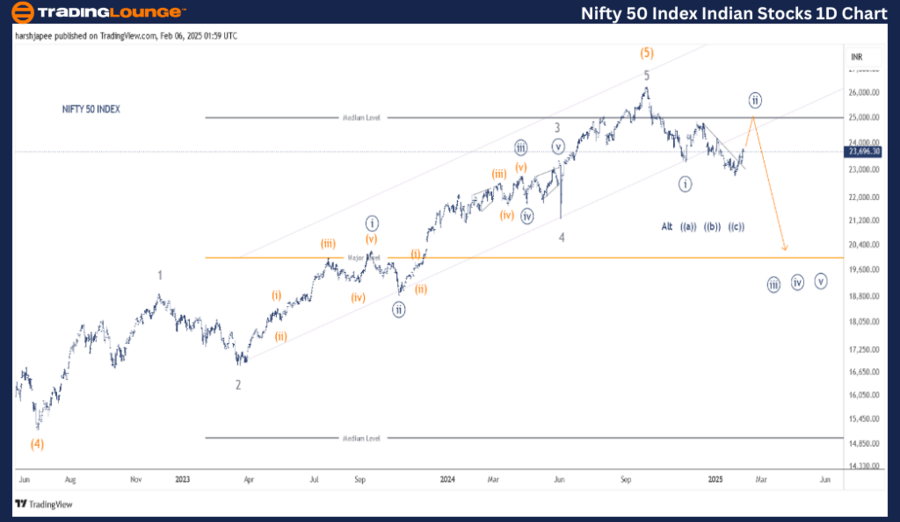

NIFTY 50 INDEX Elliott Wave Analysis - TradingLounge (1D Chart)

NIFTY 50 INDEX Day Chart Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within a Larger Degree

Position: Minute Wave ((ii))

NIFTY 50 Elliott Wave Technical Analysis & Elliott Wave Outlook

Invalidation Level: 26,400

NIFTY 50 INDEX Daily Chart – Elliott Wave Analysis & Forecast

- The NIFTY 50 Index marked a major top near 26,300 in September 2024 and subsequently reversed. This decline formed Minute Wave ((i)), reaching the 23,267 level before unfolding into a possible expanded flat corrective wave targeting the 25,000-25,100 range.

- Intermediate Wave (4) completed around 15,200 in June 2022. Following this, bulls triggered a strong Minor-degree rally (Waves 1-5), leading to the recent peak at 26,300 before the correction began.

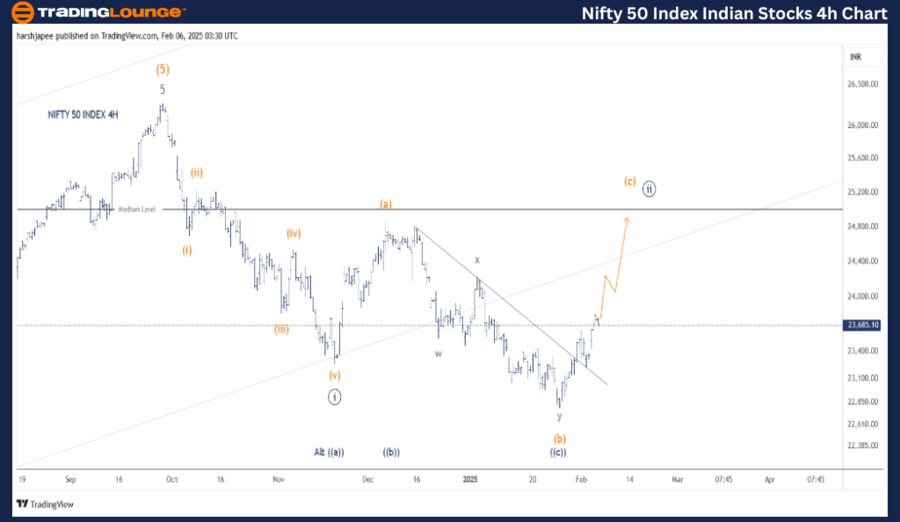

NIFTY 50 INDEX – NIFTY (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Impulse within a Larger Degree

Position: Minute Wave ((ii))

NIFTY 50 Technical Analysis & Elliott Wave Outlook

- Current Projection: Minute Wave ((ii)) appears to be progressing towards 25,000, indicating a temporary corrective phase before the downtrend continues.

- Wave Structure: The correction is evolving as an expanded flat, labeled Minuette (a)-(b)-(c) on the 4H chart.

- Alternative Scenario: The full move from the 26,300 high could be forming a Minute-degree correction ((a))-((b))-((c)) instead.

Invalidation Level: 26,400

NIFTY 50 INDEX 4H Chart – Elliott Wave Counts & Projections

- The NIFTY 50 Index rallied to 26,280-26,300 on September 27, 2024, before reversing lower. The initial drop to 23,267 subdivided into five waves, classified as Minute Wave ((i)).

- The subsequent price action is unfolding as a potential expanded flat (a)-(b)-(c), with prices likely moving towards the 25,000-25,100 region.

- A break above 24,255 would confirm further bullish momentum in the near term.

- Alternatively, the entire movement from 26,300 highs could be unfolding as a corrective wave ((a))-((b))-((c)), indicating possible bullish control soon.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NIFTY 50 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The NIFTY 50 Index is currently advancing towards the 25,000-25,100 zone as part of Minuette Wave (c) (Orange), which could complete Minute Wave ((ii)) before the broader downtrend resumes.