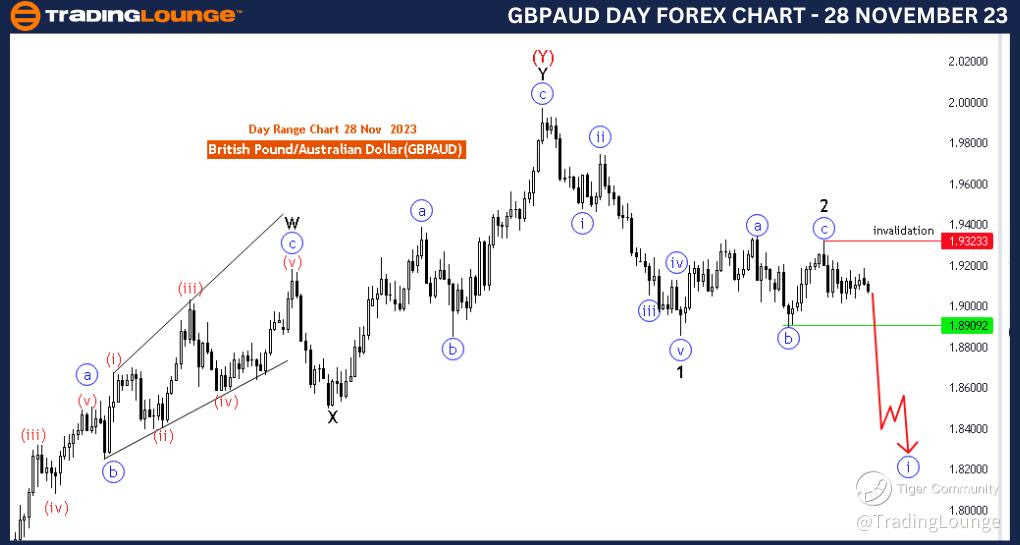

GBPAUD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 28 November 23

British Pound/ Australian Dollar(GBPAUD) 4 Hour Chart

GBPAUD Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure:red wave 3 of 1

Position: blue wave 1 of black wave 3

Direction Next lower Degrees:red wave 3 of 1(started)

Details: red wave 2 of 1 looking completed at 1.91910 . Now red wave 3 of 1 is in play . Wave Cancel invalid level: 1.93233

The "GBPAUD Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 28 November 23, provides a detailed examination of the British Pound/Australian Dollar (GBPAUD) currency pair, utilizing Elliott Wave analysis. This analysis, conducted on a 4-hour chart, is geared toward understanding potential future price movements, with a focus on the impulsive nature of the market.

The identified "Function" in this analysis is classified as "Trend," indicating a focus on identifying and riding the prevailing directional movements in the market. The market is currently in "Impulsive" mode, suggesting that strong, directional movements are underway.

The specific "Structure" under scrutiny is described as "red wave 3 of 1." This suggests an analysis of the third impulsive wave within a larger Elliott Wave structure, indicating a strong and sustained price movement.

The designated "Position" is clarified as "blue wave 1 of black wave 3." This provides insight into the smaller degree wave within the larger wave structure, showcasing a nuanced understanding of the hierarchical nature of Elliott Waves.

Concerning the "Direction Next Lower Degrees," the analysis points to "red wave 3 of 1 (started)." This implies that the third impulsive wave at a higher degree has initiated, indicating a potentially strong and sustained trend in the direction specified.

In terms of "Details," the report notes that "red wave 2 of 1 looking completed at 1.91910. Now red wave 3 of 1 is in play." This suggests the completion of a corrective wave and the initiation of the third impulsive wave, potentially leading to a sustained directional move. The "Wave Cancel invalid level" is set at 1.93233, serving as a critical reference point.

In summary, the GBPAUD Elliott Wave Analysis on the 4-hour chart signals a trending market with the initiation of the third impulsive wave. Traders are provided with valuable insights for short-to-medium-term decision-making, with the invalidation level serving as a crucial guide.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!

