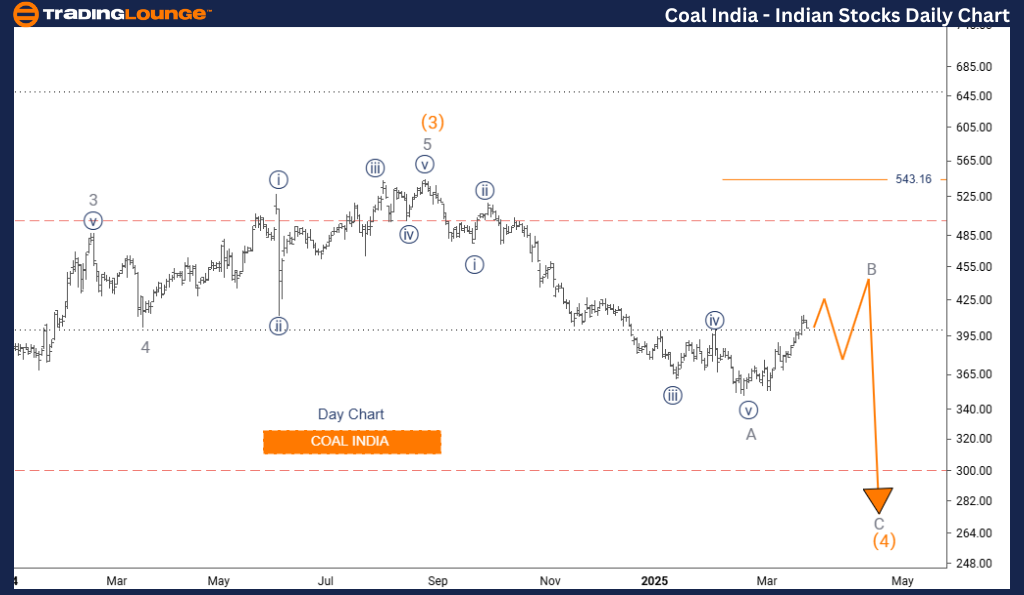

COAL INDIA – Elliott Wave Analysis | Trading Lounge Daily Chart

COAL INDIA Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Gray Wave B

Position: Orange Wave 4

Next Lower Degree Direction: Gray Wave C

Wave Cancel Invalid Level: 543.16

The Elliott Wave daily chart for COAL INDIA identifies a counter-trend correction currently underway. The price structure is unfolding within gray wave B, a retracement that follows the completed gray wave A decline. This activity sits within the broader orange wave 4 corrective structure.

Wave B typically represents a temporary reversal within a larger downward movement. As such, the ongoing bounce may be limited, with gray wave C anticipated to follow, pushing the stock lower. Critical resistance lies at 543.16—a break above this invalidates the current wave count and suggests a possible bullish shift.

The daily Elliott Wave outlook expects a continuation of the bearish structure following wave B, with wave C reinforcing the downtrend. Traders focused on short- to medium-term strategies may find potential shorting opportunities at the close of wave B.

Risk control remains key. A move above 543.16 will challenge the bearish setup. This technical analysis provides a structured method to interpret COAL INDIA stock price action, aiding decision-making within the Elliott Wave framework.

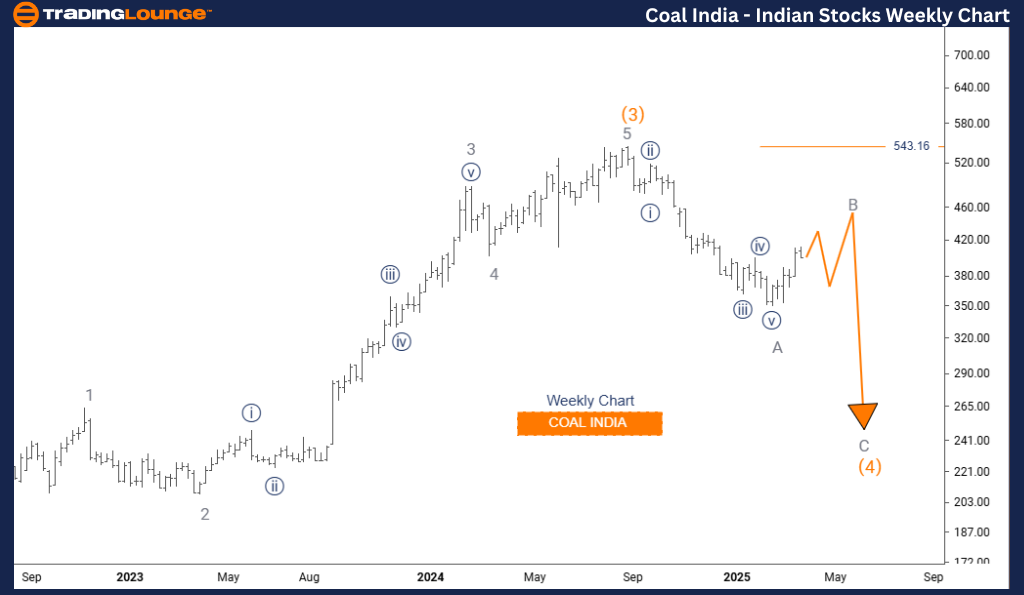

COAL INDIA – Elliott Wave Analysis | Trading Lounge Weekly Chart

COAL INDIA Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Gray Wave B

Position: Orange Wave 4

Next Lower Degree Direction: Gray Wave C

Wave Cancel Invalid Level: 543.16

The weekly chart Elliott Wave analysis for COAL INDIA presents a macro view of the stock's correction. It is currently developing within gray wave B, a retracement inside the broader orange wave 4 cycle. With gray wave A considered complete, the price appears to be navigating a temporary rally, common during corrective phases.

These patterns often produce sideways or moderate upward moves before the larger trend resumes. Key resistance at 543.16 serves as the invalidation point—surpassing this level would negate the current wave scenario and indicate a change in market sentiment.

Looking ahead, the chart anticipates a decline in gray wave C post-wave B. This scenario supports a bearish continuation in the long-term trend. Understanding this wave sequence helps traders align with the broader Elliott Wave cycle for COAL INDIA.

Corrective structures, like the one forming, usually follow identifiable three-wave or consolidation patterns. Monitoring such setups can offer timely trading insights, especially for managing existing positions or identifying new entries.

Maintaining disciplined risk levels near the invalidation zone is essential, especially if gray wave C confirms a renewed downtrend. This analysis serves as a strategic guide to assess market behavior within Elliott Wave principles.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANI PORTS & SEZ Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support