Costco Wholesale Corp., Elliott Wave Technical Analysis

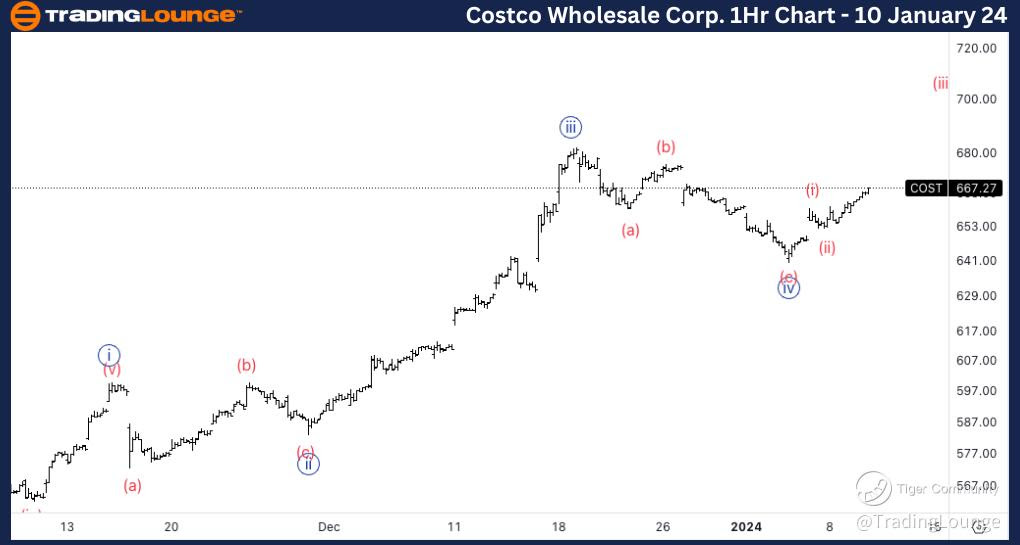

Costco Wholesale Corp., (COST:NASDAQ): 4h Chart 10 January 24

COST Stock Market Analysis: We have been monitoring the upside into wave 3 ever since the pullback in Minor wave 2. Looking for additional upside into wave {v} of 3 as we have an incomplete five wave sequence. 1.618 of 3 vs. 1 stands at 724$.

COST Elliott Wave Count: Wave {v} of 3.

COST Technical Indicators: 20EMA as support.

COST Trading Strategy: Looking for a break of wave (b) to then looking for longs.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

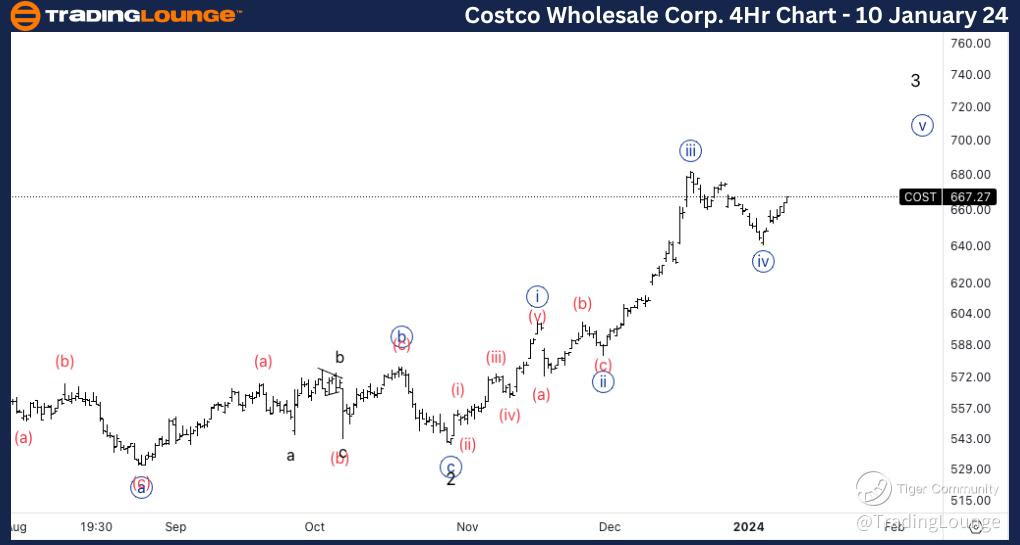

Costco Wholesale Corp.,, COST: 1-hour Chart 10 January 24

Costco Wholesale Corp., Elliott Wave Technical Analysis

COST Stock Market Analysis: We seem to be having a wave (i) and (ii) in place as we found support of 650$. This up move could also be scaled down one degree, and could become i and ii.

COST Elliott Wave count: Wave (ii) of {v}.

COST Technical Indicators: Above all averages.

COST Trading Strategy: Looking for a break of wave (b) to then looking for longs.