COAL INDIA Elliott Wave Analysis – Tradinglounge Day Chart

COAL INDIA Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Navy Blue Wave C

POSITION: Gray Wave C

DIRECTION NEXT LOWER DEGREES: Gray Wave C

DETAILS: Navy Blue Wave B looks completed; Navy Blue Wave C is currently unfolding.

The Elliott Wave daily analysis of COAL INDIA stock indicates a counter-trend corrective formation. This wave structure highlights a corrective pattern in motion rather than a continuation of the primary trend. The current labeling identifies Navy Blue Wave C as active, part of a broader corrective phase represented by Gray Wave C.

As Navy Blue Wave B appears to have ended, the development of Navy Blue Wave C suggests the stock is navigating the final portion of a multi-wave correction. This stage often features movements that run contrary to the prevailing trend and typically leads into a potential reversal.

The progression of Gray Wave C signals that COAL INDIA’s price action is undergoing a key corrective phase. Traders should monitor for the completion of Navy Blue Wave C, as this would indicate that the stock is preparing for a trend resumption.

Given the alignment of multiple corrective waves across different degrees, the current price behavior reinforces the short-term counter-trend nature. Technical traders are advised to remain observant for signs that the corrective wave structure, particularly Navy Blue Wave C within Gray Wave C, has finalized, potentially setting up a trend continuation or reversal.

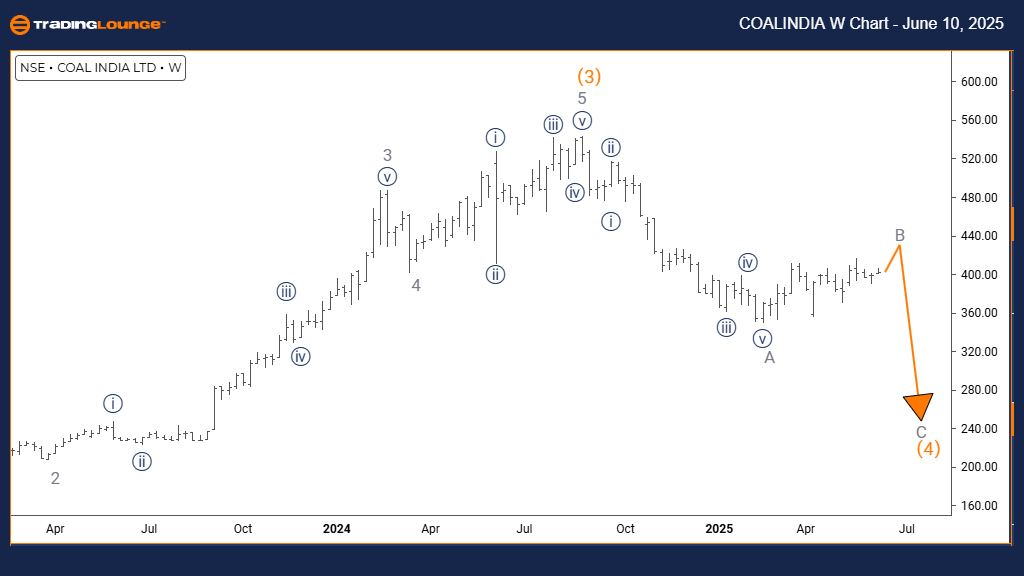

COAL INDIA Elliott Wave Analysis – Tradinglounger Weekly Chart

COAL INDIA Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Gray Wave B

POSITION: Orange Wave 4

DIRECTION NEXT LOWER DEGREES: Gray Wave C

DETAILS: Gray Wave A has likely concluded, with Gray Wave B in progress.

On the weekly time frame, the Elliott Wave outlook for COAL INDIA shows a counter-trend scenario supported by an impulsive wave. This structure develops within Gray Wave B, nested in a larger corrective framework defined by Orange Wave 4, suggesting strong movement against the dominant trend.

With Gray Wave A assumed complete, the focus shifts to the active Gray Wave B, an impulsive correction potentially offering opportunities for traders. Following the conclusion of this wave, Gray Wave C is expected to initiate, likely pushing prices downward and completing the corrective cycle.

The impulsive tone of Gray Wave B reflects a potentially robust interim move. This middle phase of the correction warrants attention, as it may yield tactical setups within a broader counter-trend direction.

Traders should stay alert for the completion of Gray Wave B, as this will likely signal the start of Gray Wave C. Anticipating this transition is vital, as Gray Wave C could represent the final movement of the larger correction, providing a clearer view of future price direction for COAL INDIA.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DR REDDY LABORATORIES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support