Polkadot (DOT/USD) continues to intrigue traders with its dynamic price movements and patterns that often adhere to the Elliott Wave principles. This analysis will explore the technical aspects of DOT/USD trading patterns on both the daily and H4 charts, providing insights into potential future movements and strategic trading decisions.

TradingLounge Elliott Wave Analysis of Polkadot (DOT/USD): Daily Chart

The Elliott Wave Technical Analysis on the daily chart for Polkadot against the U.S. dollar (DOT/USD) showcases a counter-trend structure with a flat correction pattern that is currently positioned in Wave C.

Pokadot/ U.S. dollar(DOTUSD) Daily Chart Analysis

DOTUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave C

Direction Next higher Degrees: wave (II) of Impulse

Wave Cancel invalid level:

Details: Wave II Is equal to 61.8% of Wave I at 5.225

Pokadot/ U.S. dollar(DOTUSD)Trading Strategy:

Second wave correction before rising again in the third wave with a flat pattern. The current status is a short-term pullback in wave B before falling again in wave C, so wait for the correction to complete to join the uptrend again.

Pokadot/ U.S. dollar(DOTUSD)Technical Indicators: The price is above the MA200 indicating an Uptrend, The Wave Oscillator is a Bullish Momentum.

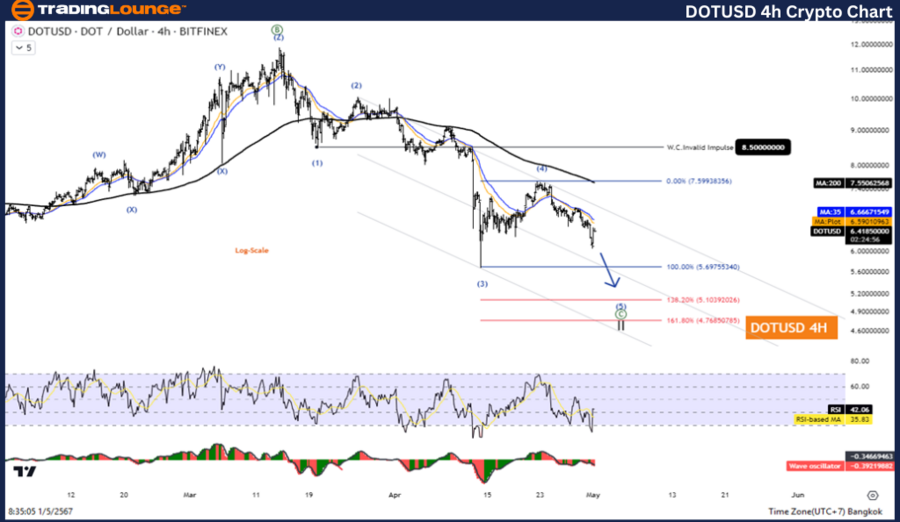

TradingLounge Elliott Wave Analysis of Polkadot (DOT/USD): 4-Hour Chart

On the H4 chart, Polkadot's market behaviour aligns with a follow-trend function, characterized by a motive structure. This indicates a more aggressive trading pattern, typically associated with significant price movements.

Pokadot/ U.S. dollar(DOTUSD) 4-hour Chart Analysis

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Direction Next higher Degrees: wave C of Flat

Wave Cancel invalid level:

Details: A short-term pullback in wave 4 before falling again in wave 5.

Pokadot/ U.S. dollar(DOTUSD)Trading Strategy:

Second wave correction before rising again in the third wave with a flat pattern. The current status is a short-term pullback in wave B before falling again in wave C, so wait for the correction to complete to join the uptrend again.

Pokadot/ U.S. dollar(DOTUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bullish Momentum.

Technical Analyst: Kittiampon Somboonsod

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Elliott Wave Technical Analysis of NEO/USD

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 6 Analysts covering over 150 Markets. Chat Room With Support

Conclusion and Trading Tips

Both the daily and H4 charts for Polkadot (DOT/USD) indicate bullish momentum with ongoing corrections that offer strategic entry points for traders. By applying Elliott Wave Analysis, traders can better anticipate price movements and optimize their trading strategies accordingly.