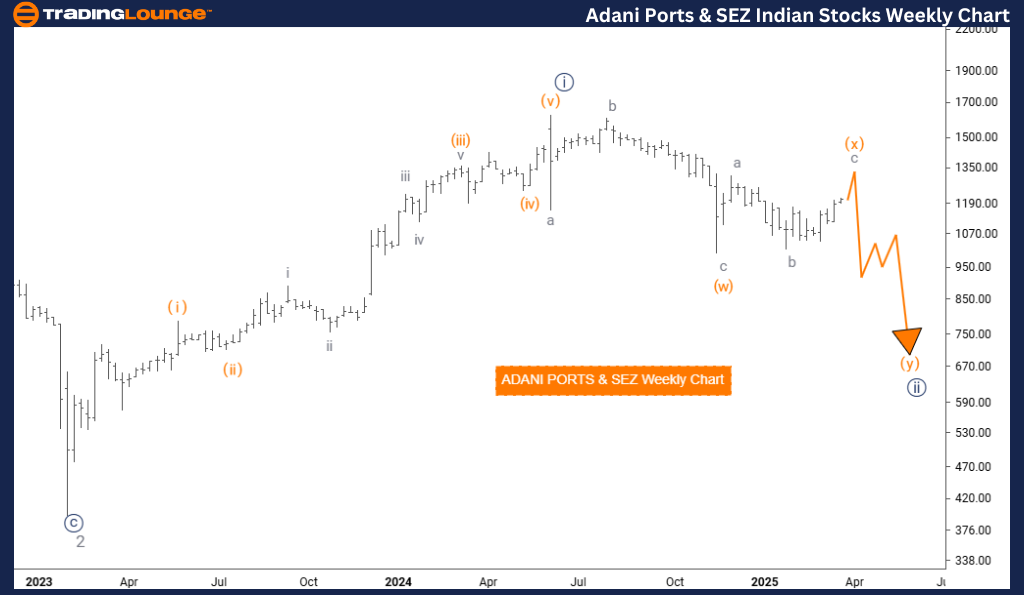

ADANI PORTS & SEZ Elliott Wave Analysis – TradingLounge Day Chart

ADANI PORTS & SEZ Technical Analysis Summary

FUNCTION: Counter-Trend

MODE: Corrective

STRUCTURE: Orange Wave X

POSITION: Navy Blue Wave 2

NEXT DIRECTION (Lower Degrees): Orange Wave Y

DETAILS:

Orange Wave W seems to have finished, and the formation of Orange Wave X is currently in motion.

This daily Elliott Wave analysis of ADANI PORTS & SEZ provides a clear interpretation of the stock’s current phase and its potential movement. The asset is in a counter-trend condition, suggesting a corrective price phase rather than a strong impulsive trend.

The analysis centers around Orange Wave X, forming part of the broader corrective structure under Navy Blue Wave 2. It appears that Orange Wave W has reached completion, and the market is progressing within Orange Wave X.

Since this is a corrective wave, traders can anticipate sideways or retracement patterns until a stronger directional trend resumes. Following this, the chart is likely to see the emergence of Orange Wave Y, the next step in the Elliott Wave cycle.

Key Takeaways:

- Track the development of Orange Wave X closely.

- Be alert for signs of the transition into Orange Wave Y.

- Familiarity with wave structure improves accuracy in predicting market changes.

This Elliott Wave technical analysis for ADANI PORTS & SEZ’s daily chart delivers practical insights for short-term trading decisions. It helps traders align strategies with current corrective movements and enhances decision-making by identifying the wave phase.

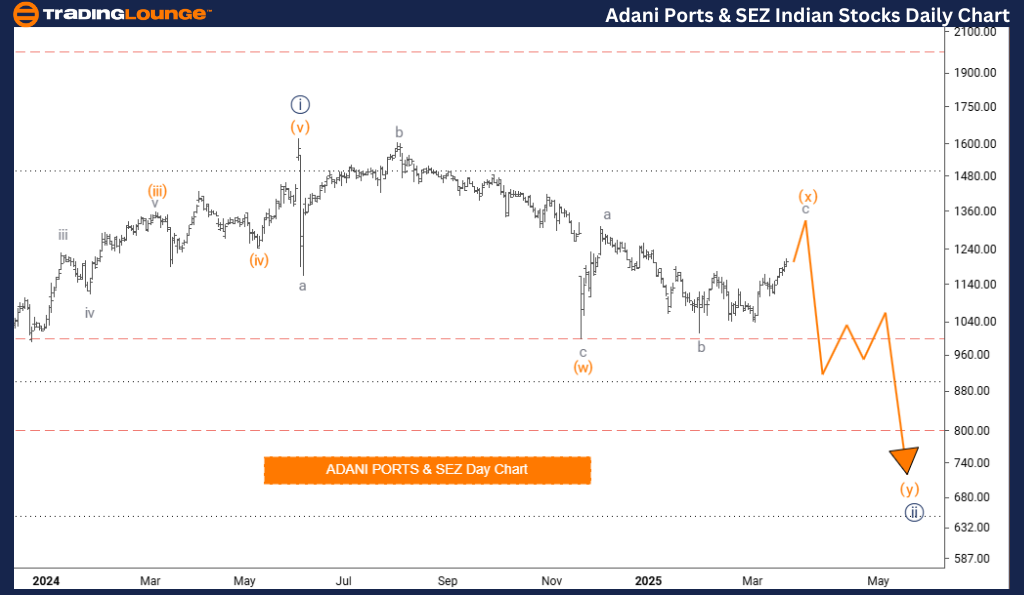

ADANI PORTS & SEZ Elliott Wave Analysis – TradingLounge Weekly Chart

ADANI PORTS & SEZ Technical Analysis Summary

FUNCTION: Counter-Trend

MODE: Corrective

STRUCTURE: Orange Wave X

POSITION: Navy Blue Wave 2

NEXT DIRECTION (Lower Degrees): Orange Wave Y

DETAILS:

Orange Wave W seems complete, with Orange Wave X now taking shape.

The weekly Elliott Wave analysis for ADANI PORTS & SEZ outlines the broader price movement and projected future trends. The stock remains in a corrective counter-trend phase, characterized by consolidation rather than impulsive moves.

Here, Orange Wave X is central, forming within the overarching structure of Navy Blue Wave 2. With Orange Wave W likely completed, the focus now shifts to the unfolding of Orange Wave X.

As a corrective wave, Orange Wave X may show sideways or pullback behavior before a fresh trend emerges. Upon its conclusion, Orange Wave Y is expected to follow in the sequence.

Key Takeaways:

- Monitor Orange Wave X development on the weekly timeframe.

- Get ready for a possible transition to Orange Wave Y.

- Use wave theory for clearer forecasts and strategic trading.

This weekly chart analysis offers long-term trading insights into ADANI PORTS & SEZ, supporting traders in aligning with market structure and potential reversals. By identifying the current wave stage, traders can improve their strategy and respond confidently to shifting price dynamics.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous:DR REDDY LABORATORIES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support