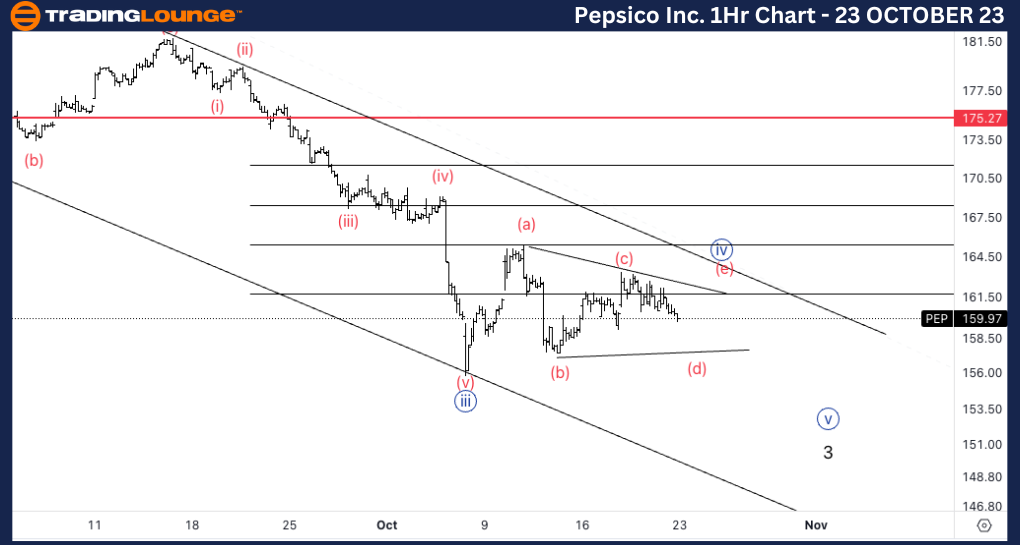

Pepsico Inc., (PEP:NASDAQ): 4H Chart, 23 October 23

Pepsico Inc., Elliott Wave Technical Analysis

PEP Stock Market Analysis: Looking for continuation lower into wave 3 as we seem to have an incomplete five wave sequence. We seem to have found resistance on the 1.618 3 vs. 1 from which we could resume lower.

PEP Elliott Wave Count: Wave {iv} of 3.

PEP Technical Indicators: Below all averages, 20EMA as resistance.

PEP Trading Strategy: Looking for shorts into wave {v}.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

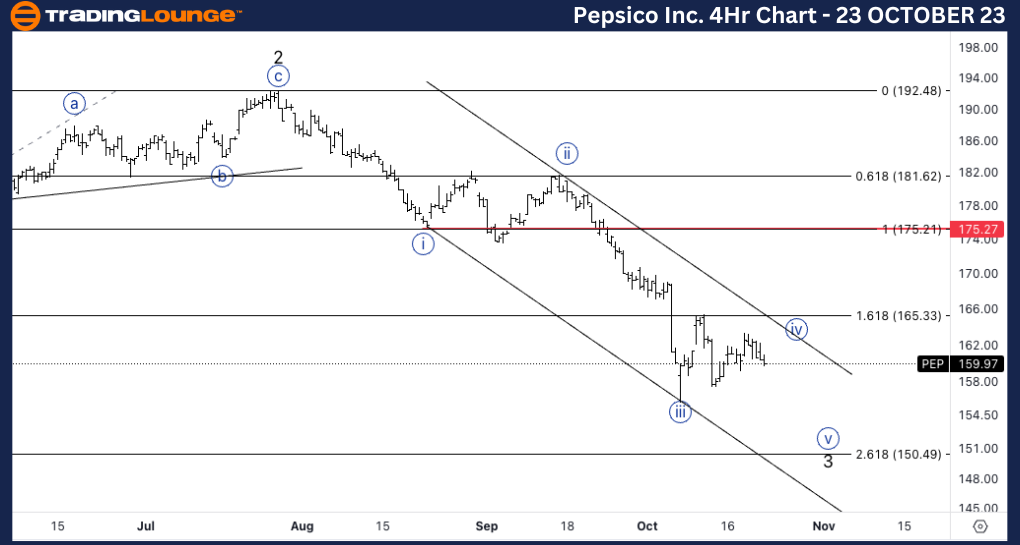

Pepsico Inc., PEP: 1-hour Chart, 23 October 23

Pepsico Inc., Elliott Wave Technical Analysis

PEP Stock Market Analysis: Looking for a potential triangle into wave {iv} as we seem to be moving sideways. We currently stand within the 23.6% retracement of wave {iii} and we could range from there to the 38.2% retracement.

PEP Elliott Wave count: Wave {iv} of 3.

PEP Technical Indicators: Below all averages.

PEP Trading Strategy: Looking for shorts after confirmation of triangle completion.