Berkshire Hathaway Inc., Elliott Wave Technical Analysis

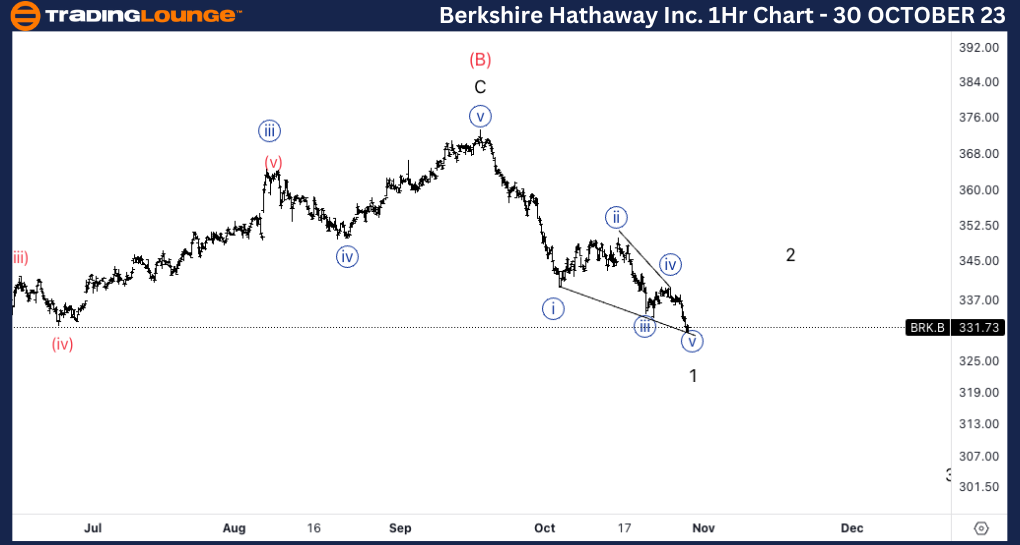

Berkshire Hathaway Inc., (BRK.B:NYSE): 4H Chart 30 October 23

BRK.B Stock Market Analysis: Looking for a different count as we have approached invalidation level and it looks like we are going to move through. Looking for a flat wave 2 as we seem to have a three wave move to the upside into wave (B).

BRK.B Elliott Wave Count: Wave (B) of 2.

BRK.B Technical Indicators: Below all averages, 20 and 200EMA crossed(bearish signal).

BRK.B Trading Strategy: Looking shorts into wave (C).

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

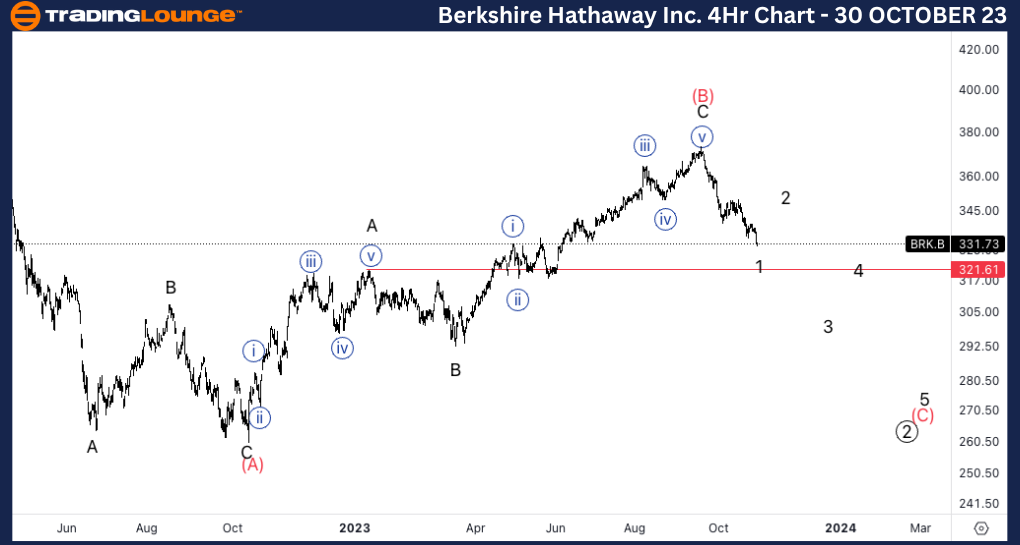

Berkshire Hathaway Inc., BRK.B: 1-hour Chart 30 October 23

Berkshire Hathaway Inc., Elliott Wave Technical Analysis

BRK.B Stock Market Analysis: Looking for a potential leading diagonal into wave 1 as RSI seems to be suggesting too, to then pullback in wave 2 where we could look for potential shorts.

BRK.B Elliott Wave count: Wave 1 of (C).

BRK.B Technical Indicators: Below all averages.

BRK.B Trading Strategy: Looking for shorts into wave 3 if we get a pullback in wave 2.