WTI Crudeoil Oil Elliott Wave Technical Analysis

WTI crude oil has completed its bullish correction from September 2024 and is now turning lower after facing resistance at a key Fibonacci zone. The decline from the January 15, 2025 top is expected to extend further, continuing both the short-term bearish cycle from July 2024 and the larger bearish trend that began in March 2022.

WTI Crudeoil Oil Commodity Daily Chart Analysis

The long-term price action is correcting the 5-wave impulse rally that followed the COVID-19 crude oil collapse. On March 7, 2022, WTI crude peaked at nearly $131, marking the top of this impulse wave advance. According to Elliott Wave Theory, a 3-wave correction follows a 5-wave trend.

This bearish correction has developed as a double zigzag pattern and remains incomplete. Thus, further downside pressure is expected in the medium to long term. Wave ((W)) ended in May 2023, followed by a 14-month sideways triangle formation for wave ((X)), which concluded in July 2024 at $84.5. As seen on the daily chart, wave ((Y)) began from the July 2024 high.

Wave (W) of ((Y)) is anticipated to push lower, with waves W and X of ((Y)) already completed. Currently, wave Y is evolving downward, indicating further bearish momentum.

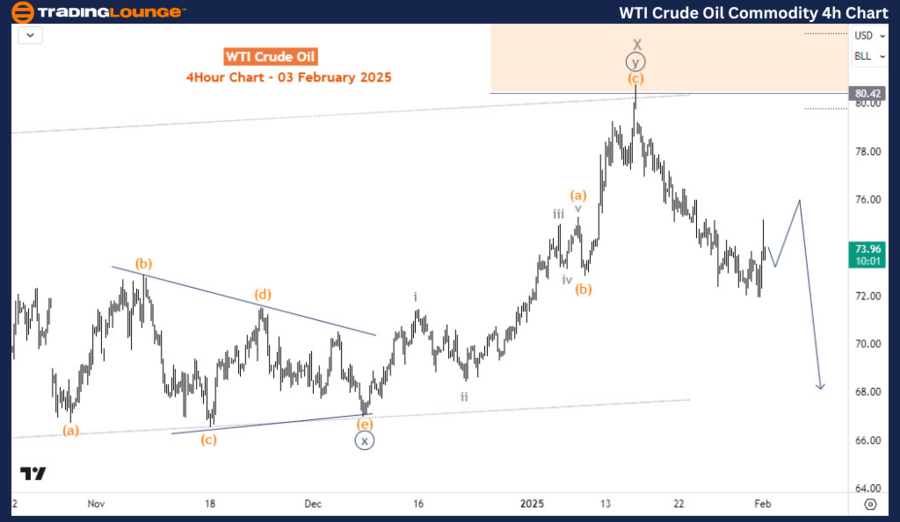

WTI Crudeoil Oil Commodity H4 Chart Analysis

On the H4 timeframe, the sub-waves of wave X are clearly visible, while the decline from wave X has either completed or is close to completing a 5-wave downtrend, potentially marking wave ((a)) of Y. From wave ((b)) of Y, sellers are expected to find fresh opportunities as long as WTI remains below the January 2025 top, where wave X was finalized.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold (XAUUSD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Key Takeaways:

- WTI crude oil is reversing lower after completing its bullish correction from September 2024.

- The long-term Elliott Wave structure suggests an incomplete double zigzag correction.

- Wave ((Y)) started in July 2024, with wave Y evolving downward.

- Short-term bearish momentum continues as long as prices remain below the January 2025 high.

This Elliott Wave forecast for WTI crude oil suggests that the market is favoring further declines in the coming weeks, making it crucial for traders to monitor key resistance levels.