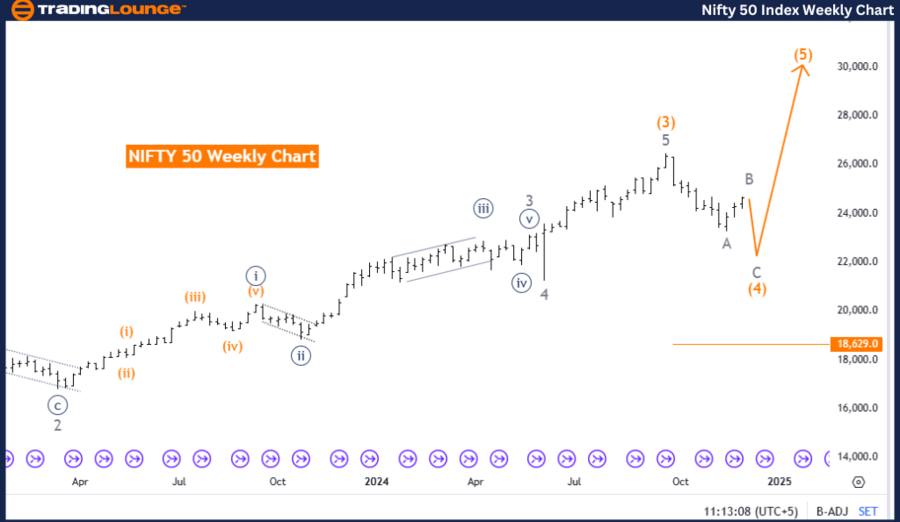

NIFTY 50 (India) Elliott Wave Analysis Trading Lounge Day Chart

NIFTY 50 (India) Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Gray Wave B

Position: Orange Wave 4

Direction Next Lower Degrees: Gray Wave C

Details: Gray Wave A of 4 appears to have completed; Gray Wave B of 4 is now active.

Wave Cancel Invalidation Level: 26,461.0

The NIFTY 50 daily chart demonstrates an Elliott Wave analysis highlighting a counter-trend phase. The ongoing wave structure is defined as Gray Wave B, part of a corrective pattern within Orange Wave 4. As per the current analysis, Gray Wave A of 4 seems to have completed, and the market has now progressed into Gray Wave B of 4.

This corrective wave represents a temporary pause or reversal in the broader trend, aligning with the principles of Elliott Wave Theory. The next expected development is Gray Wave C, which would finalize the corrective sequence within Orange Wave 4.

An invalidation level for this wave count is established at 26,461.0. Should the market fall below this level, the wave structure would require reassessment, suggesting a possible divergence from the expected trajectory.

This technical analysis provides traders with a structured outlook on the ongoing corrective phase. It highlights essential levels and directional trends, delivering insights into potential price movements within the current counter-trend framework.

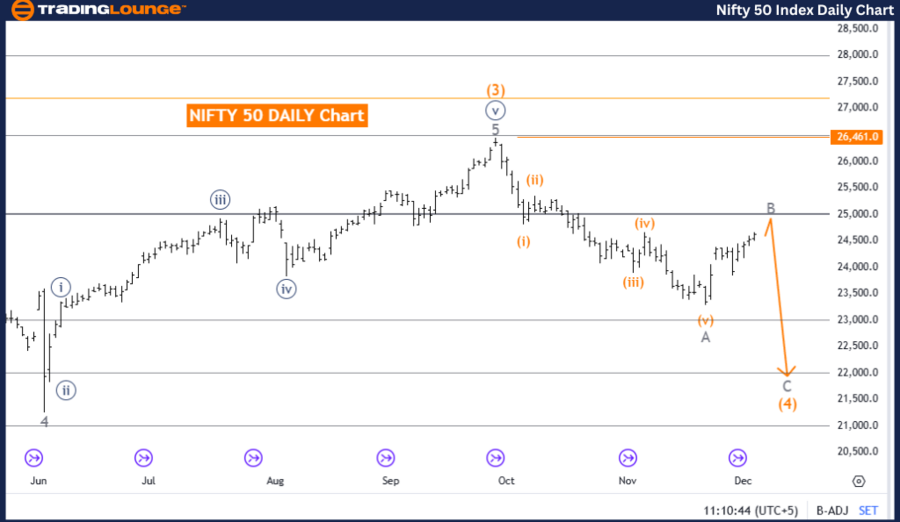

NIFTY 50 (India) Elliott Wave Analysis Trading Lounge Weekly Chart

NIFTY 50 (India) Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Direction Next Higher Degrees: Orange Wave 5

Details: Orange Wave 3 appears to have completed; Orange Wave 4 is now active.

Wave Cancel Invalidation Level: 18,629.0

The NIFTY 50 weekly chart reveals an Elliott Wave analysis pointing toward a counter-trend phase. The current wave structure is identified as Orange Wave 4, a corrective phase following the completion of Orange Wave 3. This indicates a period of consolidation or retracement before the larger bullish trend resumes.

The ongoing phase of Orange Wave 4 is expected to lead into the formation of Orange Wave 5 once the corrective structure concludes. This progression aligns with the foundational principles of Elliott Wave Theory, which describes corrective waves as brief interruptions in an overarching trend.

An invalidation level for this wave count is set at 18,629.0. If the market exceeds this threshold, the wave structure will need to be revisited, signaling a potential deviation from the anticipated pattern.

This analysis offers traders a well-defined understanding of the corrective phase currently underway. By highlighting critical levels and expected directional movements, it equips traders with actionable insights for navigating the transition toward the forthcoming bullish phase marked by Orange Wave 5.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NIKKEI 225 (N225) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support