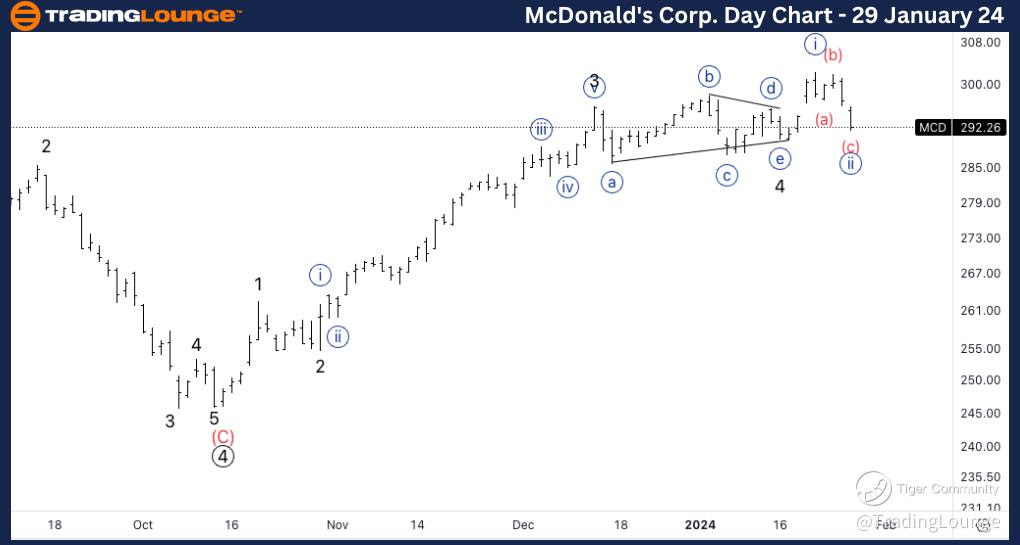

MCD Elliott Wave Analysis Trading Lounge Daily Chart, 29 January 24

McDonald’s Corp.,(MCD) Daily Chart

MCD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Wave (c) of {ii}

POSITION: Minute(Blue) wave {ii}

DIRECTION: Higher degree Minor wave 5.

DETAILS: Looking for further upside into wave 5, knowing we could already have topped, which is why we are waiting for upside confirmation.

SOURCE: Tradinglounge.com, Learn From the Experts Join TradingLounge Here

PREVIOUS: Johnson & Johnson

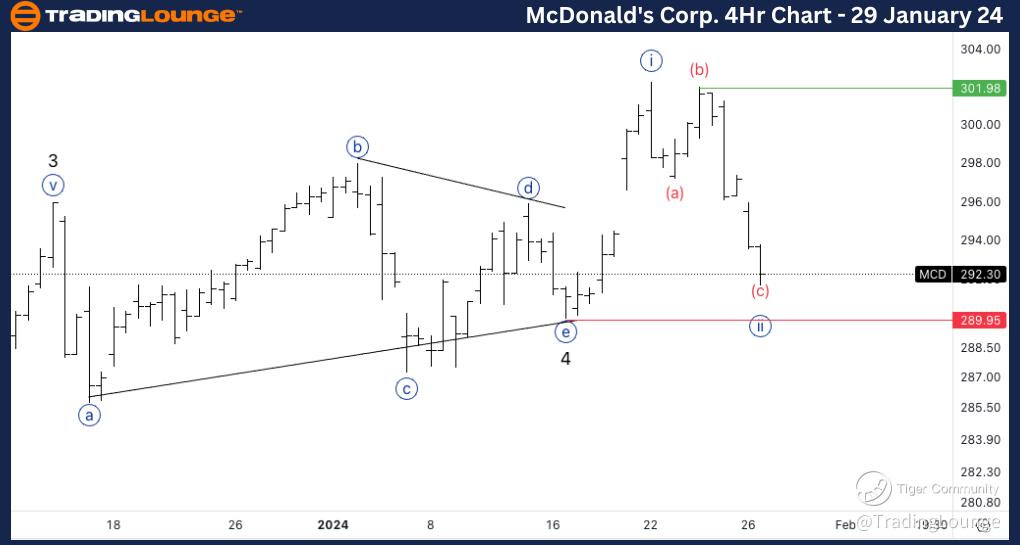

MCD Elliott Wave Analysis Trading Lounge 4Hr Chart, 29 January 24

McDonald’s Corp.,(MCD) 4Hr Chart

MCD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Wave v of (c).

POSITION: Sub minuette wave v of (c).

DIRECTION: Higher degree wave {ii}.

DETAILS: We need to break north of the green line with a break of previous wave (b) top. A break south of the red line would invalidate the count and would suggest we have a wave 5 in place.