Gold (XAUUSD) Commodity Elliott Wave Analysis

Gold recently experienced a pullback after hitting a fresh all-time high in August 2024. While this decline might seem concerning, it could be a temporary correction before buyers return, potentially pushing prices to new peaks. However, technical indicators suggest the possibility of a larger retracement ahead.

Gold Elliott Wave Technical Analysis

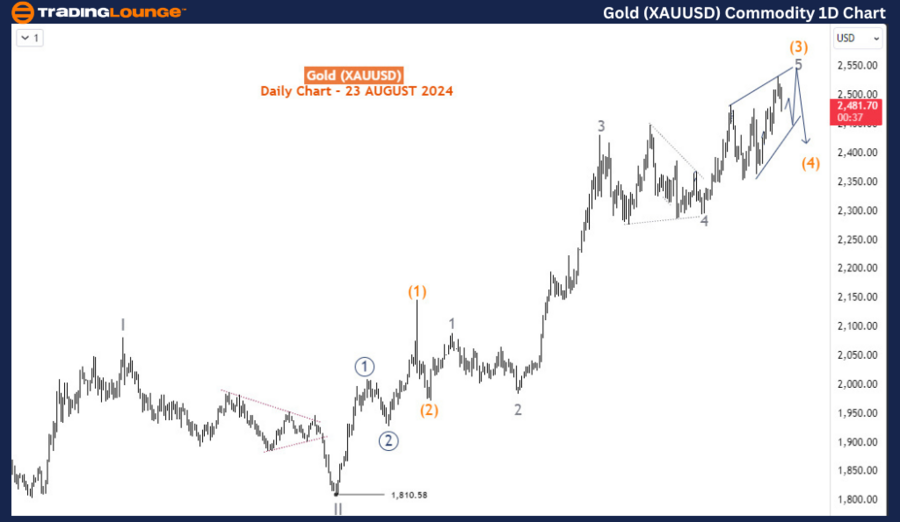

Gold (XAUUSD) Daily Chart Analysis

From a long-term perspective, Gold completed its supercycle wave (IV) within the ongoing bullish trend that began in December 2015. This completion paved the way for the initiation of a new impulse wave (V). Within this impulse, the primary degree waves I and II were completed in May and October 2023, respectively. Currently, Gold is advancing within the intermediate degree wave (3) of the primary degree wave 3 (circled) of cycle degree wave III, as depicted on the daily chart.

The price action suggests that wave (3) is approaching completion with a diagonal wave 5 structure, indicating that a corrective wave (4) could soon follow. Despite this potential pullback, the broader trend remains bullish, and further upward movement is expected after the correction completes. The end of wave (3) would likely lead to a consolidation phase before the market resumes its upward trajectory in wave (5).

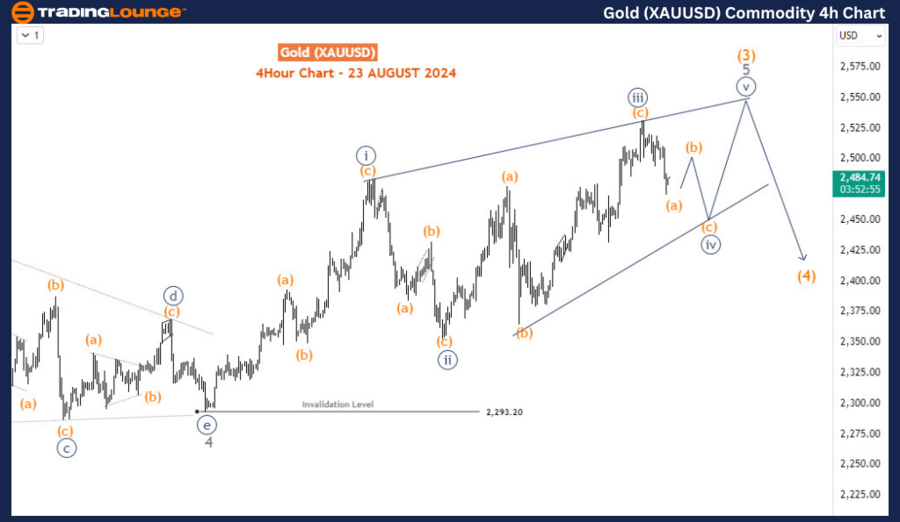

Gold (XAUUSD) 4-Hour Chart Analysis

The H4 chart provides more detailed insight into the short-term structure. It shows the development of a diagonal for wave 5, emerging after a breakout from the wave 4 triangle range in June 2024 at the 2293 level. The initial rally pushed Gold above this resistance, confirming the start of wave 5. The internal structure of wave 5 indicates that waves i-iii (circled) have been completed, while the ongoing dip represents the formation of wave iv (circled).

One final push higher is anticipated in wave v (circled), which could propel Gold above the psychological level of 2500 and closer to 2550. This zone may serve as a potential exit point for buyers, marking the end of wave (3). If this scenario materializes, a larger pullback could occur as part of wave (4) before the next bullish phase begins.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Crude Oil Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Overall, while the long-term outlook for Gold remains positive, traders should brace for short-term volatility and a possible corrective dip before the market resumes its upward trend.