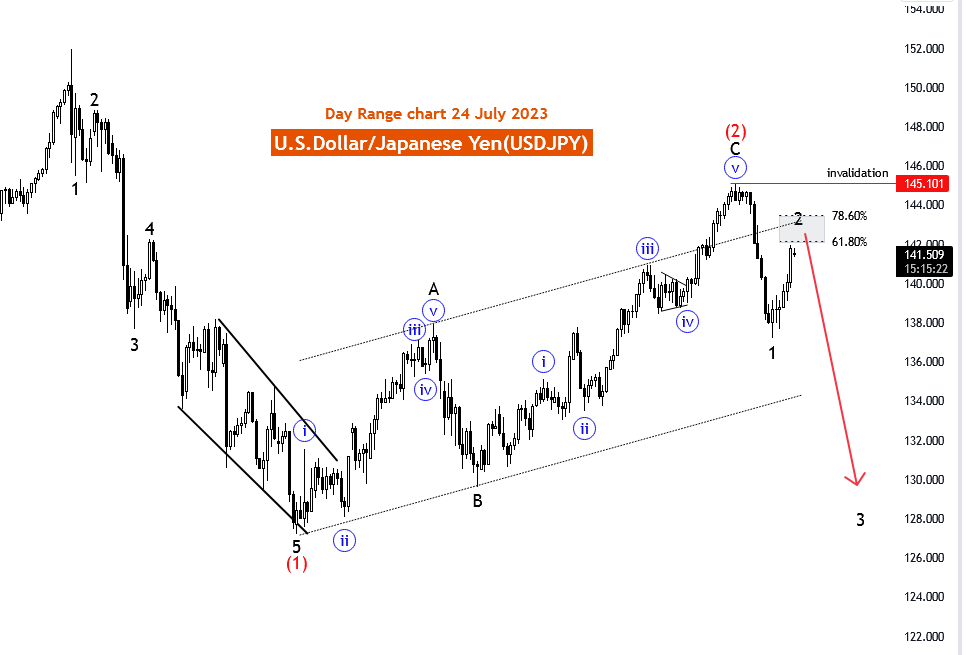

USDJPY Elliott Wave Analysis Trading Lounge Day Chart, 24 July 2023,

U.S.Dollar/ Japanese Yen (USDJPY) Day Chart

USDJPY Elliott Wave Technical Analysis

Function: CounterTrend

Mode: corrective

Structure: Zigzag

Position: Black Subwave 2 of Red wave 3

Direction Next lower Degrees:Black wave 3 of Motive

Details: After corrective wave 2 Black Subwave Wave “3 of red wave 3” started. Subwave Wave “2” is likely to end between fib level 61.80 to 78.60. Wave Cancel invalid level: 145.101

On 24th July 2023, the day chart of the U.S. Dollar/Japanese Yen (USDJPY) pair is analyzed using Elliott Wave theory, revealing a counter-trend movement with a corrective mode. The function of the price movement is identified as a counter-trend, while the mode is characterized as corrective.

The current structure is recognized as a Zigzag pattern, with the position of the price wave designated as Black Subwave 2 of Red wave 3. The projected direction for the next lower degrees is Black wave 3 of a larger Motive wave pattern.

The analysis provides further details, indicating that after the completion of corrective wave 2, Black Subwave Wave "3 of red wave 3" has started. Traders and investors are advised to closely monitor the market, as Subwave Wave "2" is expected to conclude between the Fibonacci levels of 61.80 to 78.60.

It is essential to note that the wave count provided will lose its validity if the USDJPY price falls below the level of 145.101.

As of the specified date, 24th July 2023, traders in the USDJPY market should closely observe the counter-trend corrective movement and wait for confirmation of the end of Subwave Wave "2" before considering potential trading opportunities. Corrective waves can be challenging to navigate, as they involve identifying potential reversals and require cautious risk management practices.

The analysis also hints at the continuation of the larger Motive wave pattern with Black wave 3, suggesting the potential for a stronger directional move after the completion of Subwave Wave "2."

While Elliott Wave analysis provides valuable insights into market patterns and potential price movements, it should be complemented with other technical indicators and fundamental factors to develop a comprehensive trading strategy. Economic data releases, geopolitical events, and shifts in market sentiment can significantly impact currency pairs like USDJPY, making it crucial for traders to stay informed and adaptive to changing market conditions.

By utilizing proper risk management and combining various forms of analysis, traders can make more informed decisions and improve their trading performance in the dynamic forex markets.

JOIN HERE TradingLounge Full access to 4 analysts covering Forex, Crypto, Stocks, Indices and commodities

U.S.Dollar/ Japanese Yen (USDJPY) Day Chart