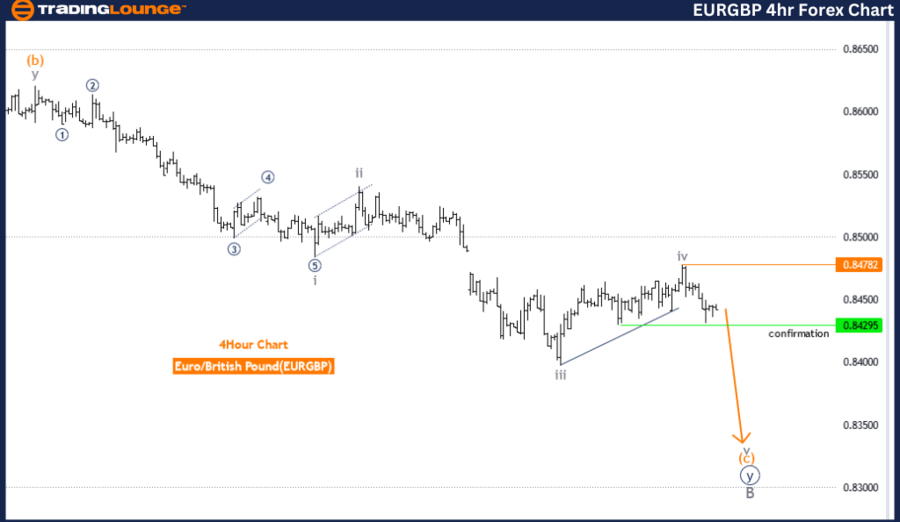

EURGBP Elliott Wave Analysis Trading Lounge Day Chart

Euro/British Pound (EURGBP) Day Chart Analysis

EURGBP Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Gray Wave 5

POSITION: Orange Wave C

DIRECTION NEXT HIGHER DEGREES: New Uptrend Expected

DETAILS: Gray Wave 4 of Orange Wave C appears completed, now Gray Wave 5 is in play.

Wave Cancellation Invalid Level: 0.84782

The EURGBP Elliott Wave analysis on the day chart identifies a counter trend using Elliott Wave principles. This analysis highlights an impulsive counter trend movement, indicating a strong and clear directional move.

Key Observations:

- Market Structure: Identified as Gray Wave 5, indicating the market is in the fifth wave of this sequence. According to Elliott Wave theory, the fifth wave is typically the final wave in the current trend direction before a reversal or significant correction.

- Current Position: Orange Wave C, indicating progression within a larger sequence, specifically the C wave of the orange wave. The C wave is part of a corrective phase, leading to the completion of the larger wave sequence.

- Next Higher Degrees: A new uptrend is expected after the current wave completes, suggesting the market is nearing the end of its current wave sequence and likely to reverse and start a new upward trend.

- Detailed Observations: Gray Wave 4 of Orange Wave C appears to be completed, transitioning into Gray Wave 5. This phase is crucial as it often represents the last push in the current trend before a major reversal or significant correction.

- Wave Cancellation Invalid Level: Set at 0.84782, this level acts as a threshold for validating the current wave count. If the market price moves beyond this level, it invalidates the existing wave structure, necessitating a reassessment of the Elliott Wave count and potentially altering the market outlook.

Summary: The EURGBP day chart analysis identifies a counter-trend within Gray Wave 5, currently positioned at Orange Wave C. The completion of Gray Wave 4 signals the beginning of Gray Wave 5, with the expectation of a new uptrend following this phase. The wave cancellation invalid level at 0.84782 serves as a crucial validation point for the current wave structure.

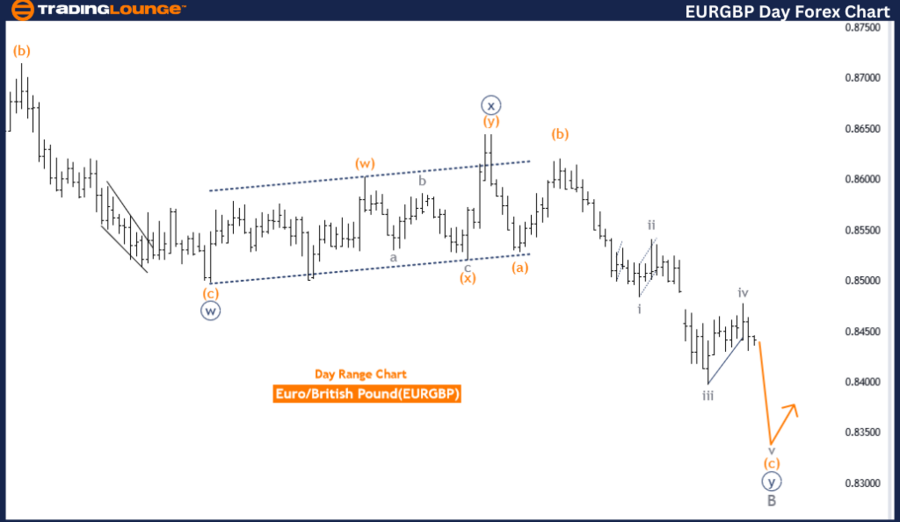

EURGBP Elliott Wave Analysis Trading Lounge 4-Hour Chart

Euro/British Pound (EURGBP) 4 Hour Chart Analysis

EURGBP Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Gray Wave 5

POSITION: Orange Wave C

DIRECTION NEXT LOWER DEGREES: Gray Wave 5 (Continue)

DETAILS: Gray Wave 4 of Orange Wave C appears completed, now Gray Wave 5 is in play.

Wave Cancellation Invalid Level: 0.84782

The EURGBP Elliott Wave analysis on the 4-hour chart focuses on identifying the counter-trend in the market using Elliott Wave principles. This analysis highlights an impulsive counter-trend movement, indicating a strong and clear directional move.

Key Observations:

- Market Structure: Identified as Gray Wave 5, suggesting the market is in the fifth wave of this sequence. According to Elliott Wave theory, the fifth wave is typically the final wave in the current trend direction before a reversal or significant correction.

- Current Position: Orange Wave C, indicating progression within a larger sequence, specifically the C wave of the orange wave. The C wave is part of a corrective phase, leading to the completion of the larger wave sequence.

- Next Lower Degrees: After the completion of the current wave, the market is expected to continue into Gray Wave 5. This represents the continuation and potentially the final leg of the current impulsive movement, suggesting the market is nearing the end of its current wave sequence.

- Detailed Observations: Gray Wave 4 of Orange Wave C appears completed, transitioning into Gray Wave 5. This phase is crucial as it often represents the last push in the current trend before a major reversal or significant correction.

- Wave Cancellation Invalid Level: Set at 0.84782, this level acts as a threshold for validating the current wave count. If the market price moves beyond this level, it invalidates the existing wave structure, necessitating a reassessment of the Elliott Wave count and potentially altering the market outlook.

Summary: The EURGBP 4-hour chart analysis identifies a counter trend within Gray Wave 5, currently positioned at Orange Wave C. The completion of Gray Wave 4 signals the beginning of Gray Wave 5, with the wave cancellation invalid level at 0.84782 serving as a crucial validation point for the current wave structure.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support