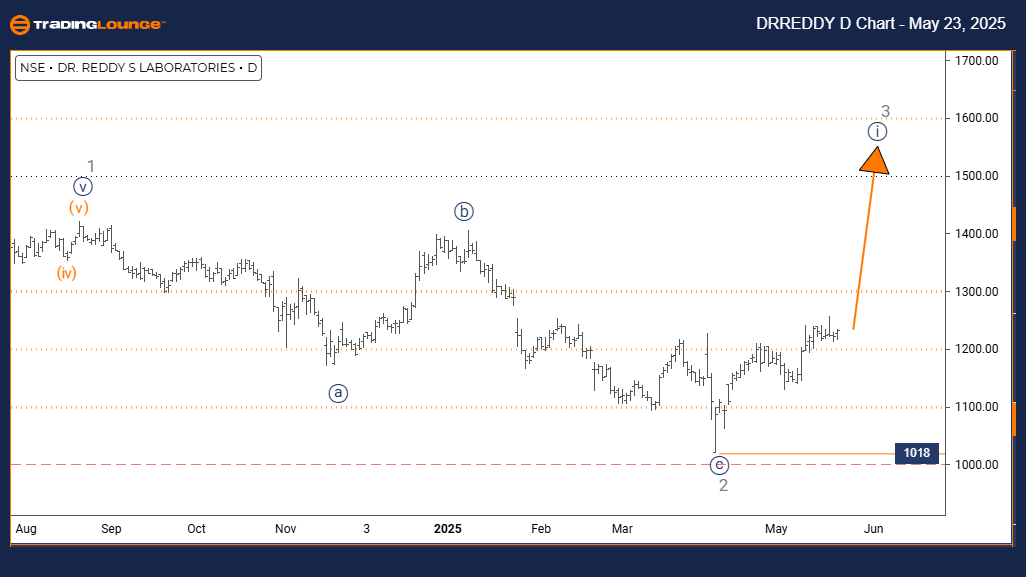

Dr Reddy’s Laboratories Elliott Wave Forecast – Trading Lounge Daily Chart

Dr Reddy’s Laboratories Daily Chart Analysis

Dr Reddy’s Laboratories Elliott Wave Technical Overview

Trend Function: Bullish Continuation

Wave Mode: Impulsive Structure

Wave Structure: Primary Wave 1 (Navy Blue)

Wave Position: Intermediate Wave 3 (Gray)

Next Higher Degree Direction: Initiation of Primary Wave 1

Key Insights: Intermediate Wave 2 (Gray) appears to have concluded; currently observing the development of Primary Wave 1 within Intermediate Wave 3.

Critical Invalidation Level: 1018 INR

The daily Elliott Wave analysis for Dr Reddy’s Laboratories suggests strong bullish momentum with the stock entering an impulsive rally. Primary Wave 1 is actively unfolding inside the broader Intermediate Wave 3, signaling a shift from the corrective structure of Intermediate Wave 2.

This bullish configuration reflects renewed upward pressure, supporting a potential sustained rally. The impulsive behavior of this wave indicates strong buying sentiment. The bullish forecast remains valid as long as prices stay above the 1018 INR level. A drop below this threshold would necessitate a reanalysis of the wave structure.

Key Takeaways:

- Strong upside potential with impulsive momentum

- Strategic point of invalidation set at 1018 INR

- Traders should observe for bullish confirmation signals and manage risk accordingly

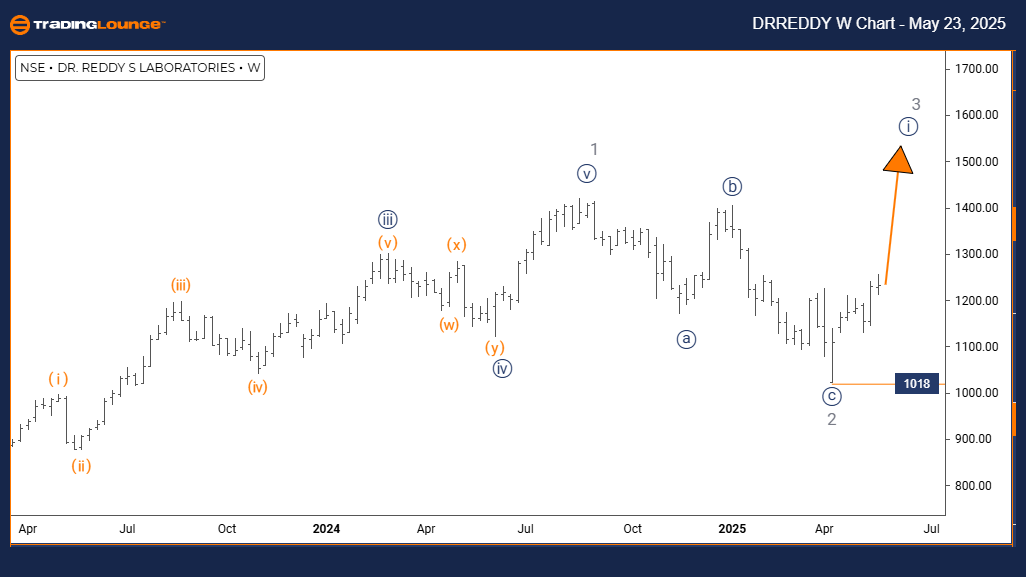

DR REDDY LABORATORIES Stock Analysis – Weekly Chart

Dr Reddy’s Laboratories Elliott Wave Technical Overview

Trend Function: Sustained Bullish Bias

Wave Mode: Impulsive Advance

Wave Structure: Primary Wave 1 (Navy Blue)

Wave Position: Intermediate Wave 3 (Gray)

Next Lower Degree Direction: Development of Primary Wave 2

Key Insights: Intermediate Wave 2 has likely completed; Primary Wave 1 is progressing within Intermediate Wave 3.

Critical Invalidation Level: 1018 INR

The weekly Elliott Wave analysis supports a strong bullish trend for Dr Reddy’s Laboratories. The ongoing impulsive structure, with Primary Wave 1 advancing in Intermediate Wave 3, underscores the end of the previous corrective phase and the start of a new bullish cycle.

This wave alignment indicates potential for a continued upward extension, often supported by institutional demand. The forecast remains intact while prices hold above the 1018 INR mark. Falling below this level would invalidate the current wave scenario and prompt a reevaluation.

Key Takeaways:

- Long-term bullish scenario remains in play

- Potential upcoming development of a corrective Primary Wave 2

- Continuous monitoring of support zones and wave validation levels advised

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: BHARAT ELECTRONICS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support