott Wave analysis on ASX: ASX LIMITED – ASX provides key insights into current market trends and strategic opportunities. We outline specific price levels that serve as validation or invalidation points for our wave count, which enhances the reliability of our forecast. This approach aims to deliver a professional and objective market perspective, helping readers make informed trading decisions.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: V300AEQ ETF UNITS Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support