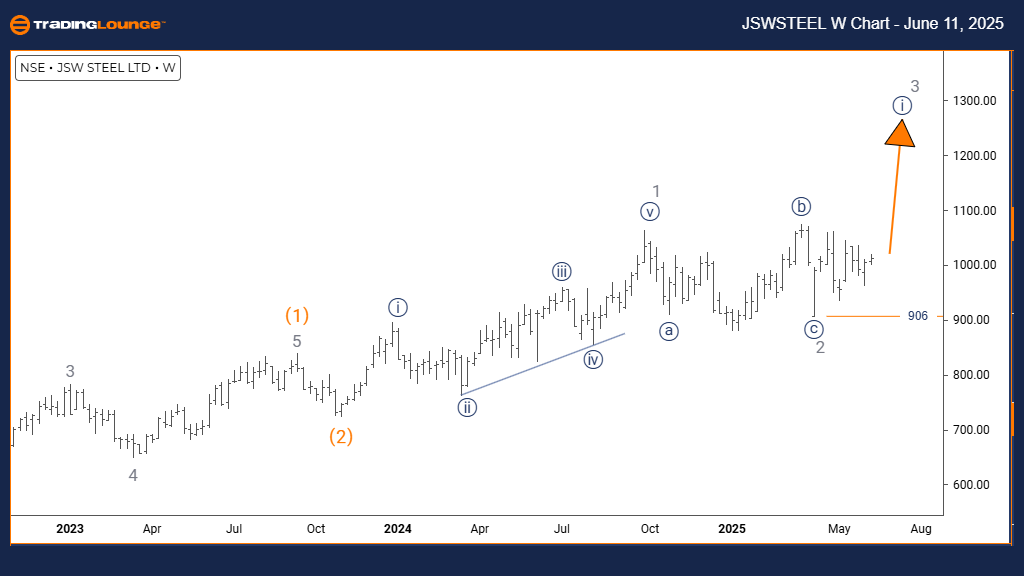

JSW STEEL Elliott Wave Analysis – TradingLounge Day Chart

JSW STEEL Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (Active)

DETAILS: Orange Wave 2 appears to have ended; Orange Wave 3 is actively progressing.

Wave Cancel Invalid Level: 906

The JSW STEEL daily chart reveals a sustained bullish trend under Elliott Wave analysis. The current wave progression shows a strong impulsive movement, highlighting Orange Wave 3 as the dominant wave. This wave unfolds within the broader structure of Navy Blue Wave 1, confirming bullish momentum in the stock's price action.

With Orange Wave 2 likely completed, the formation of Orange Wave 3 signals the start of a high-momentum phase. Orange Wave 3 typically presents the most vigorous price acceleration in Elliott Wave theory. Traders should note that Orange Wave 3 is unfolding actively, suggesting significant potential for continued upward moves.

The critical invalidation point remains at 906. A price dip below this level would challenge the bullish outlook and necessitate a fresh wave analysis. As long as JSW STEEL holds above this threshold, the technical setup supports further gains, reflecting increasing investor interest and market strength aligned with the ongoing Navy Blue Wave 1.

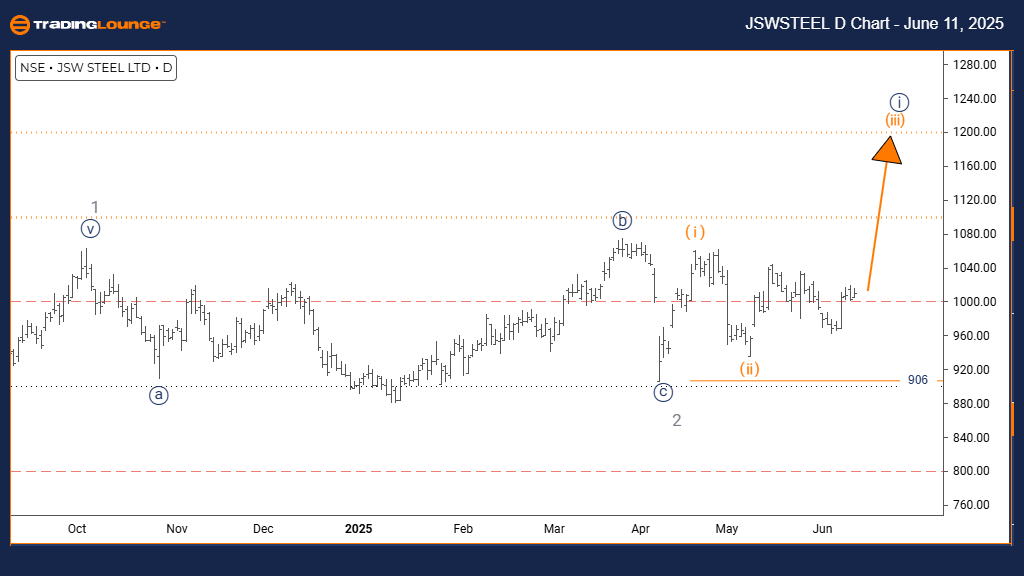

JSW STEEL Elliott Wave Analysis – TradingLounge Weekly Chart

JSW STEEL Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 appears complete; Navy Blue Wave 1 of Gray Wave 3 is in motion.

Wave Cancel Invalid Level: 906

The JSW STEEL weekly Elliott Wave analysis maintains a bullish outlook, supported by an impulsive price structure. The active wave count places the stock within Navy Blue Wave 1, a segment of the larger Gray Wave 3 trend. This configuration suggests the early phase of a potentially strong multi-week rally.

Analysis indicates the completion of Gray Wave 2, paving the way for Navy Blue Wave 1 within the developing Gray Wave 3. This transition usually leads into a dynamic bullish phase. The following anticipated move is Navy Blue Wave 2, expected to be corrective before the upward momentum resumes.

The invalidation level for this count is set at 906. A breach below this point would require a reassessment of the current wave structure. Until then, the bullish scenario holds, reinforcing upward expectations. With Gray Wave 3 advancing and Navy Blue Wave 1 in play, momentum continues to build. Monitoring price action around 906 remains crucial to validate this wave progression.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: COAL INDIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support