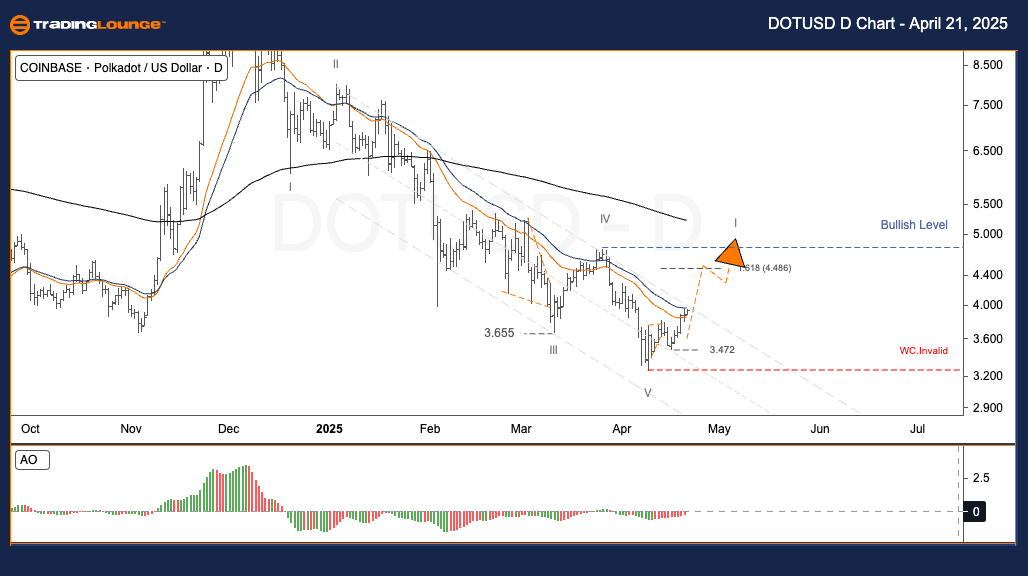

Polkadot / U.S. Dollar (DOTUSD) Elliott Wave Analysis - TradingLounge Daily Chart

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave V

Direction Next Higher Degrees: —

Wave Cancel Invalid Level: —

Polkadot / U.S. Dollar (DOTUSD) Daily Trading Strategy:

Polkadot (DOTUSD) has completed a 5-wave bearish decline from $11.653 to $3.472, marking the end of Wave I–V. A bullish trend reversal is now underway, supported by the emergence of a new Wave I. This wave is approaching key resistance at $4.486. A confirmed breakout above this level can validate the setup for Wave II and initiate a powerful Wave III advance—historically the strongest phase in an Elliott Wave cycle.

Trading Strategies

Strategy

✅ Short-Term Traders (Swing Trade)

- Monitor for Wave II retracement

- Prepare long positions at the onset of Wave III

Risk Management: —

Polkadot / U.S. Dollar (DOTUSD) Elliott Wave Analysis - TradingLounge H4 Chart

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees: —

Wave Cancel Invalid Level: —

Polkadot / U.S. Dollar (DOTUSD) Intraday Trading Strategy:

Following the Wave V bottom at $3.472 on the Daily chart, DOTUSD has started a new uptrend with Wave I in play. On the H4 timeframe, the market is currently unfolding Wave 3 of Wave I. The next resistance aligns with the 1.618 Fibonacci extension near $4.486—an important level for bullish momentum continuation.

Trading Strategies

Strategy

✅ Short-Term Traders (Swing Trade)

- Trade with the momentum in Wave 3

- Anticipate Wave 4 pullback to set up for Wave 5 entries

Risk Management: —

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AAVEUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support