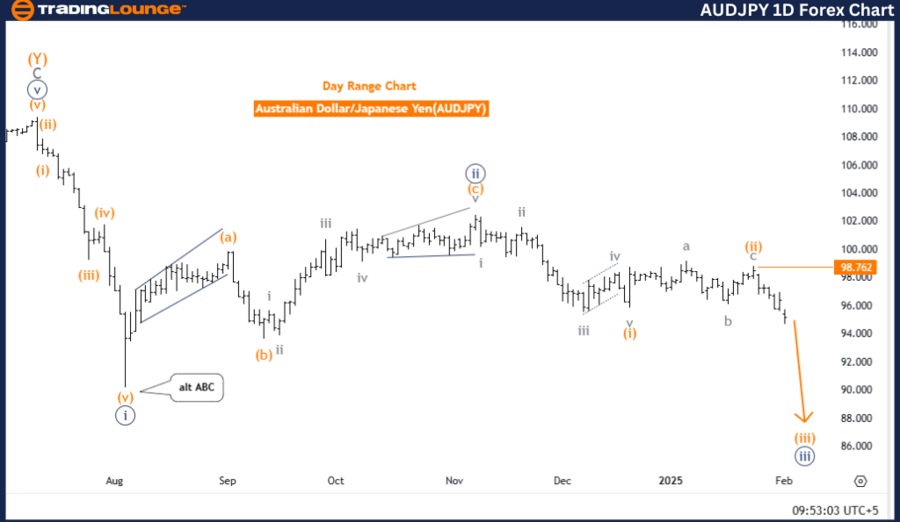

Australian Dollar / Japanese Yen (AUDJPY) – Daily Chart Analysis

AUDJPY Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 3

Next Higher Degree Direction: Orange wave 4

Details: Orange wave 2 has likely completed, with orange wave 3 now in progress.

Wave Cancellation Invalidation Level: 98.762

Analysis Overview

The AUDJPY Elliott Wave Analysis on the daily chart provides a technical insight into the current market trend. The analysis confirms that the currency pair is in a bearish impulsive phase, signifying strong downward momentum.

The ongoing wave formation places orange wave 3 as a critical part of a broader Elliott Wave cycle, occurring within navy blue wave 3. This confirms the continuation of the larger downtrend. Since orange wave 2 has already completed, the market has shifted into orange wave 3, which suggests an extension of the bearish trend.

Future Market Outlook

The next expected movement is orange wave 4, a corrective phase following the completion of the current impulsive wave. Traders should monitor the progress of orange wave 3, as its conclusion will signal the beginning of the corrective phase.

Additionally, a wave invalidation level of 98.762 has been identified. If the price surpasses this level, the current wave structure would be invalid, necessitating a reassessment of the Elliott Wave count and trend direction.

Conclusion

The AUDJPY remains in a strong bearish phase, with the current price movement aligned with orange wave 3 within navy blue wave 3. The completion of orange wave 2 has confirmed the downward momentum, making further declines likely.

Traders should closely observe orange wave 3 while keeping an eye on the 98.762 invalidation level to confirm the wave structure. This Elliott Wave analysis serves as a valuable tool for anticipating market movements and refining trading strategies.

Australian Dollar / Japanese Yen (AUDJPY) – 4-Hour Chart Analysis

AUDJPY Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 3

Next Lower Degree Direction: Orange wave 3 (initiated)

Details: Orange wave 2 has likely completed, with orange wave 3 now unfolding.

Wave Cancellation Invalidation Level: 98.762

Analysis Overview

The AUDJPY 4-hour chart Elliott Wave analysis confirms an ongoing bearish trend with an impulsive mode. The market has transitioned from orange wave 2 to orange wave 3, indicating a continuation of downward momentum.

At present, orange wave 3 is actively developing within navy blue wave 3, reinforcing a strong bearish structure. The completion of orange wave 2 has led to a confirmed impulsive phase, suggesting sustained selling pressure. Given the structure, further declines are likely as bearish momentum continues.

Future Market Outlook

The wave cancellation invalidation level remains at 98.762. Any movement above this level would invalidate the current Elliott Wave count and necessitate a fresh market analysis.

Conclusion

The AUDJPY 4-hour chart analysis highlights the continuation of a bearish phase, led by the formation of orange wave 3 within navy blue wave 3. The completion of orange wave 2 has confirmed this impulsive movement, signaling prolonged downside pressure.

Traders should closely monitor the wave invalidation level at 98.762, which serves as a key reference point for confirming the wave count. This analysis provides essential insights for trading decisions, allowing market participants to anticipate potential price movements while staying aligned with the dominant bearish trend.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NZDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support