SGX TSI Iron Ore Index Elliott Wave Analysis

The SGX TSI Iron Ore Index serves as a vital benchmark in the iron ore market, offering key insights for traders, miners, and steelmakers engaged in contract settlements and price risk management. The index's performance reflects actual transactions in the iron ore spot market, providing a reliable indicator of current market conditions.

Iron Ore Index Elliott Wave Technical Analysis

Overview and Long-Term Analysis

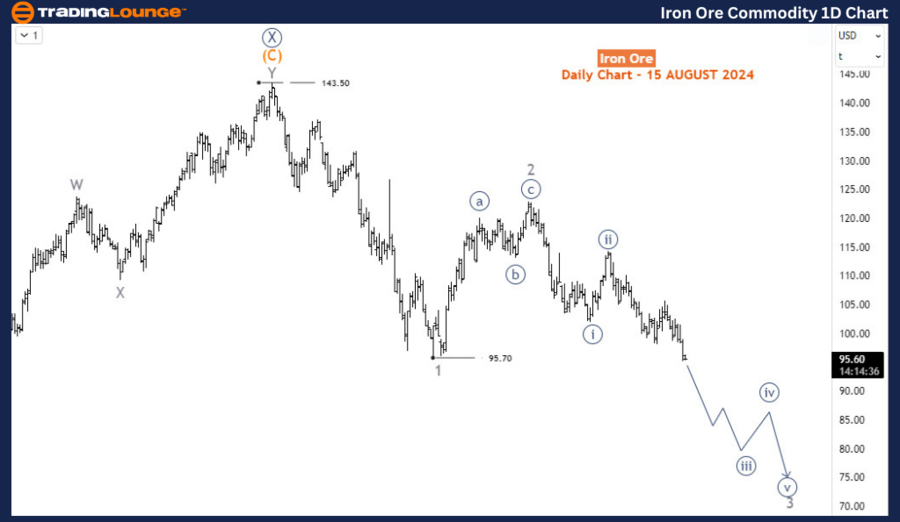

The index reached its peak in May 2021, hitting an all-time high of approximately $233 per dry metric ton, driven by robust demand from China and supply constraints among major producers. Since then, it has experienced a significant correction, declining over 68% to $73 by October 2022. A recovery followed, pushing the index to $143.5 by December 2023. However, after a major recovery in April and May 2024, the commodity is now reversing those gains, continuing the sell-off that began in January 2024.

In the long term, the index initiated a bearish corrective phase in May 2021, forming a primary wave W-X-Y (circled). The primary degree waves W and X (circled) concluded at the October 2022 low and January 2024 high, respectively. Wave Y (circled) commenced at the January 2024 high of 143.5 and is anticipated to evolve into a 3-wave structure consisting of intermediate degree waves (A)-(B)-(C). Currently, the price is in wave 3 of (A), with the potential to extend down to 45, indicating a bearish long-term outlook for the index based on Elliott Wave theory.

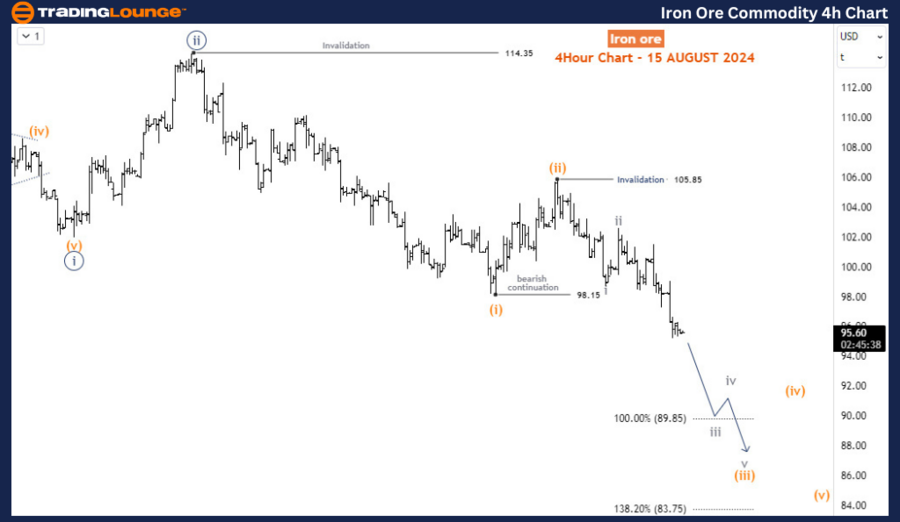

Iron Ore 4-Hour Chart Analysis

On the H4 chart, wave 3 began at 122.9 and is currently unfolding its 3rd sub-wave, wave iii (circled) of 3. A closer examination reveals that the price is in wave (iii) of iii (circled) of 3. In the near term, wave (iii) could reach 85 before a corrective bounce for wave (iv) and then resume its downward trend.

Conclusion

The SGX TSI Iron Ore Index is experiencing a significant bearish correction after peaking in May 2021. The long-term outlook indicates further downside potential, with the index likely to continue its decline as part of a broader corrective wave structure. While short-term bounces are possible, traders should remain cautious and aware of the prevailing bearish trend.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support