ASX: Commonwealth Bank of Australia (CBA) Elliott Wave Analysis (1D Chart)

Greetings, today we provide an updated Elliott Wave analysis for the Australian Stock Exchange (ASX) with a focus on the Commonwealth Bank of Australia (CBA). Our study suggests bullish potential, particularly within wave (iii) of ((iii)).

ASX: Commonwealth Bank of Australia (CBA) - Elliott Wave Technical Analysis

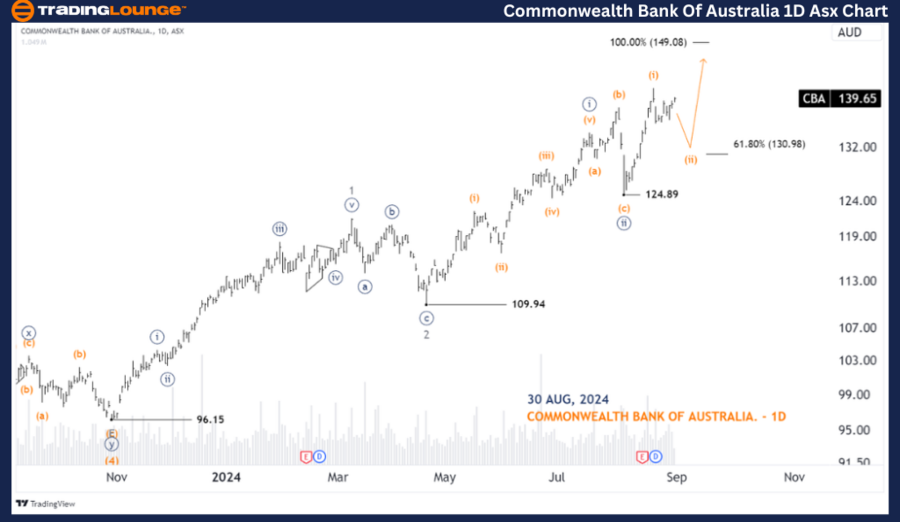

ASX: Commonwealth Bank of Australia (CBA) 1D Chart (Semilog Scale) Analysis

- Function: Major Trend (Minor degree, gray)

- Mode: Motive

- Structure: Impulse

- Position: Wave (ii)-orange of Wave ((iii))-navy

Details:

Wave (ii)-orange may not have completed its retracement, as the pullback appears too shallow. We anticipate a further push lower to finalize wave (ii)-orange. Following this, wave (iii)-orange is expected to resume its upward momentum. We are closely monitoring this for a potential long trade setup.

Invalidation Point: 124.89

Commonwealth Bank of Australia (CBA) - Elliott Wave Analysis (4-Hour Chart)

ASX: Commonwealth Bank of Australia (CBA) - Elliott Wave Technical Analysis

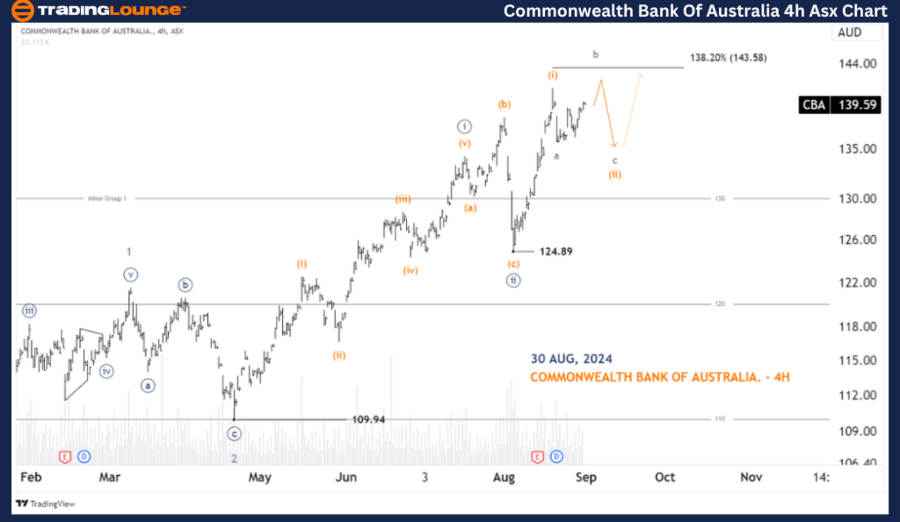

ASX: Commonwealth Bank of Australia (CBA) 4-Hour Chart Analysis

- Function: Major Trend (Minuette degree, orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave c-grey of Wave (ii)-orange

Details:

Since reaching the low at 125.02, wave (i)-orange appears to have been completed, and wave (ii)-orange is currently unfolding. Given the shallow nature of this retracement, it is likely developing as a Flat, with wave b-grey pushing slightly higher before wave c-grey pulls back to complete wave (ii)-orange. We anticipate that wave (iii)-orange will then resume its upward trajectory. We continue to watch for a long trade setup.

Invalidation Point: 124.89

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX LIMITED Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: Commonwealth Bank of Australia (CBA) provides insights into current market trends and potential trading opportunities. We have identified key price levels that serve as validation or invalidation signals for our wave count, which can enhance trading confidence. By considering these factors, we aim to offer a professional and objective perspective on market dynamics.