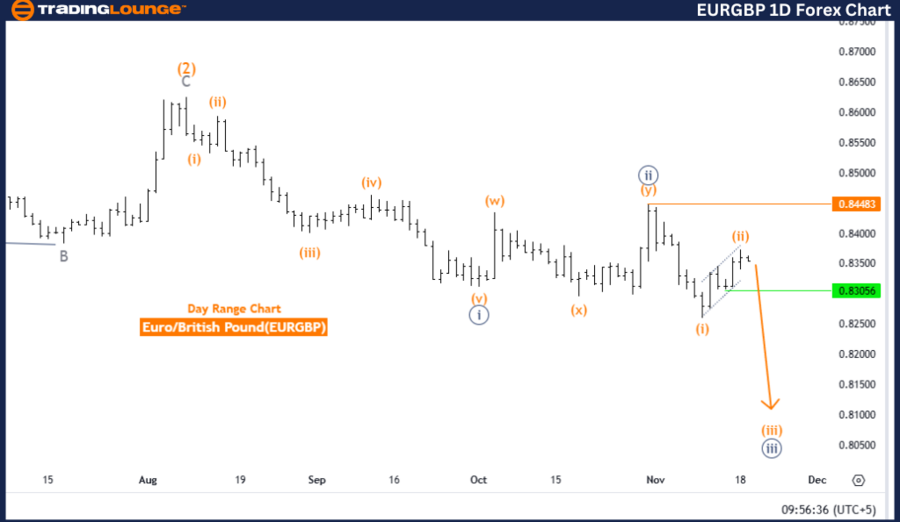

EURGBP Elliott Wave Analysis Trading Lounge Daily Chart

Euro/British Pound (EURGBP) Daily Chart

EURGBP Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction (Next Lower Degrees): Orange Wave 3 (in progress)

Details: Orange wave 2 appears to have concluded, with orange wave 3 now active.

Wave Invalid Level: 0.84483

The EURGBP daily chart analysis points to a strong bearish trend defined by an impulsive Elliott Wave pattern. The current active wave is orange wave 3, forming part of the larger navy blue wave 3, indicating persistent downward momentum. The completion of orange wave 2 signals the activation of orange wave 3, which represents the next step in this bearish progression.

According to Elliott Wave theory, wave 3 typically aligns with a dominant trend, often marked by a robust and extended price move. The development of orange wave 3 within navy blue wave 3 reinforces the bearish sentiment, suggesting that further price declines are expected as this phase evolves.

The analysis sets an invalidation level at 0.84483. If the price rises to or surpasses this level, the current wave structure would be invalidated, indicating a potential weakening or reversal of the bearish trend. This level serves as a crucial reference point for traders, helping to confirm the validity of the Elliott Wave pattern and market direction.

Summary

- Trend: Bearish, driven by orange wave 3 within navy blue wave 3.

- Next Stage: Completion of orange wave 2 sets the stage for a significant downward movement.

- Key Level: Monitor the invalidation level at 0.84483 for potential disruptions to the current structure or signs of a trend reversal.

Euro/British Pound (EURGBP) 4-Hour Chart

EURGBP Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction (Next Lower Degrees): Orange Wave 3 (in progress)

Details: Orange wave 2 appears complete, with orange wave 3 now active.

Wave Invalid Level: 0.84483

The EURGBP 4-hour chart emphasizes a bearish trend shaped by an impulsive Elliott Wave structure. The active wave, orange wave 3, resides within navy blue wave 3, signaling continued downward pressure. The resolution of orange wave 2 has initiated orange wave 3, marking the next phase in this bearish trend.

In the context of Elliott Wave theory, wave 3 often exhibits strong, decisive movements that extend the prevailing trend. The progression of orange wave 3 within navy blue wave 3 strengthens the bearish perspective, with additional price declines anticipated as this wave develops.

A key invalidation level at 0.84483 is highlighted. Breaching this level would invalidate the current wave structure, suggesting a potential trend reversal or shift. This threshold is essential for traders, acting as a reference to ensure the analysis aligns with market movements.

Summary

- Trend: Bearish, driven by orange wave 3 within navy blue wave 3.

- Next Stage: Resolution of orange wave 2 has set the market for further declines.

- Key Level: Traders should watch the invalidation level at 0.84483 closely for potential shifts in market direction or structural disruptions.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support