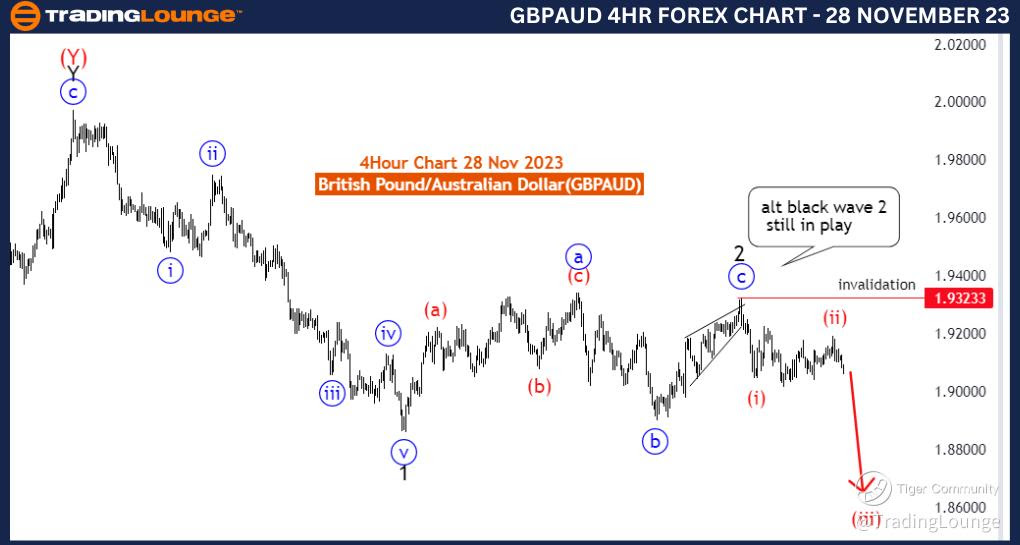

GBPAUD Elliott Wave Analysis Trading Lounge Day Chart, 28 November 23

British Pound/ Australian Dollar(GBPAUD) Day Chart

GBPAUD Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure:blue wave 1 of black wave 3

Position: black wave 3

Direction Next lower Degrees:blue wave 1(continue)

Details: After black wave 2 now blue wave 1 of black wave 3 is in play . Wave Cancel invalid level: 1.93233

The "GBPAUD Elliott Wave Analysis Trading Lounge Day Chart" dated 28 November 23, provides an insightful examination of the British Pound/Australian Dollar (GBPAUD) currency pair using Elliott Wave analysis. Conducted on a daily chart, this analysis aims to capture the broader market trends, emphasizing the impulsive nature of the market movements.

The identified "Function" in this analysis is labeled as "Trend," indicating a focus on identifying and riding the overarching directional movements in the market. The market is currently in "Impulsive" mode, suggesting that strong and sustained directional movements are expected.

The specific "Structure" under scrutiny is described as "blue wave 1 of black wave 3." This signifies an analysis of the first impulsive wave within a larger Elliott Wave structure, emphasizing the hierarchical nature of wave patterns.

The designated "Position" is clarified as "black wave 3," indicating the larger degree wave within the Elliott Wave structure. This implies a substantial and sustained trend in the direction specified.

Concerning the "Direction Next Lower Degrees," the analysis points to "blue wave 1 (continue)." This implies that the impulsive wave at a lower degree (blue wave 1) is still in progress, reinforcing the expectation of ongoing strong directional movements.

In terms of "Details," the report notes, "After black wave 2, now blue wave 1 of black wave 3 is in play." This indicates a transition from a corrective wave (black wave 2) to the initiation of the first impulsive wave within the larger degree wave structure.

The "Wave Cancel invalid level" is set at 1.93233, serving as a critical reference point for traders. This level provides guidance on potential invalidation of the current wave count and highlights a key level to monitor.

In summary, the GBPAUD Elliott Wave Analysis on the daily chart signals a sustained trend, with the initiation of the first impulsive wave within a larger degree structure. Traders are provided with valuable insights for medium-to-long-term decision-making, with the invalidation level serving as a crucial guide.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!