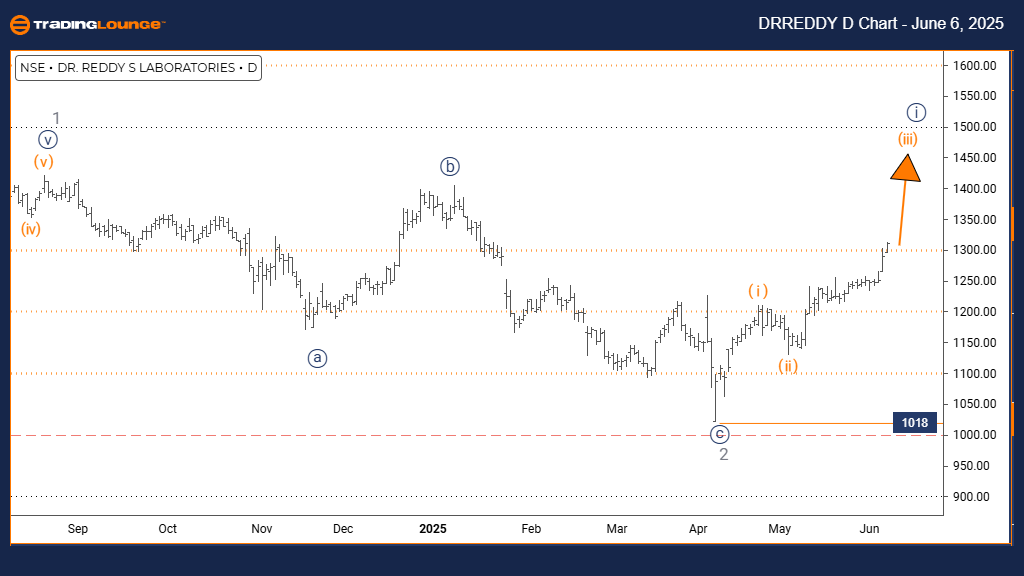

DR REDDY LABORATORIES Elliott Wave Analysis – Trading Lounge Day Chart

DR REDDY LABORATORIES Day Chart Analysis

DR REDDY LABORATORIES Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 4

DETAILS: Completion of Orange Wave 2; progression of Orange Wave 3 underway.

Wave Cancel Invalidation Level: 1018

The daily Elliott Wave analysis for Dr Reddy Laboratories stock indicates a strong bullish trend, with the current price movement forming an impulsive wave structure. The chart reveals the unfolding of orange wave 3, positioned within a larger navy blue wave 1 cycle—suggesting continued upward momentum.

Following the confirmed end of orange wave 2, the market is now advancing through orange wave 3, typically characterized by robust price action in Elliott Wave patterns. While a temporary correction in orange wave 4 may follow, the overall trend remains bullish. Traders should note the invalidation level at 1018—a decline below this price would negate the current wave scenario.

Key Takeaways:

- Impulsive wave action reflects a dominant bullish market sentiment.

- Active monitoring of wave progression is essential.

- Maintain bullish bias above the 1018 support threshold.

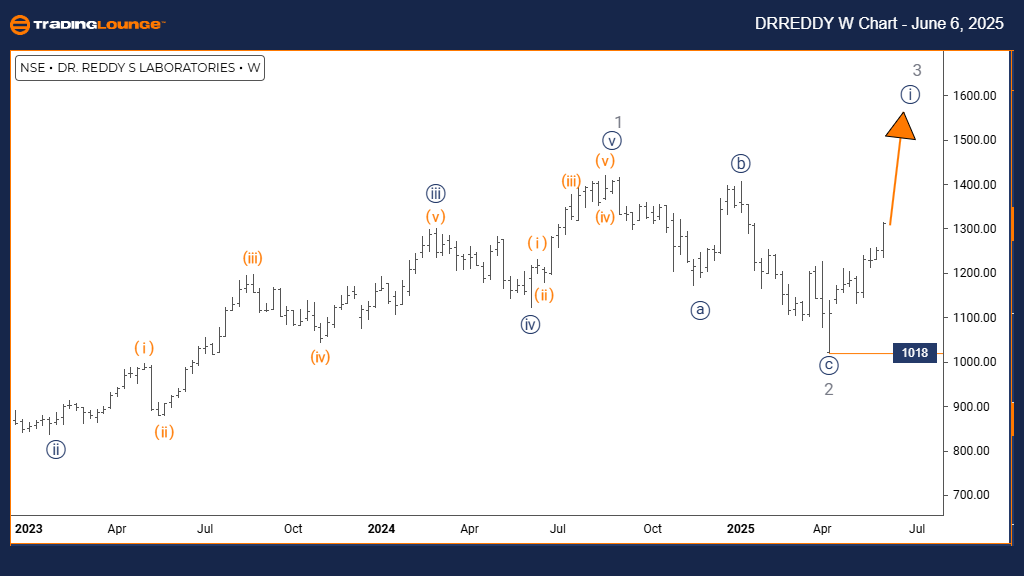

DR REDDY LABORATORIES Elliott Wave Analysis – Trading Lounge Weekly Chart

DR REDDY LABORATORIES Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT HIGHER DEGREES: Navy Blue Wave 1 (initiated)

DETAILS: Completion of Gray Wave 2; Navy Blue Wave 1 advancing within Gray Wave 3.

Wave Cancel Invalidation Level: 1018

On the weekly timeframe, Dr Reddy Laboratories shares are confirming a bullish Elliott Wave structure. The movement reflects an active navy blue wave 1, which is unfolding as part of a broader gray wave 3. This configuration supports a medium- to long-term bullish outlook.

With gray wave 2 completed, the current action within navy blue wave 1 suggests growing market strength. The beginning of the next navy blue wave 1 phase within gray wave 3 signals sustained upside momentum. If price levels fall beneath 1018, this would invalidate the existing wave structure.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: GRASIM INDUSTRIES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support