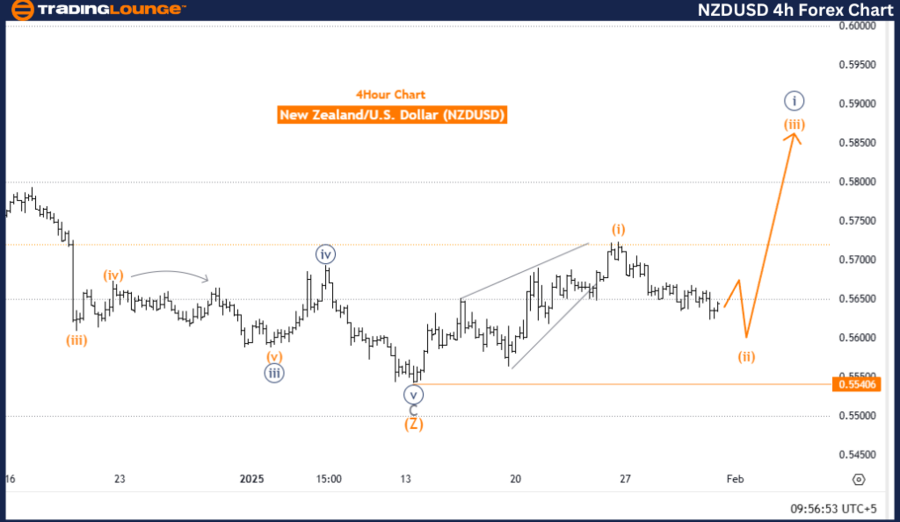

New Zealand Dollar / U.S. Dollar (NZDUSD) – TradingLounge Day Chart

New Zealand Dollar / U.S. Dollar Day Chart Analysis

NZDUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Next Higher Degree Direction: Navy Blue Wave 1 (Started)

Details:

- Navy Blue Wave 1 within Gray Wave 1 indicates a new bullish trend initiation.

- Wave cancellation invalid level: 0.55406

NZDUSD Elliott Wave Analysis Overview

The daily NZDUSD Elliott Wave analysis presents a comprehensive technical outlook on the New Zealand Dollar / US Dollar currency pair, focusing on current market structure and trend direction.

Market Trend & Structure

Key Observations

Conclusion

NZDUSD is currently in an impulsive bullish phase, defined by Navy Blue Wave 1, forming a key part of the larger structure within Gray Wave 1. This phase signals a potential upward trend continuation, making it an important period for traders.

The critical invalidation level at 0.55406 serves as a reference point for confirming wave structure integrity. This Elliott Wave analysis provides a structured framework for understanding NZDUSD’s current position and anticipating future price movements within the bullish trend.

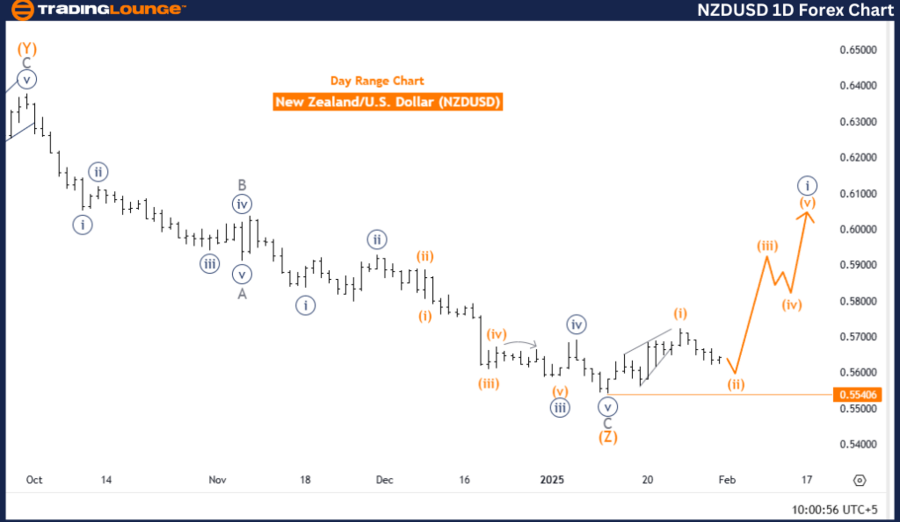

New Zealand Dollar / U.S. Dollar (NZDUSD) – 4-Hour Chart

NZDUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 1

Next Higher Degree Direction: Orange Wave 3

Details:

- Orange Wave 1 within Navy Blue Wave 1 appears to have completed.

- Orange Wave 2 is currently forming as a corrective phase.

- Wave cancellation invalid level: 0.55406

NZDUSD Elliott Wave Analysis Overview

The 4-hour NZDUSD Elliott Wave analysis provides a short-term technical perspective, focusing on corrective structures and potential trend reversals within the currency pair.

Market Trend & Structure

Key Observations

Conclusion

NZDUSD is currently in a corrective phase labeled as Orange Wave 2, forming part of a broader counter-trend movement within Navy Blue Wave 1. Once this phase completes, the market is anticipated to shift into Orange Wave 3, which may trigger a renewed upward push.

Traders should monitor the completion of the corrective phase and pay close attention to the invalidation level at 0.55406 to validate the wave count. This Elliott Wave framework offers valuable insights for assessing the market’s current trajectory and preparing for potential future price actions.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support