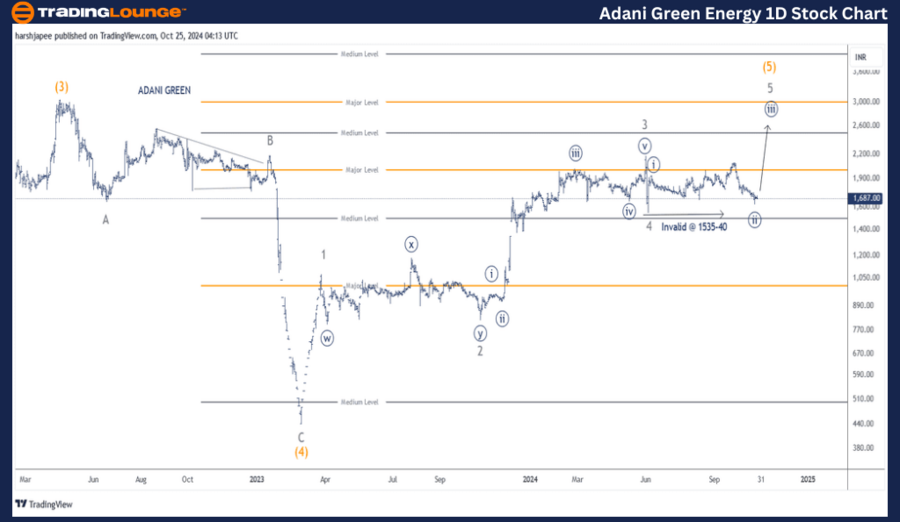

ADANI GREEN ENERGY – ADANIGREEN Elliott Wave Analysis (1D Chart)

ADANIGREEN Elliott Wave Technical Analysis

Trend Overview: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((ii)) Navy

Analysis: The 1D chart of ADANI GREEN ENERGY suggests that Minute Wave ((iii)) Navy is likely to continue advancing within Minor Wave 5 Grey of Intermediate Wave (5) Orange, as long as the 1535-1540 support level holds. A decline below this range would prompt a reevaluation of the current wave count, necessitating caution for long positions.

Invalidation Level: 1535

ADANI GREEN ENERGY Daily Chart – Elliott Wave Analysis and Potential Counts

The daily analysis of ADANIGREEN ENERGY indicates that Intermediate Wave (5) could extend upwards, potentially reaching the 3050 level in the longer term. Currently, the stock has dropped to 1636, and maintaining levels above 1535 is crucial to preserve the bullish outlook.

In March 2023, ADANIGREEN Energy concluded Intermediate Wave (4) around the 430 mark, having previously surged to a high of 3050 in Intermediate Wave (3). Following this, the stock retraced sharply to 430 in a corrective A-B-C flat pattern. Since this correction, Intermediate Wave (5) appears to be progressing upwards.

Minor Waves 1 through 4 seem complete, and Minor Wave 5 might be in progress against the 1535 level. A drop below 1535 would invalidate the bullish wave count.

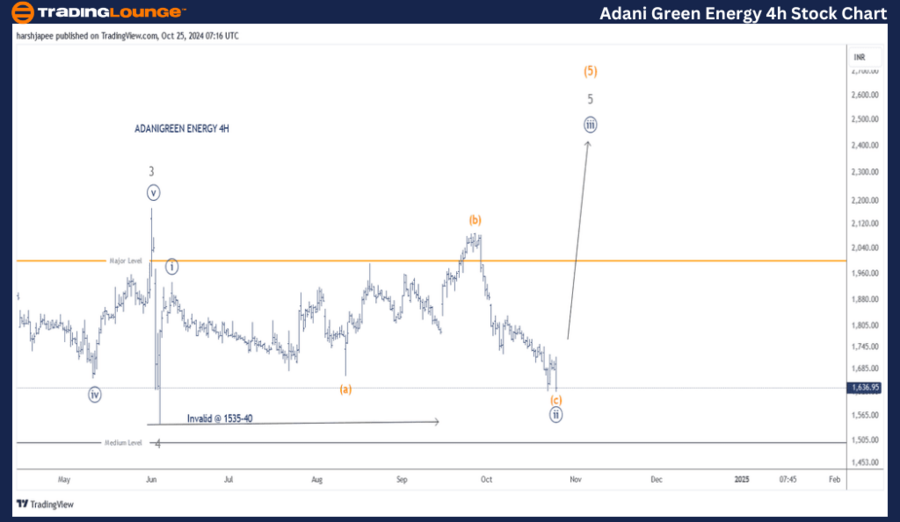

ADANI GREEN ENERGY – ADANIGREEN Elliott Wave Analysis (4H Chart)

Trend Overview: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((ii)) Navy

Analysis: The 4H chart analysis shows that Minute Wave ((iii)) Navy may resume its upward path within Minor Wave 5 Grey of Intermediate Wave (5) Orange, as long as the 1535-1540 support holds. There is also the potential that Minute Wave ((ii)) completed as an expanded flat. A break below this range would signal the need for a revised wave count, warranting caution.

Invalidation Level: 1535

ADANI GREEN ENERGY 4H Chart – Technical Analysis and Elliott Wave Counts

The 4H chart of ADANIGREEN Energy presents the wave structure from Minor Wave 3 onward. Notably, Minor Wave 4 completed around the 1535-1540 range on June 5, 2024. Currently, Minor Wave 5 appears to be unfolding. At the time of writing, Minute Wave ((ii)) could be complete around the 160 range, and if accurate, Minute Wave ((iii)) might soon resume its upward trend.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TATA Consumer Product Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

ADANI GREEN ENERGY seems poised to initiate Minute Wave ((iii)) upwards, within Minor Wave 5 of Intermediate Wave (5) Orange, as long as prices remain above the 1535 level.